Reimbursement for Business Use of Personal Vehicles

Study prepared for The Treasury Board of Canada Secretariat

By Corporate Fleet Services

1 Fuel Price Update Synopsis

Corporate Fleet Services (CFS) has been mandated by the Treasury Board of Canada Secretariat to perform the Annual evaluation of per-kilometre Reimbursement Rates for government employees that are required to use their personal vehicles while performing government business. Furthermore, the periodic impact of varying fuel prices was to be evaluated quarterly by producing three additional Fuel Price Updates per year. The present document represents the Update for August 2022 (for publication on October 1st, 2022).

The latest Annual study established Reimbursement Rates for each Canadian Province and Territory after performing a comprehensive analysis of all vehicle operating expenses. These rates were presented in the Reimbursement for Business Use of Personal Vehicles Report, dated November 2021 (for publication on January 1st, 2022). Two subsequent Fuel Updates were produced for February 2022 (for publication on April 1st, 2022) and May 2022 (for publication on July 1st, 2022) respectively.

The present Update reflects the impact of current fuel prices on the Travel and Commuting Rates’ recommendations made in the Annual Report with a focus on average pump prices of gasoline by Province and Territory. The prices were averaged for each Province or Territory for the three months prior to the release of the current Update (the months of June, July and August 2022). All prices are given in dollars per litre.

This Update also presents the latest recommended rates of reimbursement for consideration by the Treasury Board Secretariat in dollars per kilometre. Federal and Provincial sales taxes were also researched to determine if there were any recent changes that could have had an immediate impact on the total costs of vehicle ownership and operation.

For the period June - August 2022 fuel expenses represent 27.7% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average of 16.3 cents per kilometre. The present Update identified considerable increases in average gasoline prices across Canada, which had an upward impact on the Reimbursement Rates. As a result, both Reimbursement Rates for the ten Provinces increased by a maximum of 2.5 cents relative to the previous Fuel Update (May 2022 for publication on July 1st, 2022). For the Territories, Nunavut remained constant, while the Northwest Territories and the Yukon saw an increase of up to 3.5 cents.

2 Fuel Prices

2.1 Energy Market Context

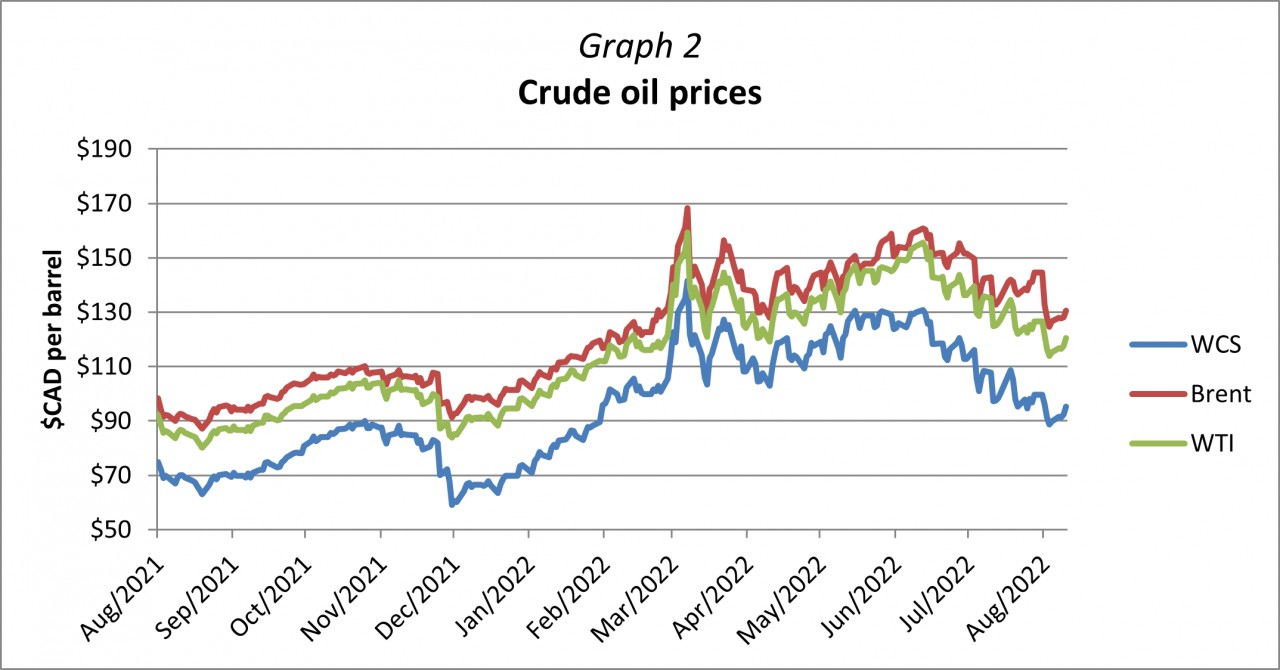

Over the past three months, the global energy markets have been on a decline. While volatility remains elevated, the global crude prices along with gasoline have been trending downwards. The three months period’s highest crude oil prices were recorded on June 8th when West Texas Intermediate (WTI) reached $122.11 USD per barrel and Brent was at $123.58 USD per barrel. Since then, the prices, albeit with significant daily fluctuations, have been declining steadily. As of August 12th, WTI stood at $92.09 USD and Brent at $98.15 USD per barrel, a reduction of 24.58% and 20.58% respectively from their earlier highs. In general, oil prices remain about 50% higher than a year ago.

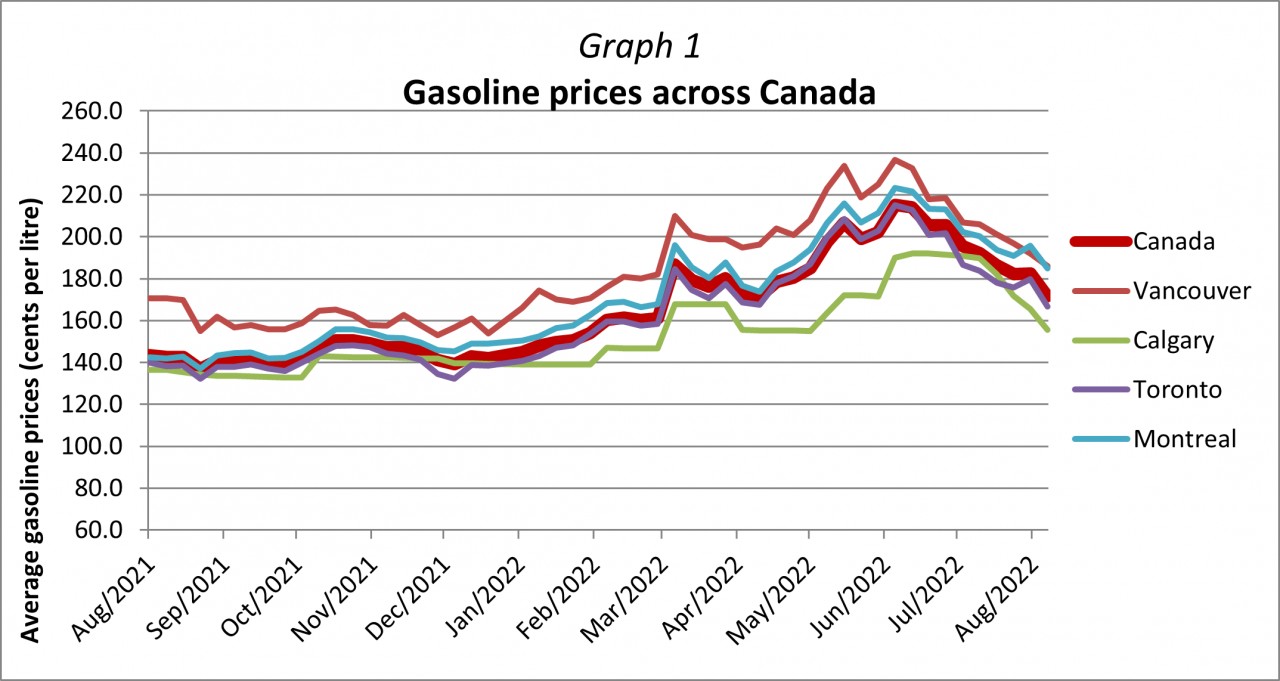

Gasoline prices have followed the oil market and have also been trending downwards since early June. Gasoline prices continued to rise until early June, with the highest price being recorded on June 7th when a Canadian average price of $2.151 was recorded. As of August 12th, 2022, the average price for gasoline in Canada was $1.762. Overall, gas prices are disproportionally higher than oil prices due to low inventories, reduced refining capacity as well as war-related disruptions.

The main factors affecting the global energy markets have been the concerns of a slowdown in global economic growth and surging inflation, as well as continued supply shortages.

The global Coronavirus case numbers saw a surge in July, likely due to easing of restrictions and the rise in travel. As most countries lifted testing and vaccination requirements related to travel, the industry saw a rapid return in customer numbers. While in most regions the surge was limited, it was much more pronounced in Japan and China, both of which, during the past few months, saw the highest infection rates since the beginning of the pandemic.

This report strives to provide an overview of the current market situation and present the latest estimates and forecasts pertinent to the global energy market. Similar to previous reports, caution must be exercised when considering the data available due to the rapidly changing nature of global markets.

2.1.1 Global Crude Oil Demand

The economic recovery following the coronavirus pandemic has been slowing down. The global economic output as measured by the gross domestic product (GPD) contracted in the second quarter of this year. This was mainly driven by significantly reduced economic activity in China due to COVID-19 lockdowns, the international sanctions put on Russia, as well as lower than expected consumer spending in the United States (US). Further negative spillovers from the war in Ukraine have also been a major contributor. In addition, the US dollar has been appreciating in 2022. Between December of last year and June of this year it has gained about 5% in nominal effective terms. This has been adding further pressure on the slowing of the global trade since it is the dominant international currency. As a result, the International Monetary Fund (IMF) estimates that the global economic growth will be 3.2% in 2022 and 2.9% in 2023, a reduction of 0.4 and 0.7 percentage points respectively as compared to the April 2022 World Economic Outlook and significantly lower than the 6.1% growth last year.

Inflation has been a major factor in the global outlook. Inflation has been high worldwide, especially in the United States (US) and major European economies with it continuing to rise largely driven by the surging oil and food prices, along with the returning demand for services and continued supply constraints in many sectors. In fact, more countries have recorded inflation levels not seen in decades. As an example, in June, the consumer price index rose by 9.1% in the US as well as the UK the highest inflation rates in these two countries in 40 years, while in the Euro Area the 8.6% inflation was the highest since the inception of the monetary union in 1993.

Responding to the high inflation rates, governments have been tightening their monetary policies by more assertively rising the interest rates and conducting quantitative tightening, i.e. central banks are letting certain bonds to mature and not replacing them with new bonds. Both of these practices in turn reduce capital accessibility and weigh on economic growth. Notably, inflation expectations also have a direct impact on inflation because they are factored in when firms set wages and prices. When inflation is expected to rise, businesses transfer more of their cost increase to the consumer, but in turn this also creates pressure on wages. As a result, the IMF in its latest World Economic Outlook (WEO) Update from July 2022 reports that inflation in 2022 is anticipated to reach 6.6% in advanced economies and 9.5% in emerging markets and developing economies – an upward revision of 0.9 and 0.8 percentage points respectively as compared to the WEO from April 2022.

The war in Ukraine continues to place an additional strain on the global economy. It has had a significant impact on global food prices, particularly those related to wheat, due to the war preventing Ukraine from maintaining its significant exports of wheat to world markets. This has been felt more in low-income countries, where food represents a larger share of consumption and as a result these are having a greater impact of this inflation. Since April 2022, major advanced economies have placed additional financial sanctions on Russia and the European Union agreed on embargoes on imports of coal starting in August 2022 and on Russian seaborne oil starting in 2023.

As a result, advanced economies are projected to grow by 2.5% in 2022 and 1.4% in 2023, down from 5.2% in 2021. The high energy costs, spillovers from the war in Ukraine, including the imposed sanctions, as well as tighter financial conditions due to the European Central Bank raising rates for the first time since 2011 have been impairing European manufacturing and services, weighing on growth projections. While Italy has seen improved prospects for tourism and industrial activity, significant downgrades in France, Germany and Spain are providing a net-negative adjustment to the growth outlook. In addition, the flow of Russian pipeline gas to Europe has declined sharply by about 60% as compared to the level a year ago, contributing to a steep increase in natural gas prices in June, adding to the inflationary pressures and posing risks of energy shortages.

Similarly, the economic activity in the United States (US) has been weaker than expected. The US economy is expected to grow by 2.3% this year and a further 1.0% in 2023, a sharp downward revision of 1.4 and 1.3 percentage points respectively, and significantly slower growth than the 5.7% in 2021. This is indicating less momentum in private consumption in the first two quarters of 2022, in part reflecting the erosion of household purchasing power due to inflation. Like in many other countries, the tightening of the monetary policy is weighing on the growth prospects in terms of consumptions and business investments.

Canadian economic outlook has similarly seen sharp reductions. The Bank of Canada, in its Monetary Policy Review (MPR) from July 2022, projects that the GDP will grow by 3.5% in 2022 and 1.8% in 2023, a reduction of about 0.7 and 1.4 percentage points respectively as compared to the previous MPR from April 2022. Similarly, the IMF has reduced their projections to 3.4% this year and 1.8% next year. While the Canadian economy has had a strong start this year with an estimated 4% growth in the second quarter, it is expected to slow down significantly to about 2% in the third quarter. The consumption growth is expected to moderate as the pent-up demand for in-person services eases and high inflation is challenging household budgets. In fact, inflation measured by the consumer price index (CPI) is at a 40-year high and projected to be 7.2% in 2022 and 4.6% in 2023, and both numbers have been revised up by nearly 2 percentage points. This has been driven by high energy and food prices, as well as the low unemployment rates and labour shortages that are pushing wages higher. As noted by the Bank of Canada, “businesses continue to report capacity constraints, including labour shortages and supply chain challenges. Supply constraints are still weighing on production and sales.” The automotive sector remains particularly affected by the difficulties to source semiconductors and get motor vehicles to retailers. To respond to the inflationary pressures, the Bank of Canada has tightened its monetary policy and has begun to increase policy rates since March and initiating quantitative tightening in April. This has been increasing the cost to finance purchases of big-ticket items, including housing, which is now cooling down. This has resulted in some areas outside downtown cores that had previously seen large and unsustainable price increases during the pandemic, to now experience a price decline. On the positive side, however, the elevated energy prices are boosting exports and investments in the energy sector as firms seek to make full use of existing production capacity.

As reported by the IMF, emerging markets and developing economies as a group are expected to grow by 3.6% this year and 3.9% in 2023, thus revised downwards by 0.2 and 0.5 basis points respectively. While some oil-exporting countries are expected to benefit from increased oil revenues, the sharp tightening of financial conditions in many emerging market economies is also weighing on domestic demand, slowing the growth. In China, the COVID-19 outbreak and the subsequent containment measures, including an 8-week COVID-19 lockdown of Shanghai, have had a negative impact on manufacturing and the economy in general. This has led to a significant 1.1 percentage point downward revision of the outlook and is now estimated at mere 3.3% in 2022, a sharp decline from 8.1% last year. China’s economic slowdown has had major global spillovers with added pressure onto the global supply chain disruptions. On the other hand, Russia’s economy has been more robust against the economic sanctions than previously anticipated, mostly due to crude oil as well as non-energy exports holding up better than expected. IMF estimates that it will contract by 6.0% in 2022 (up from negative 8.5% in April 2022 report).

As noted by the IMF, the risks to the global economic outlook remain “overwhelmingly tilted to the downside”. Among other factors, the uncertainties surrounding the war in Ukraine and its impact onto the energy supplies to the European market, effectiveness of the monetary measures on the global inflation and renewed COVID-19 outbreaks, all pose high risks to the current outlook.

According to the Monthly Oil Market Report from August 2022, the Organization of the Petroleum Exporting Countries (OPEC) estimates that global oil demand will average 100.03 mb/d this year – a slight reduction of 0.26 mb/d from the outlook of three months ago. The OPEC reference basket price (calculated as a weighted average of prices of crude oil produced by OPEC countries) averaged $108.55 USD per barrel in July 2022, $35.02 USD or 47.63% per barrel higher than a year ago.

2.1.2 Global Crude Oil Supply

As the demand for crude oil remains high, despite the looming economic challenges, the supply has been slowly increasing and as a result has helped to stabilize the crude oil prices globally. Nevertheless, the situation in the energy markets remain tight as geopolitical tensions affect the normal transportation routes, disruptions limit the supply and refining capacity remains limited.

The Organization of the Petroleum Exporting Countries (OPEC) produce about 40% of the global crude oil. In April 2020, the alliance along with several non-OPEC countries including Russia (referred to as OPEC+) agreed to restrict their combined output by 10 mb/d or about 10% of the global supply. For the past year, the coalition has been slowly unwinding that production agreement releasing more oil to the market. In June, the OPEC+ coalition agreed to lift the remaining production quotas a month early, ending the agreement in August 2022. While this has been adding some crude back on the market, the sanctions on Russian oil exports as well as production challenges in other countries have meant that the coalition has been producing significantly less oil than expected. In fact, it was reported that in June the coalition’s combined oil production was nearly 3 mb/d lower than the planned levels, which represents about 3% of the global crude oil production. In addition, due to the low crude oil prices during the pandemic, many countries have suffered from underinvestment in the energy industry resulting in reduced production capacity. Furthermore, production interruptions have also been playing a role as Libya and Ecuador, that have a combined production capacity of 1.8 mb/d or nearly 2.0% of global supplies, announced sharp output reductions in early July due to political unrest and protests.

At the same time, US oil production has been on a rise. According to the latest Short-Term Energy Outlook (STEO) published by the EIA in August 2022, the US crude oil supply is projected to average 11.9 million barrels per day (mb/d) in 2022 and 12.7 mb/d in 2023. The latter number would set a new record for the highest yearly crude oil production level exceeding the current record of 12.3 mb/d reached in 2019.

The Canadian crude oil industry has similarly been benefiting from the elevated crude prices. As reported by ATB Economics, Alberta reached a new production record averaging 3.6 mb/d between January and June 2022 with oilsands accounting for 85% of the total output. Overall, Canadian oil production remains strong. According to the data published by the Canada Energy Regulator, the national oil supply is estimated to have averaged 4.84 mb/d in the first quarter of 2022, slightly higher than the yearly average of 4.74 mb/d in 2021. The increased production is resulting in record profits for both the producers as well as governments. For example, during the latest quarterly earnings, Imperial Oil posted a six-fold increase in profits compared to the same three-month period a year ago, reaching $2.4 billion. Similarly, Suncor Energy’s $4 billion profit was a four-fold increase over last year’s figures. As provincial governments collect royalty payments on oil and natural gas production, a major revenue boost is expected for the Alberta, Saskatchewan and Newfoundland governments this year, in addition to the Federal government. Alberta is estimated to receive a royalty revenue in the range of $15-$20 billion. The Federal government is also benefiting financially through increased corporate and income taxes, however, the effects are more difficult to measure.

The EIA forecasts that the total global crude oil supply will average 99.4 mb/d in 2022, remaining below the global demand level. Despite the uptick in production, crude oil inventory levels remain low and weekly fluctuations are higher than usual by as much as two times. The low inventory levels continue to reflect tightness in the energy markets.

During the pandemic when the demand for gasoline tanked, a number of refineries shut down or were being repurposed to produce other fuels, e.g. renewable diesel. In addition, many new refinery projects were cancelled. In fact, over the past three years, refiners in the US have shut – or announced plans to shut – about 2 million barrels of capacity a day or enough gasoline production to fuel an estimated 30 million cars. With the demand recovering and approaching pre-pandemic levels, this has led to an imbalance in the market. As a result, the existing refineries are working at their maximum refining capacity, recording as high as 95% in late June. In addition, it has been reported that refiners have delayed maintenance to satisfy fuel markets, which could bring challenges later in the year.

2.2 Gasoline Prices Across Canada

In the past three months, gas prices have followed crude oil price trends reaching their peak in early June and receding steadily since then. Demand, as well as price of gasoline in the US, has a direct impact on gasoline prices at the pump in Canada due to the shared infrastructure and products that cross the border in both directions.

The EIA measures the demand for gasoline on a week-to-week average basis, and during the summer months the demand has shown large fluctuations. For example, the EIA reported high demand for the last week of June at 9.4 mb/d followed by a swift downward dip to 8.1 mb/d the following week, before recovering gradually and exhibiting sustained demand over 9.0 mb/d for several weeks in late July and into August. Overall, the demand has remained strong adding an upward pressure on the prices at the pump and remaining disproportionately elevated as compared to the price of crude oil. This has resulted in increased short-term profit margins for oil refineries. The profits are estimated using a 3-2-1 Crack spread that approximates the product yield at a typical North American refinery. It roughly reflects the short-term profit margin for oil refineries by comparing the cost of the crude oil inputs to the output prices of finished products. For every three barrels of crude oil the refinery processes, it typically makes two barrels of gasoline and one barrel of diesel. Historically, the crack spread has kept a stable range increasing slightly during economic downturns. Before 2008, the crack spread ranged from $5-$20 per barrel. During the Great Recession and a few years afterwards, the crack spreads increased to the $20-$30 range, receding to $10-$25 per barrel between 2014 and 2020. Nevertheless, recently, the crack spread has seen an unprecedented increase due to the Russia-Ukraine conflict, rampant inflation as well as low global refining capacity that has limited supply unable to meet the demand and thus disproportionally increasing the spread. As a result, since March 2022, the crack spread has fluctuated in the range of $35-$65 per barrel, twice as high as during and after the Great Recession.

As a result, an increase in the three-month average gasoline prices as compared to the previous Fuel Update from May 2022 (for publication on July 1st, 2022) has been observed across all Canadian Provinces and Territories by an average of 11.1%. The largest increase has been recorded in Prince Edward Island where the average gas prices rose by 17.2% and the lowest, in British Columbia, that saw in increase of 8.1%. In a year-to-year perspective, the three-month average price is 41.8% higher than in 2021. In Nunavut, where fuel pricing is set on a territorial level, the price for gasoline remains the lowest anywhere in Canada – presently at around 120.7 cents per litre.

Prices of gasoline, in Canada, include all applicable taxes. Prices vary significantly across Canada, mainly due to the difference in the types and amounts of taxes being charged on fuel in different Provinces and Territories. The present Update calculated the average prices of regular gasoline charged at the pump. The fuel price data was primarily obtained from Natural Resources Canada via Kent Marketing, based on daily published fuel prices for 78 locations across Canada. This data was verified against additional databases that similarly track fuel prices all across Canada.

Consistent with the methodology of the Annual Report, when determining average gasoline prices per Province or Territory, we have used weighted averages according to population in order to better conform to reality. In this manner, metropolitan population centers account for a greater portion of the total average price compared to smaller municipalities.

The following is a table with average regular gasoline prices for all Canadian Provinces and Territories, in dollars per litre, for the period June - August 2022:

|

Province/Territory |

Current fuel price |

July 1st, 2022 Fuel Update fuel price |

Price |

|

Alberta |

$1.780 | $1.569 | $0.211 |

|

British Columbia |

$2.114 | $1.956 | $0.158 |

|

Manitoba |

$1.922 | $1.683 | $0.239 |

|

New Brunswick |

$1.994 | $1.723 | $0.271 |

|

Newfoundland and Labrador |

$2.095 | $1.902 | $0.193 |

|

Northwest Territories |

$1.987 | $1.736 | $0.251 |

|

Nova Scotia |

$1.956 | $1.711 | $0.245 |

|

Nunavut |

$1.207 | $1.201 | $0.006 |

|

Ontario |

$1.921 | $1.745 | $0.176 |

|

Prince Edward Island |

$2.026 | $1.729 | $0.297 |

|

Quebec |

$2.056 | $1.823 | $0.233 |

|

Saskatchewan |

$1.893 | $1.659 | $0.234 |

|

Yukon |

$2.088 | $1.803 | $0.285 |

Fuel price data was extracted for a period of three months (May 16th, 2022 to August 12th, 2022) in order to reflect current gasoline price trends. Subsequent reports will focus on three-month periods following the period covered in the present study. Average gasoline prices per litre and per Province or Territory (except for Nunavut) were found to vary between $1.780 in Alberta to $2.114 in British Columbia, with a Canadian average of $1.962, an increase of 19.6 cents from the previous Fuel Update (May 2022 for publication on July 1st, 2022). The three-month period’s lowest price was recorded in Lloydminster, Alberta at $1.399 per litre on August 12th and the highest in Labrador City, Newfoundland and Labrador at $2.380 per litre on May 19th.

Gas prices in Nunavut are typically set for a full calendar year and rarely exhibit any changes. Nonetheless, this year gasoline prices were adjusted on April 1st, thus resulting in a slight average price increase of 0.6 cents as compared to the previous Fuel Update, which, however, had no impact on either Reimbursement Rate.

For illustration purposes, Graph 1 displays gasoline prices for the main metropolitan areas for a one-year period (August 2021 - August 2022).

Also, for illustration purposes, Graph 2 displays crude oil prices for three benchmarks – WCS (Western Canadian Select), Brent and WTI (West Texas Intermediate) for a one-year period (August 2021 - August 2022).

2.3 Sales Taxes

For the current Update, research was performed to see if there were any relevant changes to Federal and Provincial sales taxes that could have an immediate impact on the Reimbursement Rates. As of the date of this Update, no changes were observed in sales taxes anywhere in Canada as compared to the previous Annual Report. Moreover, no changes are foreseen at this time for the immediate future.

3 Impact of Fuel Prices on Reimbursement Rates

3.1 Fuel Consumption

In calculating the fuel costs contribution to the total vehicle operating costs, the methodology employed in the Annual Report was strictly adhered to. Fuel consumption for every vehicle model in the study was thus combined with average prices per Province or Territory to determine the fuel portion of operating costs, based on an average of 20,000 kilometres per year.

3.2 Updated Reimbursement Rates

For comparison, the following table provides updated Travel and Commuting Rates, as well as rates previously calculated for the Annual Report (November 2021, for publication on January 1st, 2022), the February 2022 Fuel Update (for publication on April 1st, 2022) and the May 2022 Fuel Update (for publication on July 1st, 2022):

Current Fuel Update Reimbursement Schedule (in dollars per kilometre)

|

Travel Rate |

Commuting Rate |

|||||||

|

Province/Territory |

Current Fuel Update |

Jul 1st 2022 |

Apr 1st 2022 |

Jan 1st 2022 Annual Report |

Current Fuel Update |

Jul 1st 2022 Fuel Update |

Apr 1st 2022 Fuel Update |

Jan 1st 2022 Annual Report |

|

Alberta |

$0.550 |

$0.530 |

$0.515 |

$0.515 |

$0.245 |

$0.225 |

$0.210 |

$0.210 |

|

British Columbia |

$0.580 |

$0.565 |

$0.540 |

$0.535 |

$0.280 |

$0.270 |

$0.240 |

$0.240 |

|

Manitoba |

$0.560 |

$0.540 |

$0.515 |

$0.515 |

$0.265 |

$0.245 |

$0.215 |

$0.215 |

|

New Brunswick |

$0.595 |

$0.570 |

$0.550 |

$0.545 |

$0.270 |

$0.250 |

$0.225 |

$0.220 |

|

Newfoundland and Labrador |

$0.620 |

$0.605 |

$0.580 |

$0.575 |

$0.280 |

$0.265 |

$0.235 |

$0.235 |

|

Northwest Territories |

$0.675 |

$0.645 |

$0.620 |

$0.620 |

$0.350 |

$0.320 |

$0.295 |

$0.295 |

|

Nova Scotia |

$0.595 |

$0.575 |

$0.550 |

$0.550 |

$0.270 |

$0.250 |

$0.220 |

$0.220 |

|

Nunavut |

$0.580 |

$0.580 |

$0.570 |

$0.570 |

$0.260 |

$0.260 |

$0.250 |

$0.250 |

|

Ontario |

$0.615 |

$0.600 |

$0.575 |

$0.575 |

$0.265 |

$0.250 |

$0.225 |

$0.220 |

|

Prince Edward Island |

$0.585 |

$0.560 |

$0.535 |

$0.530 |

$0.275 |

$0.250 |

$0.225 |

$0.220 |

|

Quebec |

$0.600 |

$0.580 |

$0.555 |

$0.550 |

$0.285 |

$0.265 |

$0.240 |

$0.235 |

|

Saskatchewan |

$0.550 |

$0.530 |

$0.505 |

$0.505 |

$0.260 |

$0.240 |

$0.215 |

$0.215 |

|

Yukon |

$0.665 |

$0.630 |

$0.605 |

$0.600 |

$0.360 |

$0.330 |

$0.300 |

$0.300 |

Note: All figures were rounded up to the nearest half-cent.

The impact of gasoline prices on the Reimbursement Rates was significant for the present Fuel Update. In comparison with the May 2022 Fuel Update (for publication on July 1st, 2022), both the Travel and Commuting Rates displayed a maximum increase of 2.5 cents per kilometre for the Provinces, whereas for the Territories the maximum increase was 3.5 cents. Canadian weighted averages have increased by 1.5 cents for the Travel Rate and 2.0 cents for the Commuting Rate. They are now at 59.0 cents per kilometre and 27.0 cents per kilometre respectively.

Fuel contributes on average 16.3 cents per kilometre to total operating costs, ranging from 14.0 cents in Nunavut to 24.2 cents in the Yukon. The socio-economic factors affecting the global energy market are hard to forecast and it is difficult to make any prediction regarding gasoline prices for the next three-month period. However, any future changes will be reflected in the subsequent Annual Report.