Reimbursement for Business Use of Personal Vehicles

Study prepared for The Treasury Board of Canada Secretariat

By Corporate Fleet Services

1 Fuel Price Update Synopsis

Corporate Fleet Services (CFS) has been mandated by the Treasury Board of Canada Secretariat to perform the Annual evaluation of per-kilometre Reimbursement Rates for government employees that are required to use their personal vehicles while performing government business. Furthermore, the periodic impact of varying fuel prices was to be evaluated quarterly by producing three additional Fuel Price Updates per year. The present document represents the Update for May 2022 (for publication on July 1st, 2022).

The latest Annual study established Reimbursement Rates for each Canadian Province and Territory after performing a comprehensive analysis of all vehicle operating expenses. These rates were presented in the Reimbursement for Business Use of Personal Vehicles Report, dated November 2021 (for publication on January 1st, 2022). A subsequent Fuel Update was produced for February 2022 (for publication on April 1st, 2022).

The present Update reflects the impact of current fuel prices on the Travel and Commuting Rates’ recommendations made in the Annual Report with a focus on average pump prices of gasoline by Province and Territory. The prices were averaged for each Province or Territory for the three months prior to the release of the current Update (the months of March, April and May 2022). All prices are given in dollars per litre.

This Update also presents the latest recommended rates of reimbursement for consideration by the Treasury Board Secretariat in dollars per kilometre. Federal and provincial sales taxes were also researched to determine if there were any recent changes that could have had an immediate impact on the total costs of vehicle ownership and operation.

For the period March - May 2022 fuel expenses represent 25.6% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average of 14.7 cents per kilometre. The present Update identified a substantial increase in average gasoline prices across Canada, which had a significant impact on Reimbursement Rates. As a result, both Reimbursement Rates for the ten Provinces increased relative to the previous Fuel Update (February 2022 for publication on April 1st, 2022) by between 1.5 cents and 3.0 cents. For the Territories, both rates increased by between 1.0 cent and 3.0 cents respectively.

2 Fuel Prices

2.1 Energy Market Context

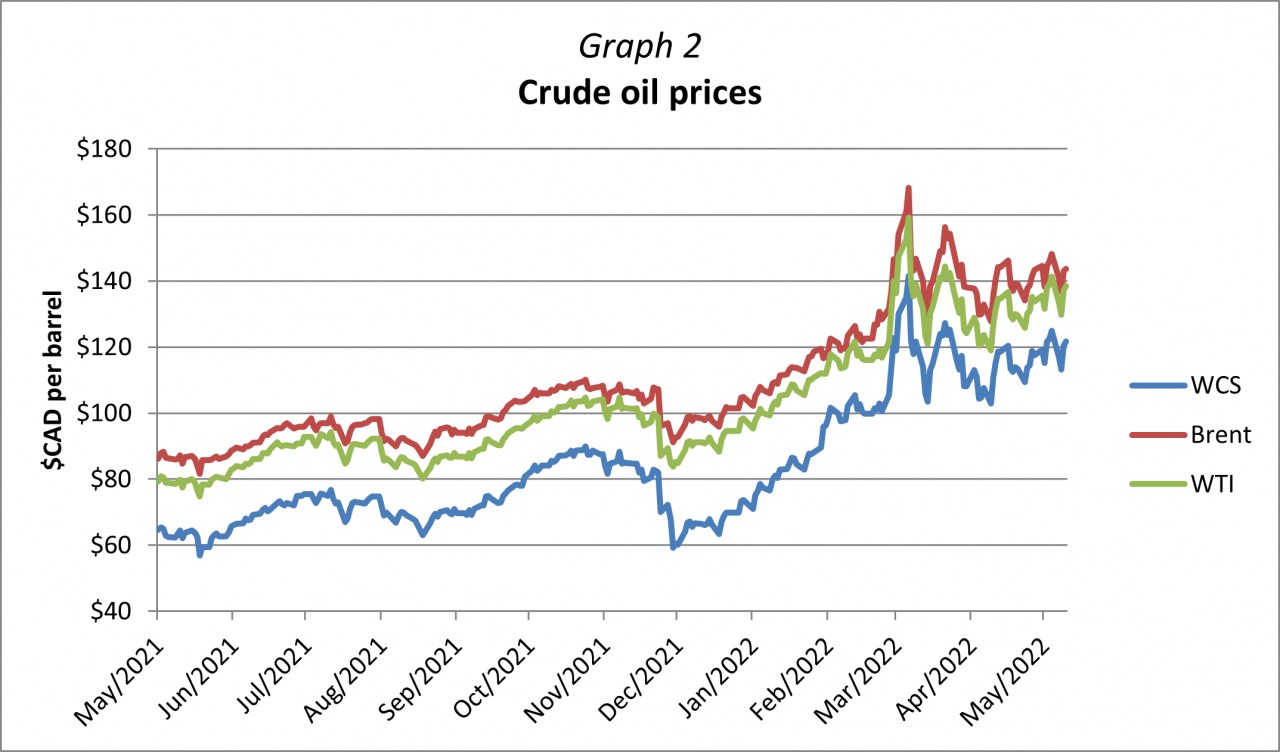

Over the past three months, global energy markets have seen a significantly increased volatility with large price swings in both directions. Overall, the period’s lowest price was recorded on February 18th when West Texas Intermediate (WTI) stood at $91.07 USD per barrel and Brent was at $93.54 USD per barrel. The three-month maximum was recorded on March 8th, when the WTI reached $123.70 USD per barrel and the Brent $127.98 USD per barrel. As of May 13th, WTI stands at $110.49 USD and Brent at $111.55 USD per barrel, 69% and 62% higher than a year ago.

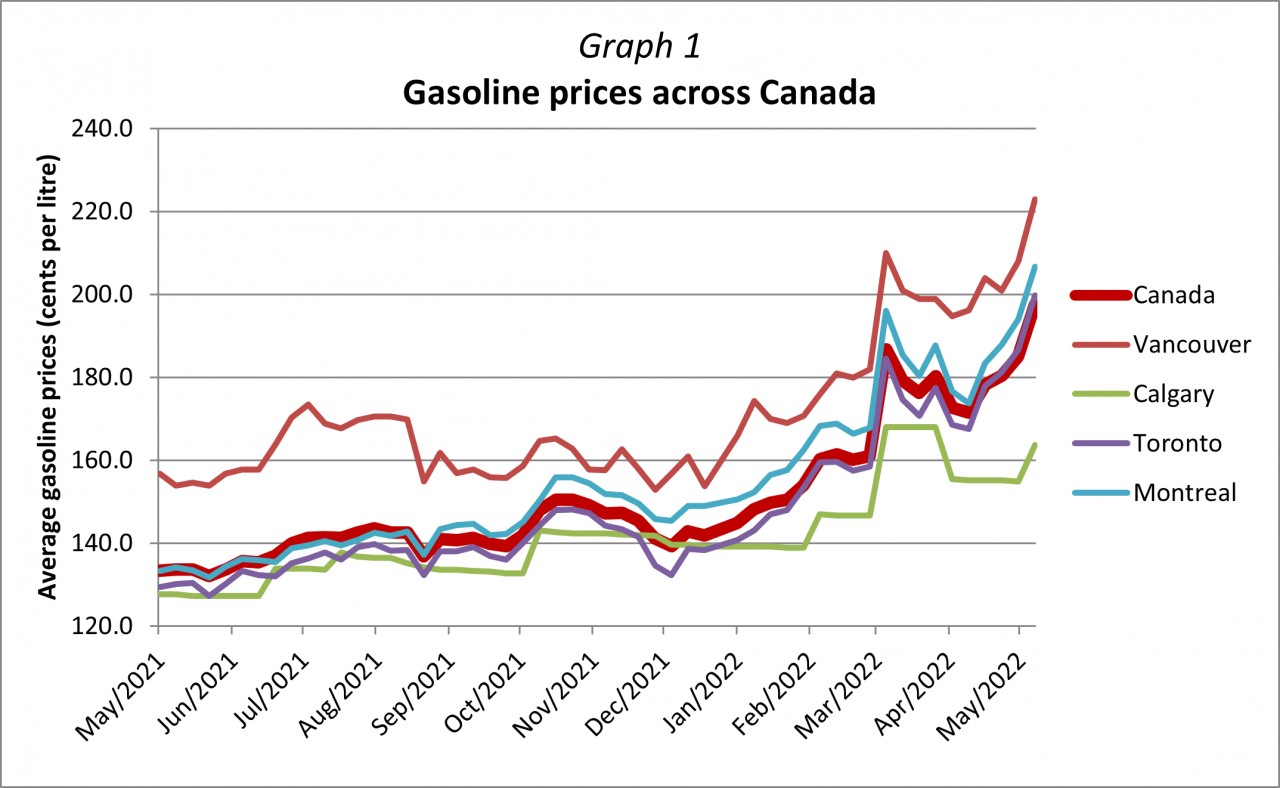

Gasoline prices have also been on an upward trend and have exhibited increased volatility, however, much less pronounced than crude oil. The Canadian average price for gasoline rose significantly from $1.600 per litre on February 18th to $1.975 per litre on May 13th, 2022 – an increase of 23.4% in the three-month period, or 47.2% more than in May 2021.

The primary factors affecting global crude oil market have been the war in Ukraine as well as an easing of the COVID-19 pandemic. In late February, Russia invaded Ukraine, beginning a war which has led to numerous rounds of ever-increasing sanctions. The war has had a broad global impact on both the demand as well as the supply side of the markets. On one hand, the war is reducing the global economic activity thus curbing demand. On the other hand, it has exacerbated global supply shortages for oil, grains and other commodities both from Ukraine and Russia, resulting in a rapid rise of prices and increasing volatility.

At the same time, the global Coronavirus pandemic has been steadily easing. The surge of the highly contagious Omicron variant has been slowing considerably with global case numbers plummeting from over 4 million cases per day in January 2022 to about 0.5 million cases per day in May. This has led to the removal of most of the previous restrictions and has resulted in more economic activity, which has increased demand for crude oil products and contributed to the upward price pressures.

This report strives to provide an overview of the current market situation and present the latest estimates and forecasts pertinent to the global energy market. Similar to previous reports, caution must be exercised when considering the data available due to the rapidly changing nature of global markets and, as noted by the Bank of Canada, “uncertainty around the assumed outlook for oil prices is particularly high.” Furthermore, the International Monetary Fund (IMF) indicates that “unusually high uncertainty surrounds this forecast, and downside risks to the global outlook dominate—including from a possible worsening of the war, (..) and a renewed flare-up of the pandemic should a new, more virulent virus strain emerge”, among other factors.

2.1.1 Global Crude Oil Demand

On the demand side of global crude oil markets, two opposing forces have been affecting the outlook. On one hand, the war in Ukraine has led to significant economic damage globally and, according to the International Monetary Fund, the conflict “will contribute to a significant slowdown in global growth in 2022.” On the other hand, the easing of the pandemic has led to the lifting of many restrictions, which has encouraged increased economic activity. These two factors have had a varying impact on different economies, while, overall, the outlook has been affected negatively. The International Monetary Fund (IMF) in its World Economic Outlook (WEO) Update from April 2022 projects that the global economic output will increase by 3.6% this year, as well as next year, a significant downward adjustment of 0.8% for 2022 and 0.2% for 2023 as compared to the previous WEO Update from January 2022. Declining growth rate projections are fueling price volatility both in the energy as well as the financial markets. Inflation, while initially projected to be short-lived, it remains elevated globally, currently driven mostly by the war-induced commodity price increases. For 2022, inflation is projected to average 5.7% in advanced economies and 8.7% in emerging markets and developing economies – this is 1.8 and 2.8 percentage points higher than the previous projections from January 2022.

The effects of the war are felt on both sides of the frontlines, with global spillovers through commodity markets, trade, and financial channels. On one hand, the war is having a devastating effect on Ukraine’s economy. The IMF’s initial projections indicate that its economy is likely to shrink by 35% this year. On the other hand, tight trading conditions and financial sanctions put on Russia are expected to have a severe impact on its economy, resulting in a 8.5% economic contraction in 2022 and a further 2.3% contraction in 2023. (IMF Apr 2022) The sanctions put on the Russian economy include loss of correspondent banking privileges, access of some banks to the SWIFT payment system, the interdiction of central bank assets, as well as the oil and gas embargo imposed by large economies (refer to the Global Crude Oil Supply section for details).

While globally the COVID-19 pandemic has been easing, a significant exception has been China. The Omicron variant has led to extended lockdowns in large metropolitan areas, including the world’s fifth-largest city and China’s financial hub, Shanghai. This has dampened economic activity and affected manufacturing. As China is the second-largest consumer of crude oil, shutdowns have led to reduced demand, providing some relief to the tight oil markets and allowing for prices to retreat temporarily. Similar to other countries, China is facing higher inflation rates (e.g., in March, their consumer price index increased 1.5% in a single month). Consequently, China’s growth projections have been reduced from 4.8% to 4.4%. As a result, the projection for emerging markets and developing economies as a group has been revised down by 1.0 basis point, and now is estimated to be 3.8% this year.

The overall growth rate in advanced economies has also seen a downward adjustment to 3.3% in 2022, a reduction of 0.6 percentage points. Due to Europe’s geographic proximity and economic ties, the war in Ukraine has had much a more significant impact on European countries than Canada or the U.S. Household and business confidence in the Euro Area have been affected significantly by the increased uncertainty caused by the war, along with higher energy prices and continuing supply challenges. As a result, the Euro Area is projected to expand by 2.8% in 2022 which is 1.1 percentage points lower than estimates from three months ago. The largest gross domestic product (GDP) downgrades are in Germany and Italy, due to their large manufacturing sectors and greater dependence on energy imports from Russia.

The economic links between Russia and North America are more limited. The impact of the war in the U.S. and Canada is mostly indirect, resulting from lower growth in their trading partners’ economies. As a result, the U.S. gross domestic product (GDP) growth projection has seen a more moderate adjustment from 4.0% to 3.7% for this year as compared to the January 2022 report. The economy remains robust, with strong job gains and rising wages. Nevertheless, the rising inflation, which was 8.5% annually in March (the highest level in over 40 years), has effectively eliminated the wage gains. To balance the rapid economic expansion and limit inflation, the Federal Reserve has begun increasing the interest rates in March and further incremental increases are expected to continue throughout the year. This makes borrowing more expensive and is aimed at reducing business and consumer spending.

Similar to the U.S., the IMF projection for Canada’s economic expansion has seen a moderate adjustment of 0.2 basis points and is now estimated to be 3.9% this year, mostly reflecting the withdrawal of policy support and weaker external demand from the U.S. The IMF projections for next year remain unchanged at 2.8% for 2023. By comparison, the Bank of Canada projections have seen improvements. According to the Monetary Policy Review (MPR) published in April 2022, the Canadian economy has seen a strong momentum with the employment and participation rates at near or above their pre‐pandemic levels and the unemployment rate at a record low. While the effects of COVID-19 continue to pose challenges, high vaccination rates are lessening severe impacts and most restrictions are being lifted. As a result, household spending is growing, and exports are expected to rise in response to solid foreign demand and high commodity prices. Consequently, the Bank of Canada projects that the GDP will grow by 4.25% in 2022, which is 0.25 basis points higher than projected previously. The economy is projected to expand by an additional 3.25% in 2023.

According to the Monthly Oil Market Report from May 2022, the Organization of the Petroleum Exporting Countries (OPEC) estimates that global oil demand will average 100.29 mb/d this year – a slightly reduced outlook than three months ago. The OPEC reference basket price (calculated as a weighted average of prices of crude oil produced by OPEC countries) averaged $105.64 USD per barrel in April 2022. This is an increase of 23.7% as compared to January 2022 and 67.1% more than a year ago.

2.1.2 Global Crude Oil Supply

As the world’s second-largest producer, Russia accounts for about 10% of the global crude oil supply. In 2021, about 60% of its exports went to Europe and 20% to China. Russia’s invasion of Ukraine was met with severe sanctions, including an oil import embargo. The U.S. imposed the embargo at the beginning of March, while the European Union (EU) reached an agreement in early May. The EU relies on Russia for almost 40% of their natural gas and about 25% of their oil consumption. The phased embargo is set to result in a total ban of Russian oil imports, totaling about 4.7 mb/d, by the end of this year. It must be noted however that even though the EU embargo is not yet in place, Russia’s energy exports have been dropping due to other factors (e.g., importers are wary of risks that deals might not be finalized because of the sanctions put on the Russia’s banking system). Despite the declining global supply, the OPEC+ (an alliance of the Organization of the Petroleum Exporting Countries (OPEC) along with several other non-OPEC countries, including Russia) has not deviated from their pre-established monthly increase schedule of an additional 0.4 mb/d.

To aid in balancing the oil market supply and demand, 31 countries from the Organization for Economic Co-operation and Development (OECD) that are members of the International Energy Agency (IEA) released oil from their strategic reserves. The IEA has stockpiled a total of 1.5 billion barrels of oil that the agency has reserved for emergencies. On March 31st, 2022, the United States announced that it would sell a total of 180 million barrels of its 560 million barrels currently in reserve at a rate of 1.0 mb/d starting in May. This is the largest release from the stockpile since it was created in the 1970s. Other member countries are releasing an additional 60 million barrels to temper global prices. While the only long-term solution is to increase production, this release is providing a short-term support, curbing crude prices and proving some relief for consumers and businesses.

Crude oil production in the U.S. has remained sluggish. Many oil companies have been reluctant to increase production due to the financial hardships associated with the pandemic as well as prospects of tougher environmental rules. In addition, scaling production has been hard as oil companies face the same supply chain and hiring challenges as other businesses. To encourage future increase in production, the U.S. government reopened the permits to drill on Federal land, albeit with increased royalty fees by about 50%. It takes 6 to 18 months from receiving a permit to beginning production, so any increase in output resulting from this decision will come no sooner than in the Fall of this year. The Energy Information Agency (EIA) forecasts that the U.S. crude oil production will average 11.9 mb/d this year, 0.7 mb/d more than in 2021, increasing to 12.8 mb/d in 2023 and surpassing the previous annual average record of 12.3 mb/d set in 2019.

In Canada, however, the high energy prices have been benefiting the oil and gas industry. It has been reported that in dollar value, the fossil-fuel industry represented 27.4% of export shipments in March 2022, matching the all-time high recorded in 2014. Furthermore, according to data from Statistics Canada, oil, natural gas, coal and refined petroleum exports recorded a one-month record of $17.4 billion in March and total shipments over the past 12 months also set a record of about $150 billion.

According to the latest Short-Term Energy Outlook (STEO) published in May 2022 by the EIA, total global production is set to average 99.89 mb/d in 2022, a significant decline of 1.5 mb/d as compared to the STEO from February 2022.

Over the last three months, oil price volatility has been unusually high. The war in Ukraine had sent a particularly large shockwave through the markets, with the WTI increasing by 35.1%, from $91.59 to $123.70 in twelve days. Similarly, the Brent price rose from $97.93 to $127.98 (or 30.7%) during the same period. Even more notably, within only a week following this sharp increase, prices receded close to the levels seen before the invasion, before rising sharply again. This illustrates the unusually high volatility, largely driven by geopolitical instability. Since March, the price movements have tempered, but the overall volatility remains elevated. Before the invasion, crude prices typically moved by roughly $1 USD per barrel each day, sometimes a little more and sometimes less. Since then, crude oil price changes have been around $4 USD in a day (four times higher than usual). On certain days, the swings have been even higher, reaching as much as $12-$15 USD or more than 10% in a single day.

2.2 Gasoline Prices Across Canada

The price of gasoline rises and falls with the price of crude, although not always in perfect sync or to the same extent. The crude oil price accounts for about 50%-60% of the total retail gasoline price. In addition, taxes, refining costs, distribution and marketing costs have their own effects. Furthermore, gas prices at the pump also exhibit more stability than crude due to the “sticky pump” effect. Retail fuel stations are hesitant to have their prices swinging too much and too often, as it alienates customers and can lead to losing market share to competitors. The price changes at the pump are typically kept to a minimum while following the broader trend, resulting in slower price increases and decreases than the ones exhibited by oil prices (e.g. while the WTI increased by more than 35% in early March, the corresponding change in average gasoline prices in Canada was less than 19%). Adding to the price pressures at the pump is the fact that not only is the oil production lagging behind pre-pandemic levels but the refining capacity is also more limited (e.g. in the U.S., where most of the gasoline sold in Canada comes from, the refining capacity to turn oil into gasoline, diesel, jet fuel and other petroleum-based products is one million barrels less than before the pandemic).

To ease the pressures on gas prices, several U.S. states as well as Canadian provinces have been introducing temporary fuel tax cuts (e.g. Alberta paused collecting the provincial tax of 13 cents per litre of gasoline and diesel from April 1st until at least June 30th, 2022. In April, Ontario proposed a legislation that would reduce the gas tax by 5.7 cents per litre from July 1st until the end of the year.

While not directly affecting gasoline prices, it must be noted that diesel fuel has seen even more rapid price hikes. Demand for diesel is not as elastic as gasoline – companies can’t simply cancel their travel the way consumers may cancel a vacation. In early March, diesel in the U.S. recorded the largest single day increase in history, 35 cents per gallon. As of mid-May, diesel is still selling at record high prices.

Overall, gas prices have followed crude oil price trends. Average prices in Canada saw a spike in early March, when the gas price was $1.914 per litre. Prices receded until mid-April with volatility remaining higher than usual. Since then, the prices have been on a rise again and, as of the writing of this report, the gas price is setting a new record of $1.975 per litre on May 13th, 2022. Outside of Nunavut (which has gasoline prices pre-set at the Territorial level), as of May 13th, 2022, the three-month highest price has been recorded in Labrador City, NL at 223.9 cents per litre (on May 10th through 13th) and the lowest in Sarnia, ON at 140.6 cents per litre (on February 22nd, 2022). Overall, an increase in the three-month average gasoline prices as compared to the previous Fuel Update from February 2022 (for publication on April 1st, 2022) has been observed across all Canadian Provinces and Territories. Except for Alberta and the Territories, where gasoline price increased between 7.2% and 14.9%, all other Provinces have seen an average price hike between 19.5% and 23.4%, with the Canadian average gasoline price rising by 15.2%. In a year-to-year perspective, the three-month average price is 37.4% higher than in 2021.

Prices of gasoline, in Canada, include all applicable taxes. Prices vary significantly across Canada, mainly due to the difference in the types and amounts of taxes being charged on fuel in different Provinces and Territories. The present Update calculated the average prices of regular gasoline charged at the pump. The fuel price data was primarily obtained from Natural Resources Canada via Kalibrate Technologies Limited (previously Kent Marketing), based on daily published fuel prices for 78 locations across Canada. This data was verified against additional databases that similarly track fuel prices all across Canada.

Consistent with the methodology of the Annual Report, when determining average gasoline prices per Province or Territory, we have used weighted averages according to population in order to better conform to reality. In this manner, larger metropolitan centers account for a greater portion of the total average price compared to smaller municipalities.

The following is a table with average regular gasoline prices for all Canadian Provinces and Territories, in dollars per litre, for the period March - May 2022:

|

Province/Territory |

Current fuel price |

April 1st, 2022 Annual Report fuel price |

Price |

|

Alberta |

$1.569 | $1.373 | $0.196 |

|

British Columbia |

$1.956 | $1.613 | $0.343 |

|

Manitoba |

$1.683 | $1.364 | $0.319 |

|

New Brunswick |

$1.723 | $1.440 | $0.283 |

|

Newfoundland and Labrador |

$1.902 | $1.584 | $0.318 |

|

Northwest Territories |

$1.736 | $1.525 | $0.211 |

|

Nova Scotia |

$1.711 | $1.391 | $0.320 |

|

Nunavut |

$1.201 | $1.120 | $0.081 |

|

Ontario |

$1.745 | $1.437 | $0.308 |

|

Prince Edward Island |

$1.729 | $1.416 | $0.313 |

|

Quebec |

$1.823 | $1.525 | $0.298 |

|

Saskatchewan |

$1.659 | $1.367 | $0.292 |

|

Yukon |

$1.803 | $1.570 | $0.233 |

Fuel price data was extracted for a period of three months (February 14th to May 13th, 2022) in order to reflect current gasoline price trends. Subsequent reports will focus on three-month periods following the period covered in the present study. Average gasoline prices per litre and per Province or Territory were found to vary between $1.201 in Nunavut to $1.956 in British Columbia, with a Canadian average of $1.766, an increase of 29.2 cents from the previous Fuel Update (February 2022 for publication on April 1st, 2022).

Gas prices in Nunavut are typically set for a full calendar year and rarely exhibit any changes throughout the year. However, on April 1st, 2022 a new price update was issued to reflect the yearly increase in the Federal Carbon Tax, that brought the average price up by 0.7 cents for the current report. This, however, only had a slight effect on the Reimbursement Rates. Due to its unique practice of setting gas prices for a full year, Nunavut average prices are expected to stay relatively constant for the next Fuel Update and Annual Report.

For illustration purposes, Graph 1 displays gasoline prices for the larger metropolitan areas for a one-year period (May 2021 - May 2022).

Also for illustration purposes, Graph 2 displays crude oil prices for three benchmarks – WTI (West Texas Intermediate), Brent and Heavy Canadian Crude for a one-year period (May 2021 - May 2022).

* Note that the crude oil prices vary depending on the trading location and the source of data. Graph data source: Kalibrate Technologies Limited (previously Kent Marketing).

2.3 Sales Taxes

For the current Update, research was performed to see if there were any relevant changes to Federal and Provincial sales taxes that could have an immediate impact on the Reimbursement Rates. As of the date of this Update, no changes were observed in sales taxes anywhere in Canada as compared to the previous Annual Report. Moreover, no changes are foreseen at this time for the immediate future.

3 Impact of Fuel Prices on Reimbursement Rates

3.1 Fuel Consumption

In calculating the fuel costs contribution to the total vehicle operating costs, the methodology employed in the Annual Report was strictly adhered to. Fuel consumption for every vehicle model in the study was thus combined with average prices per Province or Territory to determine the fuel portion of operating costs, based on an average of 20,000 kilometres per year.

3.2 Updated Reimbursement Rates

For comparison, the following table provides updated Travel and Commuting Rates, as well as rates previously calculated for the November 2021 Annual Report (for publication on January 1st, 2022) and the February 2022 Fuel Update (for publication on April 1st, 2022):

Current Fuel Update Reimbursement Schedule (in dollars per kilometre)

|

Travel Rate |

Commuting Rate |

|||||

|

Province/Territory |

Current Fuel Update |

Apr 1st 2022 |

Jan 1st 2022 Annual Report |

Current Fuel Update |

Apr 1st 2022 Fuel Update |

Jan 1st 2022 Annual Report |

|

Alberta |

$0.530 |

$0.515 |

$0.515 |

$0.225 |

$0.210 |

$0.210 |

|

British Columbia |

$0.565 |

$0.540 |

$0.535 |

$0.270 |

$0.240 |

$0.240 |

|

Manitoba |

$0.540 |

$0.515 |

$0.515 |

$0.245 |

$0.215 |

$0.215 |

|

New Brunswick |

$0.570 |

$0.550 |

$0.545 |

$0.250 |

$0.225 |

$0.220 |

|

Newfoundland and Labrador |

$0.605 |

$0.580 |

$0.575 |

$0.265 |

$0.235 |

$0.235 |

|

Northwest Territories |

$0.645 |

$0.620 |

$0.620 |

$0.320 |

$0.295 |

$0.295 |

|

Nova Scotia |

$0.575 |

$0.550 |

$0.550 |

$0.250 |

$0.220 |

$0.220 |

|

Nunavut |

$0.580 |

$0.570 |

$0.570 |

$0.260 |

$0.250 |

$0.250 |

|

Ontario |

$0.600 |

$0.575 |

$0.575 |

$0.250 |

$0.225 |

$0.220 |

|

Prince Edward Island |

$0.560 |

$0.535 |

$0.530 |

$0.250 |

$0.225 |

$0.220 |

|

Quebec |

$0.580 |

$0.555 |

$0.550 |

$0.265 |

$0.240 |

$0.235 |

|

Saskatchewan |

$0.530 |

$0.505 |

$0.505 |

$0.240 |

$0.215 |

$0.215 |

|

Yukon |

$0.630 |

$0.605 |

$0.600 |

$0.330 |

$0.300 |

$0.300 |

Note: All figures were rounded up to the nearest half-cent.

The impact of gasoline prices on the Reimbursement Rates was substantial for the present Fuel Update. In comparison with the February 2022 Fuel Update (for publication on April 1st, 2022), the Reimbursement Rates increased between 1.5 cents to 3.0 cents per kilometre for the Provinces. For the Territories, the Rates have increased by between 1.0 cents per kilometre in Nunavut to 3.0 cents in the Yukon. Canadian weighted averages have increased by 2.5 cents per kilometre for both the Travel and Commuting Rates, and are now at 57.5 cents per kilometre for the Travel Rate and 25.0 cents per kilometre for the Commuting Rate.

Fuel contributes on average 14.7 cents per kilometre to total operating costs, ranging from 13.1 cents in Alberta to 20.9 cents in the Yukon. The socio-economic factors affecting the global energy market are hard to forecast and it is difficult to make any prediction regarding gasoline prices for the next three-month period. However, any future changes will be reflected in the subsequent Fuel Update.