Reimbursement for Business Use of Personal Vehicles

Study prepared for The Treasury Board of Canada Secretariat

By Corporate Fleet Services

1 Fuel Price Update Synopsis

Corporate Fleet Services (CFS) has been mandated by the Treasury Board of Canada Secretariat to perform the Annual evaluation of per-kilometre Reimbursement Rates for government employees that are required to use their personal vehicles while performing government business. Furthermore, the periodic impact of varying fuel prices was to be evaluated quarterly by producing three additional Fuel Price Updates per year. The present document represents the Update for August 2023 (for publication on October 1st, 2023).

The latest Annual study established Reimbursement Rates for each Canadian Province and Territory after performing a comprehensive analysis of all vehicle operating expenses. These rates were presented in the Reimbursement for Business Use of Personal Vehicles Report, dated November 2022 (for publication on January 1st, 2023). Two subsequent Fuel Updates were produced for February 2023 (for publication on April 1st, 2023) and May 2023 (for publication on July 1st, 2023) respectively.

The present Update reflects the impact of current fuel prices on the Travel and Commuting Rates’ recommendations made in the Annual Report with a focus on average pump prices of gasoline by Province and Territory. The prices were averaged for each Province or Territory for the three months prior to the release of the current Update (the months of June, July and August 2023). All prices are given in dollars per litre.

This Update also presents the latest recommended rates of reimbursement for consideration by the Treasury Board Secretariat in dollars per kilometre. Federal and Provincial sales taxes were also researched to determine if there were any recent changes that could have had an immediate impact on the total costs of vehicle ownership and operation.

For the period June - August 2023, fuel expenses represent 24.0% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average of 13.6 cents per kilometre. The present Update identified minor increases in average gasoline prices across Canada, which had a slight upward impact on the Reimbursement Rates. As a result, the Travel Rates for the ten Provinces increased by a maximum of 1.5 cents and the Commuting Rates by a maximum of 1.0 cents relative to the previous Fuel Update (May 2023 for publication on July 1st, 2023). For the Territories, the maximum increase for both rates was 1.0 cents.

2 Fuel Prices

2.1 Energy Market Context

Over the past three months, the factors affecting the global energy market have remained largely unchanged: concerns over the health of the global economy as well as local economies, persistent inflation and the resulting rise in interest rates, geopolitical instabilities, in particular the war in Ukraine and the general balancing of supply and demand, have all contributed to the current market conditions.

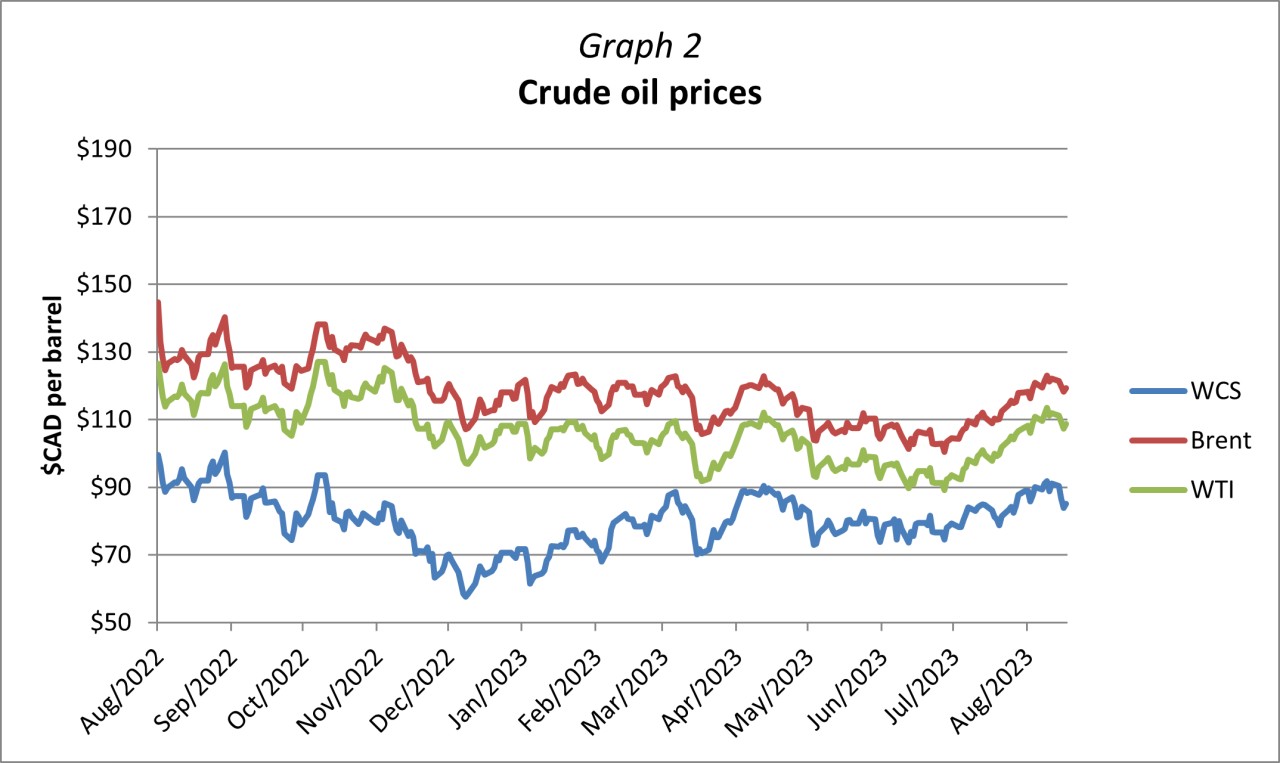

During the month of June, global crude oil prices remained relatively stable, fluctuating within a range of $10 USD per barrel and recorded the minimum price for the three-month period on June 11th. At that time the price for the West Texas Intermediate (WTI) was just over $67 USD per barrel and the Brent was nearly $72 USD per barrel. From late June onwards prices began to climb steadily, peaking on August 8th, 2023, with the WTI closing at nearly $84.50 USD per barrel and the Brent at $87.50 USD per barrel. The average oil price in July recorded a 15% surge over June due to increased demand and tighter supply that was fuelled by OPEC+ production cuts, which overshadowed the concerns of persistent inflation and interest rate hikes. This was the first time in over 18 months that the crude price rose that rapidly. Since early August, however, the prices have been receding, and as of August 17th the WTI stood at $81.25 USD per barrel and the Brent was at $84.80 USD per barrel.

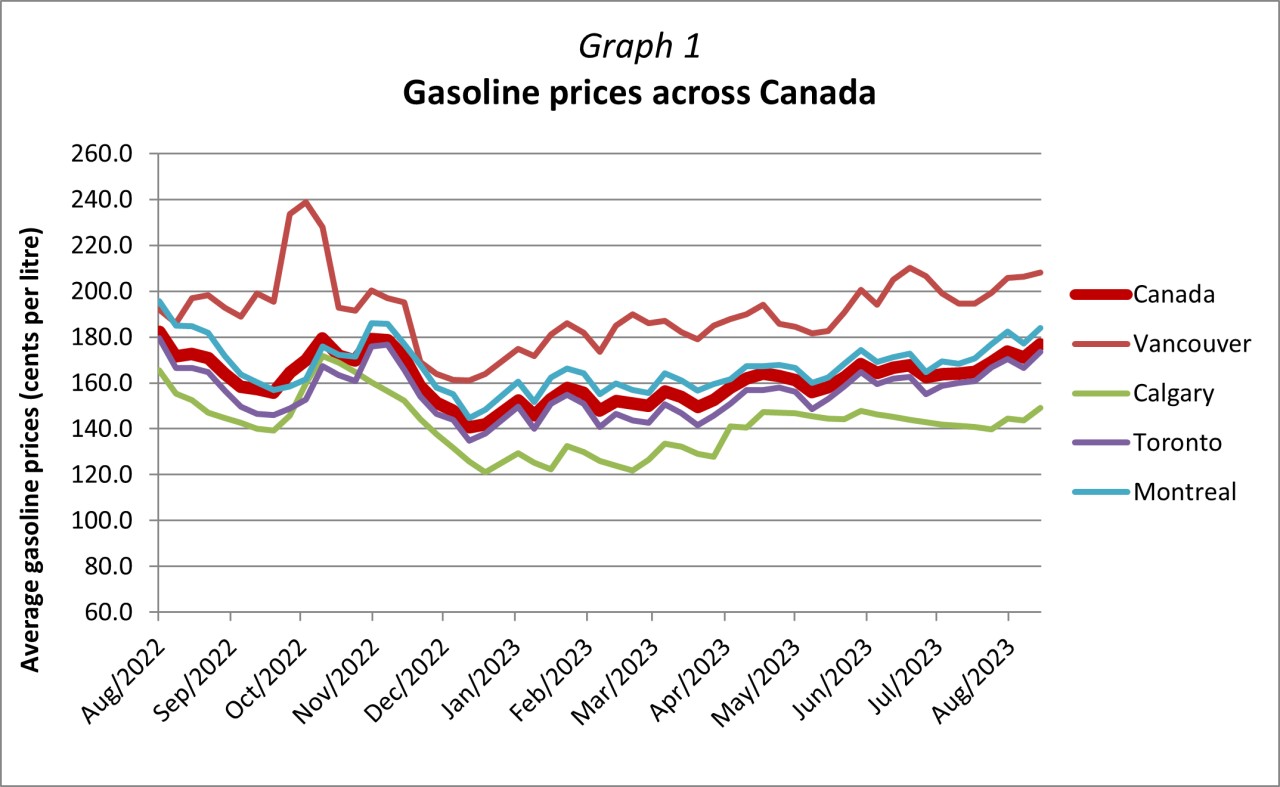

Gasoline prices followed crude oil quite closely, exhibiting about equal up and down fluctuations in June, followed by rising prices in July and August. As a result, the price for gasoline in the three-month period averaged $1.673 per litre in Canada, or an increase of 6.7% over the previous three-month period. From a yearly perspective, however, the price of gas was still 14.7% lower than during the same three-month period last year, when it averaged $1.962 per litre.

2.1.1 Global Crude Oil Demand

According to the World Economic Outlook (WEO) Update published in July 2023 by the International Monetary Fund (IMF), global economic growth is projected to decline from 3.5% in 2022 to 3.0% in 2023. Overall, due to the high and still increasing interest rates, the cost of borrowing is increasing significantly while high inflation continues to diminish household purchasing power, both of which are hindering economic activity. Some adverse risks to the outlook have been reduced with the resolution of the U.S. debt ceiling as well as the actions taken by authorities to contain the turbulence in the U.S. and Swiss banking sectors earlier in the year. Nevertheless, as noted by the IMF, the risks remain tilted on the downside, including even more persistent inflation that could trigger further restrictive monetary policy among others.

In contrast to the WEO from April 2023, the outlook for 2023 has seen an upward revision of 0.2 percentage points. Despite the inflation, thus far global demand has remained robust, mainly driven by the pent-up services demand following the COVID-19 pandemic. Nevertheless, the reopening of China, the world’s second-largest economy, which provided a lot of support for the global economy earlier this year, is losing its momentum. China’s economic data indicated a softer recovery in the first half of the year than initially projected, leading to concerns of weakening demand and thus providing downward pressure on oil prices in June. Despite China’s policymakers' reassurances that significant measures would be taken to stimulate the economic recovery, further setbacks reignited market concerns in August, contributing to the crude oil price decline after the rally seen in July. Nevertheless, the growth forecast for China stands at 5.2% for 2023 and 4.5% in 2024.

Advanced economies continued to drive the decline in growth from 2022 to 2023, with weaker manufacturing, as well as idiosyncratic factors offsetting stronger services activity. Growth in advanced economies as a group is set to decline from 2.7% last year to 1.5% this year and to 1.4% in 2024.

The U.S. consumption growth in the first quarter of the year was more resilient than projected, leading to an improved growth forecast, and it now stands at 1.8% for this year (up by 0.2 percentage points as compared to the previous WEO from April 2023). This momentum is not expected to last as consumers have largely depleted excess savings accumulated during the pandemic. Furthermore, in July, the U.S. Federal Reserve raised the interest rate again, which is now ranging between 5.25% and 5.5%, the highest level in 22 years. As a result, the U.S. economic growth forecast for 2024 stands at 1.0%.

In Canada, as reported by Statistics Canada, the inflation has continued to ease, reaching 2.8 % in June (in comparison to over 8.0% last summer), although it rebounded to 3.3% in July. According to the Monetary Policy Review published by the Bank of Canada in July 2023, the progress towards the target inflation rate of 2% has been slower than anticipated as the demand continues to exceed supply, adding to the inflationary pressures. Household spending has been robust, supported by continued population growth, accumulated household savings, as well as a strong demand for labour (resulting in tight labour market conditions). As a result, the Bank of Canada has continued to increase the interest rate. The last such rise was on July 12th when the rate went up by 0.5%, from 4.5% to 5.0%. This was the 10th increase since March 2022 and the first time since April 2001 that the figure reached 5%. Notably, despite the rapidly rising interest rates, housing resales and house prices have picked up. As a result, the Bank projects that the economy will expand by 1.8% this year (up from 1.4% in the April 2023 MPR). The next year’s growth projection, however, has seen a downward adjustment and is now forecasted to be 1.2% (down from the 1.3% projection in April 2023 and 1.8% in January 2023 MRP). By comparison, the IMF projections are quite similar, with the projection increasing by 0.2 percentage points from 1.5% to 1.7% for 2023 and declining slightly by 0.1 percentage points from 1.5% to 1.4% for 2024.

Largely due to the volatile economic outlook, the global demand estimates for crude oil presently vary quite significantly. On one hand, the U.S. Energy Information Agency’s (EIA) Short-Term Energy Outlook (STEO) from August 2023 projects the total global consumption to average 101.2 million barrels per day (mb/d) in 2023 and 102.8 mb/d in 2024. On the other hand, the International Energy Agency (IEA) estimates stand considerably higher and are projected to average 102.2 mb/d in 2023, 1.0 mb/d above the EIA projection. The OPEC forecasts fall somewhere in between, with the global demand projected to average 102.0 mb/d this year, a slightly increased forecast from three months ago, when it stood at 101.9 mb/d.

2.1.2 Global Crude Oil Supply

While news on the global economy, inflation, and interest rates have been contributing to the global crude oil price fluctuations, the news on the crude oil supply has had mostly price-boosting effects as the global crude oil supply remains tight.

In early June the OPEC+ alliance extended the 3.66 million barrels per day (mb/d) output cut agreement (representing about 3.6% of the global crude oil supply) that had started in April 2023 and is now set to expire at the end of 2024. In addition to the broader OPEC+ agreement, Saudi Arabia announced an additional 1.0 mb/d cut in their output for July which was later extended until September 2023. Saudi Arabia produces about 10% of the global crude oil supply and this output cut means that they have reduced their output from about 10 mb/d to 9 mb/d. It must be noted that Saudi Arabia is the only member of OPEC+ with sufficient spare capacity and storage to be able to easily reduce and increase the output of crude oil. With Saudi Arabia’s voluntary output cuts, as of right now, the OPEC+ alliance’s total output reduction is at about 5% of the global oil supply.

On the other hand, the non-OPEC production has been slowly increasing, partially offsetting the OPEC+ output reductions. For example, U.S. production in the first quarter of 2023 was almost 10% higher than the year prior. The latest Short-Term Energy Outlook (STEO) report published by the U.S. Energy Information Administration (EIA) in August 2023 indicates an improved outlook for 2023 due to higher expected productivity from the existing wells and an overall higher crude oil price, thus encouraging more production. The EIA forecast now stands at 12.8 mb/d for 2023 as compared to the 12.5 mb/d projected in the STEO from May 2023. The EIA currently projects further growth in 2024, with production averaging at 13.1 mb/d. In Canada, production is also expected to increase. According to the U.S. EIA estimates, Canada will produce an average of 5.84 mb/d this year, an increase of 0.14 mb/d over the last year, with a more significant increase of an additional 0.29 mb/d projected for 2024. Similarly, yet more conservatively, the OPEC estimates for Canadian production stand at 5.7 mb/d in 2023, which is 0.1 mb/d more than last year and is expected to increase by a further 0.2 mb/d to 5.9 mb/d in 2024.

Significant declines in U.S. crude oil inventories this summer provided an additional lift to oil price pressures in July and early August. At the beginning of July, oil inventories dropped much more than anticipated, temporarily providing strong support to crude oil prices, despite the concerns over the economy and the U.S. interest rate hikes. Similarly, a significant draw of 6 million barrels was reported in the first week of August, contributing to the crude oil price hike.

The U.S. EIA Short-Term Energy Outlook from August 2023 projects that global oil production will increase by 1.4 million barrels per day (mb/d) in 2023, averaging 101.3 mb/d. The non-OPEC production increase is expected to be 2.1 mb/d in 2023, which will be partly offset by a drop in OPEC production. Similarly, global production is projected to increase by 1.7 million to an average of 103.0 mb/d in 2024, with 1.2 mb/d coming from non-OPEC countries led by the United States, Brazil, Canada, Guyana, and Norway. The International Energy Agency (IEA) estimates are very similar, at 101.5 mb/d for this year and 102.8 mb/d for 2024.

2.2 Gasoline Prices Across Canada

Increasing crude oil prices coupled with a strong demand for gasoline as well as refinery outages in the U.S. have had a significant impact on gas prices across Canada this summer. In addition to the elevated number of scheduled refinery closures for maintenance, several refineries had unplanned outages, adding to the tightness in the gasoline supply market. As reported by Reuters, unplanned outages in June 2023 averaged about 550,000 barrels per day (b/d) in the U.S., nearly double from June of last year. As a result of the refinery outages, the U.S. Energy Information Administration (EIA) reported that in July, the peak of the summer driving season, U.S. gasoline and other distillate inventories remained close to their 10-year lows. The unscheduled outages had a particular impact on the East Coast gasoline supplies as two refineries went offline. One refinery in New Jersey that has the largest gasoline-making unit in the Western Hemisphere was offline for most of June and July for unplanned repairs, thus removing 150,000 barrels per day of gasoline from the market. Another refinery with a 75,000 b/d capacity in Texas was offline from May 2023 through the end of July.

As a result, gasoline prices, in general, increased more rapidly in the Eastern provinces than in the rest of Canada. The largest increases during the last three months as compared to the previous three-month period reported in the previous Fuel Update (May 2023 for publication on July 1st, 2023) were recorded in Nova Scotia at 8.44% and Ontario at 8.06%. On the other hand, a smaller increase of less than 2% was recorded in Manitoba, Saskatchewan, and Northwest Territories.

Prices of gasoline, in Canada, include all applicable taxes. Prices vary significantly across Canada, mainly due to the difference in the types and amounts of taxes being charged on fuel in different Provinces and Territories. The present Update calculated the average prices of regular gasoline charged at the pump. The fuel price data was primarily obtained from Natural Resources Canada via Kalibrate (previously known as Kent Marketing), based on daily published fuel prices for 78 locations across Canada. This data was verified against additional databases that similarly track fuel prices all across Canada.

Consistent with the methodology of the Annual Report, when determining average gasoline prices per Province or Territory, we have used weighted averages according to population in order to better conform to reality. In this manner, metropolitan population centers account for a greater portion of the total average price compared to smaller municipalities.

The following is a table with average regular gasoline prices for all Canadian Provinces and Territories, in dollars per litre, for the period June - August 2023:

|

Province/Territory |

Current fuel price |

April 1st, 2023 Fuel Update fuel price |

Price |

|

Alberta |

$1.417 | $1.353 | $0.064 |

|

British Columbia |

$1.958 | $1.825 | $0.133 |

|

Manitoba |

$1.587 | $1.578 | $0.009 |

|

New Brunswick |

$1.690 | $1.613 | $0.077 |

|

Newfoundland and Labrador |

$1.747 | $1.682 | $0.065 |

|

Northwest Territories |

$1.667 | $1.641 | $0.026 |

|

Nova Scotia |

$1.671 | $1.541 | $0.130 |

|

Nunavut |

$1.501 | $1.456 | $0.045 |

|

Ontario |

$1.623 | $1.502 | $0.121 |

|

Prince Edward Island |

$1.712 | $1.631 | $0.081 |

|

Quebec |

$1.732 | $1.623 | $0.109 |

|

Saskatchewan |

$1.577 | $1.550 | $0.027 |

|

Yukon |

$1.851 | $1.760 | $0.091 |

Fuel price data was extracted for a period of three months (May 23rd, 2023 to August 18th, 2023) in order to reflect current gasoline price trends. Subsequent reports will focus on three-month periods following the period covered in the present study. Average gasoline prices per litre and per Province or Territory were found to vary between $1.417 in Alberta to $1.958 in British Columbia, with a Canadian average of $1.673, an increase of 10.5 cents from the previous Fuel Update (May 2023, for publication on July 1st, 2023). The three-month period’s lowest price was recorded in Edmonton, Alberta at $1.347 per litre on July 25th and the highest in Vancouver, British Columbia at $2.102 per litre on June 20th.

Gas prices in Nunavut are typically set for a full calendar year and rarely exhibit any changes. Nonetheless, this year gasoline prices were adjusted on April 1st, thus resulting in a slight average price increase of 4,5 cents as compared to the previous Fuel Update (May 2023 for publication on July 1st, 2023), which only had a minimal impact on the Reimbursement Rates.

For illustration purposes, Graph 1 displays gasoline prices for the main metropolitan areas for a one-year period (August 2022 - August 2023).

Also, for illustration purposes, Graph 2 displays crude oil prices for three benchmarks – WCS (Western Canadian Select), Brent and WTI (West Texas Intermediate) for a one-year period (August 2022 - August 2023).

2.3 Sales Taxes

For the current Update, research was performed to see if there were any relevant changes to Federal and Provincial sales taxes that could have an immediate impact on the Reimbursement Rates. As of the date of this Update, no changes were observed in sales taxes anywhere in Canada as compared to the previous Annual Report. Moreover, no changes are foreseen at this time for the immediate future.

3 Impact of Fuel Prices on Reimbursement Rates

3.1 Fuel Consumption

In calculating the fuel costs contribution to the total vehicle operating costs, the methodology employed in the Annual Report was strictly adhered to. Fuel consumption for every vehicle model in the study was thus combined with average prices per Province or Territory to determine the fuel portion of operating costs, based on an average of 20,000 kilometres per year.

3.2 Updated Reimbursement Rates

For comparison, the following table provides updated Travel and Commuting Rates, as well as rates previously calculated for the Annual Report (November 2022, for publication on January 1st, 2023), the February 2023 Fuel Update (for publication on April 1st, 2023) and the May 2023 Fuel Update (for publication on July 1st, 2023):

Current Fuel Update Reimbursement Schedule (in dollars per kilometre)

|

Travel Rate |

Commuting Rate |

|||||||

|

Province/Territory |

Current Fuel Update |

July 1st 2023 Fuel Update |

April 1st |

Jan 1st 2023 Annual Report |

Current Fuel Update |

July 1st 2023 Fuel Update |

April 1st, 2023 Fuel Update |

Jan 1st 2023 Annual Report |

|

Alberta |

$0.530 |

$0.525 |

$0.520 |

$0.540 |

$0.220 |

$0.215 |

$0.210 |

$0.230 |

|

British Columbia |

$0.565 |

$0.550 |

$0.545 |

$0.565 |

$0.275 |

$0.265 |

$0.255 |

$0.280 |

|

Manitoba |

$0.545 |

$0.540 |

$0.540 |

$0.555 |

$0.240 |

$0.240 |

$0.235 |

$0.255 |

|

New Brunswick |

$0.575 |

$0.570 |

$0.570 |

$0.575 |

$0.250 |

$0.245 |

$0.245 |

$0.250 |

|

Newfoundland and Labrador |

$0.590 |

$0.585 |

$0.585 |

$0.595 |

$0.255 |

$0.250 |

$0.250 |

$0.260 |

|

Northwest Territories |

$0.705 |

$0.700 |

$0.700 |

$0.715 |

$0.325 |

$0.325 |

$0.320 |

$0.340 |

|

Nova Scotia |

$0.580 |

$0.570 |

$0.570 |

$0.580 |

$0.250 |

$0.240 |

$0.240 |

$0.250 |

|

Nunavut |

$0.675 |

$0.670 |

$0.665 |

$0.640 |

$0.305 |

$0.300 |

$0.295 |

$0.270 |

|

Ontario |

$0.590 |

$0.580 |

$0.580 |

$0.590 |

$0.245 |

$0.235 |

$0.230 |

$0.240 |

|

Prince Edward Island |

$0.560 |

$0.555 |

$0.550 |

$0.565 |

$0.255 |

$0.245 |

$0.245 |

$0.255 |

|

Quebec |

$0.575 |

$0.565 |

$0.565 |

$0.575 |

$0.260 |

$0.255 |

$0.250 |

$0.260 |

|

Saskatchewan |

$0.525 |

$0.525 |

$0.520 |

$0.530 |

$0.240 |

$0.235 |

$0.230 |

$0.245 |

|

Yukon |

$0.705 |

$0.695 |

$0.690 |

$0.710 |

$0.350 |

$0.340 |

$0.335 |

$0.355 |

Note: All figures were rounded up to the nearest half-cent.

The impact of gasoline prices on the Reimbursement Rates was minimal for the present Fuel Update. In comparison with the May 2023 Fuel Update (for publication on July 1st, 2023), the Travel Rates for the ten Provinces increased by a maximum of 1.5 cents and the Commuting Rates by a maximum of 1.0 cent, whereas for the Territories the maximum increase for both rates was 1.0 cent. Canadian weighted averages have increased by 1.0 cent for both the Travel and Commuting Rates. They are now at 57.0 cents per kilometre and 25.0 cents per kilometre respectively.

Fuel contributes on average 13.6 cents per kilometre to total operating costs, ranging from 11.6 cents in Alberta to 21.9 cents in the Yukon. The socio-economic factors affecting the global energy market are hard to forecast and it is difficult to make any prediction regarding gasoline prices for the next three-month period. However, any future changes will be reflected in the subsequent Annual Report.