Reimbursement for Business Use of Personal Vehicles

Model Year 2023

Study prepared for

The Treasury Board of Canada Secretariat

by Corporate Fleet Services

November 2022

1 Executive Summary

Corporate Fleet Services (CFS) has been mandated by the Treasury Board of Canada Secretariat to perform the annual evaluation of per-kilometre reimbursement rates for government employees required to use their personal vehicles while performing government business. This study assesses all vehicle operating expenses and provides recommendations for reimbursement rates for each Canadian Province and Territory.

The present study is based on 2023 model year vehicles and accounts for all of the following:

- 2023 model year vehicle prices for six different vehicle classes (compact, mid-size, minivan, small crossover/SUV, medium crossover/SUV and electric vehicles – which include Battery Electric and Plug-in Hybrid Electric vehicles)

- additionally, a light-duty truck class was used for the evaluation in the Territories

- prevalent manufacturer rebates, interest rates and residual values

- top-selling vehicle models by 2022 Canadian sales (September year-to-date) in each class studied, for a total of 57 vehicles

- cash purchases, financing and lease contracts, according to their respective share of the market

- updated vehicle insurance premium rates

- updated vehicle registration and licensing rates

- updated fuel price data and fuel consumption parameters

- updated preventative maintenance, repairs, tires and miscellaneous expenses

This report summarizes all assumptions, methodology, values and findings. It presents up-to-date recommended rates of reimbursement for consideration by the Treasury Board of Canada Secretariat.

1.1 Methodology and Evaluation

The recommendations are given for the year 2023 for:

- travel rates (government-requested use for business of a personal vehicle by government employees)

- commuting rates (employee-requested and government-approved use of a personal vehicle)

These rates are given on a per-kilometre basis, for each Province and Territory. This is intended to accurately account for differences in vehicle operating costs across Canada.

The recommendations are based on total costs of operating privately owned or leased vehicles. In order to reflect realistic conditions, the study assumes an annual driving distance of 20,000 kilometres and ownership terms of both four and five years. Fixed costs include ownership expenses consisting of depreciation, financing or leasing interest and taxes, as well as vehicle insurance and registration. Variable costs cover fuel, preventative maintenance, repairs, tires and miscellaneous items. All cost variations between the Provinces and Territories are accounted for, as well as the special driving conditions in the three Territories.

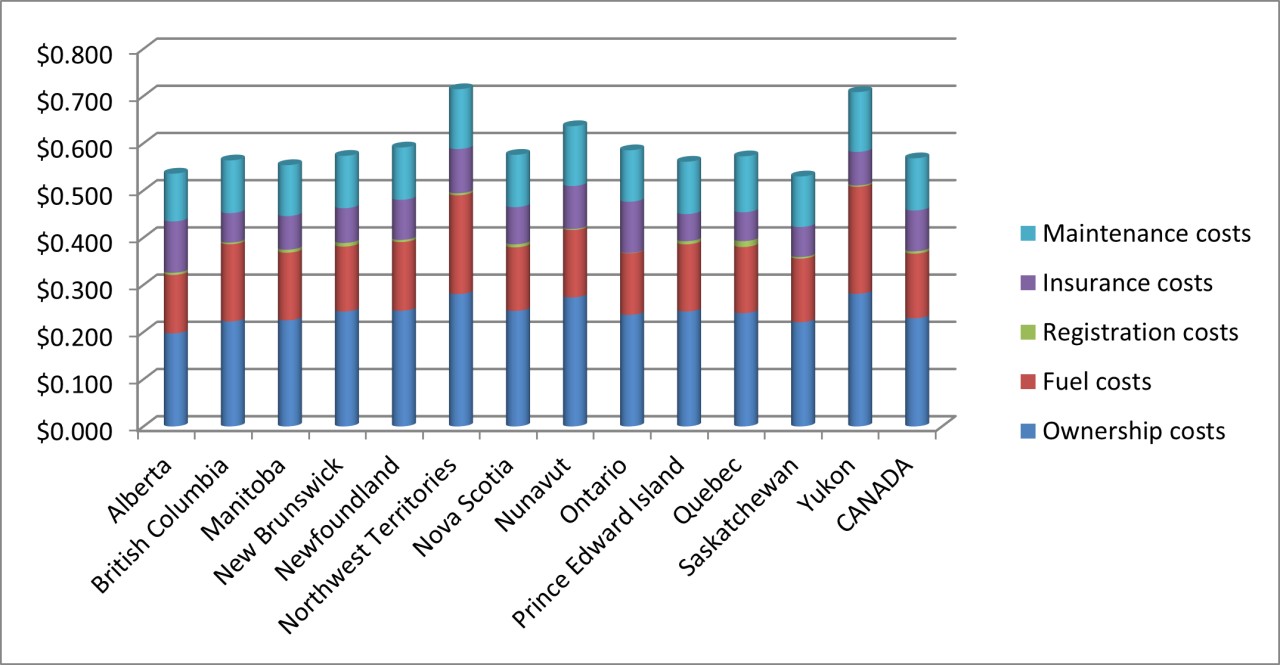

Weighted average nationwide costs of operating personally owned or leased vehicles were determined to be $0.570 per kilometre, as compared to $0.590 in the previous Fuel Update (August 2022, for publication on October 1st, 2022) and $0.550 in the previous year Annual Report (November 2021, for publication on January 1st, 2022). The overall decrease versus the previous Fuel Update was primarily due to a reduction in fuel prices after steep increases in previous periods. The only exception was Territories, where cost of ownership increased, raising the reimbursement rates. Refer to Section 4.1.9 for a detailed analysis.

The following table indicates Canadian average expenses by cost component as calculated in the current study, in dollars per kilometre, before rounding up to the nearest half-cent:

|

Cost component |

Cost |

Cost sub-component |

Cost |

|---|---|---|---|

|

Ownership |

$0.230 |

Depreciation |

$0.150 |

|

Interest |

$0.034 |

||

|

Acquisition Sales Tax |

$0.046 |

||

|

Registration |

$0.005 |

Registration |

$0.005 |

|

Insurance |

$0.087 |

Insurance |

$0.087 |

|

Fuel |

$0.137 |

Fuel |

$0.137 |

| Maintenance | $0.110 |

Preventative Maintenance |

$0.057 |

|

Repairs |

$0.019 |

||

|

Tires |

$0.015 |

||

|

Miscellaneous |

$0.007 |

||

|

Maintenance Sales Tax |

$0.012 |

||

|

TOTAL |

$0.569 |

Rounded up to $0.570 |

$0.569 |

The largest component of vehicle operating expenses is ownership (encompassing depreciation, interest and acquisition sales tax), which accounts for 40.4% of total costs, followed by fuel expenses at 24.1%.

2 Preamble

Corporate Fleet Services (CFS) has calculated reimbursement rates for business use of personal vehicles by government employees according to the methodology and parameters listed in a Statement of Work issued through a competitive RFP process. CFS is therefore pleased to present this study with its findings and recommendations, based on extensive research performed on behalf of the Treasury Board of Canada Secretariat.

2.1 Note on Methodology

The current study follows strictly the methodology employed in the previous Annual Report (November 2021, for publication on January 1st, 2022) as well as subsequent Fuel Updates. The analysis is deemed to accurately reflect costs in the current Canadian automotive marketplace and is described in detail in Sections 3 through 6.

2.2 Policy Recommendations

It is our opinion that public employees continue to be reimbursed for government business use of personal vehicles on a cents per kilometre basis, reflective of the practice that has been in use since 1999. This is deemed to be consistent with current public and private sector practices as well as it accounts for a fair and simple reimbursement method in line with accepted reimbursement policies across Canada.

However, since there are substantial differences among the ten Canadian Provinces and three Territories, these rates are calculated separately for each Province and Territory in order to account for differences in vehicle operating costs.

3 Methodology And Cost Component Determination

3.1 Assumptions

The present study’s objective is to determine reimbursement rates for business use of personal vehicles by government employees, in order to reflect current Canadian automotive market conditions, as accurately as possible. In order to accomplish this, an in-depth analysis was performed on all components of the total cost of operating a vehicle.

The methodology employed follows all the elements listed in the Statement of Work that were similarly used in the previous Annual Report (November 2021, for publication on January 1st, 2022). The purpose was to calculate the different rates of reimbursement, in cents per kilometre, separately for all ten Canadian Provinces as well as the three Territories. In light of this, we performed research and data analysis to calculate costs for the following components, which represent the total costs of running a personal vehicle:

- Fixed expenses

- Ownership

- depreciation

- prevalent retail rebates

- financing methods

- prevalent interest rates

- applicable sales taxes

- projected resale values

- Registration and licensing

- Insurance

- Ownership

- Variable expenses

- Fuel

- Vehicle maintenance

- Preventative maintenance

- Projected costs of repairs beyond manufacturer warranty

- Tires

- Miscellaneous expenses

All calculations assumed four and five year retention periods as well as considered all vehicles to run an average of 20,000 kilometres per year.

In addition, in order to assess current prevalent insurance premiums by Province and Territory, the study used a certain demographic range to reflect the average government employee. The demographics are based on data available from the Treasury Board of Canada Secretariat as well as Statistics Canada. The following characteristics were used:

- DRIVER: 44 years old, both male and female, married, with more than 20 years of driving experience, a clean driving record (no accidents in the last 5 years), employed full-time, with post-secondary education

- VEHICLE: 2023 Toyota RAV4 LE AWD, with a total cost of $34,040 plus applicable taxes, financed by Toyota Financial Services, driven a projected 20,000 kilometres per year, having up to 15% business use and driving an average of 15 kilometres to work every day

- COVERAGE: Third-party liability ($1,000,000 for all Provinces and Territories, comprehensive and collision coverage included with a deductible typically ranging between $250 and $500, based on individual insurance company offers)

The following table gives an overview of the cost proportion of the components involved in total expenses of operating a vehicle:

| Expense | Cost Proportion |

|---|---|

| Acquisition Sales tax | 8.1% |

| Depreciation | 26.4% |

| Fuel | 24.1% |

| Insurance | 15.3% |

| Interest | 6.0% |

| Maintenance Sales Tax | 2.1% |

| Preventative Maintenance | 10.0% |

| Registration | 0.9% |

| Repairs | 3.3% |

| Tires | 2.6% |

| Miscellaneous | 1.2% |

3.2 Vehicle Selection

In order to be reflective of the Canadian marketplace we have performed a thorough study throughout all Provinces and Territories, focusing on 57 vehicle models (nameplates) grouped under six vehicle classes for the Provinces, and three classes for the Territories (small crossovers/SUVs, medium crossovers/SUVs and light duty pick-up trucks). The models studied account for a significant portion of the Canadian vehicle market, and they were deemed representative for the types of vehicles used by government employees.

The following list describes the parameters used:

- The study covers the following categories of vehicles, prevalent in the Canadian automotive landscape:

- Compact sedans

- Mid-size sedans

- Minivans

- Small crossovers/SUVs

- Medium crossovers/SUVs

- Electric vehicles (both Battery Electric and Plug-in Hybrid Electric)

- Light duty pick-up trucks (for the Territories only)

- For each of these categories, the most sold vehicle models from relevant manufacturers (according to sales in Canada) were studied, covering approximately 71% of the Canadian market for their respective classes. For compact sedans, small crossovers/SUVs, medium crossovers/SUVs as well as electric vehicles, ten (10) vehicles were chosen for each category. The minivan and pick-up truck classes only contain five (5) nameplates each, due to the lower number of available models on the Canadian market. Moreover, in the mid-size sedan class there are only seven (7) vehicles this year due to the manufacturers’ trend of retiring vehicles in this segment in favour of the crossover segment. However, consistent with the past approach, no luxury or executive vehicles have been considered in this study, as it is our opinion, they do not reflect the typical vehicle choice of the average government employee.

- In order to accurately account for costs of all the nameplates studied, each vehicle was assigned a percentage weight directly proportional to total year-to-date sales as of September 2022. Subsequently, all costs, both fixed and variable, were averaged per Province or Territory according to the weight assigned to each vehicle.

- Following is a table listing the vehicles studied, as well as the class they belong to and the weight assigned to each according to recent Canadian sales for the ten Provinces:

|

Make |

Model |

Class |

Weight for Provinces |

2023 Model Year Pricing* |

|---|---|---|---|---|

|

Toyota |

Corolla |

Compact |

5.5% |

$25,410 |

|

Honda |

Civic |

Compact |

5.0% |

$30,930 |

|

Hyundai |

Elantra |

Compact |

4.2% |

$24,124 |

|

Kia |

Forte |

Compact |

1.7% |

$23,795 |

|

Nissan |

Sentra |

Compact |

1.6% |

$24,948* |

|

Mazda |

3 |

Compact |

1.4% |

$27,150 |

|

Volkswagen |

Jetta |

Compact |

1.0% |

$29,145 |

|

Kia |

Soul |

Compact |

0.8% |

$26,295 |

|

Subaru |

Impreza |

Compact |

0.4% |

$29,045 |

|

Volkswagen |

Golf GTI |

Compact |

0.1% |

$38,545 |

|

Toyota |

RAV4 |

Small Crossover/SUV |

8.8% |

$34,040 |

|

Honda |

CR-V |

Small Crossover/SUV |

4.9% |

$39,540 |

|

Ford |

Escape |

Small Crossover/SUV |

4.1% |

$37,544 |

|

Hyundai |

Kona |

Small Crossover/SUV |

4.0% |

$26,274 |

|

Nissan |

Rogue |

Small Crossover/SUV |

3.8% |

$34,318 |

|

Mazda |

CX-5 |

Small Crossover/SUV |

3.7% |

$32,850 |

|

Hyundai |

Tucson |

Small Crossover/SUV |

3.4% |

$32,224 |

|

Nissan |

Kicks |

Small Crossover/SUV |

2.7% |

$22,853 |

|

Nissan |

Qashqai |

Small Crossover/SUV |

2.7% |

$28,593 |

|

Subaru |

CrossTrek |

Small Crossover/SUV |

2.6% |

$29,170 |

|

Toyota |

Camry |

Mid-Size |

1.8% |

$32,010 |

|

Chevrolet |

Malibu |

Mid-Size |

0.8% |

$28,598 |

|

Honda |

Accord |

Mid-Size |

0.7% |

$35,450* |

|

Hyundai |

Sonata |

Mid-Size |

0.4% |

$30,924 |

|

Nissan |

Altima |

Mid-Size |

0.3% |

$32,853 |

|

Kia |

K5 |

Mid-Size |

0.1% |

$31,795 |

|

Subaru |

Legacy |

Mid-Size |

0.1% |

$34,845 |

|

Chrysler |

Pacifica |

Minivan |

1.2% |

$53,690* |

|

Toyota |

Sienna |

Minivan |

1.0% |

$43,540 |

|

Chrysler |

Grand Caravan |

Minivan |

0.6% |

$47,890* |

|

Kia |

Carnival |

Minivan |

0.3% |

$37,695 |

|

Honda |

Odyssey |

Minivan |

0.3% |

$47,540 |

|

Jeep |

Wrangler |

Medium Crossover/SUV |

4.0% |

$44,485 |

|

Jeep |

Grand Cherokee |

Medium Crossover/SUV | 2.8% | $56,140 |

|

Ford |

Explorer |

Medium Crossover/SUV |

2.7% |

$50,135 |

|

Toyota |

Highlander |

Medium Crossover/SUV |

2.6% |

$47,540 |

|

Ford |

Bronco Sport |

Medium Crossover/SUV |

2.0% |

$38,094 |

|

Volkswagen |

Atlas |

Medium Crossover/SUV |

1.9% |

$43,945 |

|

Hyundai |

Santa Fe |

Medium Crossover/SUV |

1.8% |

$39,174 |

|

Ford |

Bronco |

Medium Crossover/SUV |

1.7% |

$51,585 |

|

Toyota |

4Runner |

Medium Crossover/SUV |

1.2% |

$52,940 |

|

Dodge |

Durango |

Medium Crossover/SUV |

1.2% |

$54,790 |

|

Tesla |

Model 3 |

Battery Electric/Plug-in Hybrid |

3.6% |

$62,120 |

|

Ford |

Mustang Mach E |

Battery Electric/Plug-in Hybrid |

0.9% |

$59,090 |

|

Hyundai |

IONIQ 5 |

Battery Electric/Plug-in Hybrid |

0.9% |

$50,924 |

|

Hyundai |

Kona EV |

Battery Electric/Plug-in Hybrid |

0.7% |

$46,324 |

|

Toyota |

Prius Prime |

Battery Electric/Plug-in Hybrid |

0.6% |

$35,570* |

|

Chevrolet |

Bolt EUV |

Battery Electric/Plug-in Hybrid |

0.5% |

$41,998 |

|

Chevrolet |

Bolt |

Battery Electric/Plug-in Hybrid |

0.4% |

$39,998 |

|

Mitsubishi |

Outlander PHEV |

Battery Electric/Plug-in Hybrid |

0.4% |

$48,188 |

| Volkwagen | ID.4 |

Battery Electric/Plug-in Hybrid |

0.2% |

$45,945 |

|

Nissan |

Leaf |

Battery Electric/Plug-in Hybrid |

0.2% |

$41,493 |

* Note: The current study used 2022 model-year pricing for vehicles for which prices were not yet available for 2023 model-year. All prices are given before applicable taxes.

- Following are two tables showing the weight of each class as well as that of each brand name, for all vehicles studied, relative to their respective Canadian sales:

Distribution of vehicles studied by class

| Vehicle Class | Distribution |

|---|---|

| Battery Electric/Plug-in Hybrid | 8% |

| Compact | 22% |

| Medium Crossover/SUV | 22% |

| Mid-Size | 4% |

| Minivan | 3% |

| Small Crossover/SUV | 41% |

Distribution of vehicles studied by brand name

| Brand Name | Distribution |

|---|---|

| Chevrolet | 1.7% |

| Chrysler | 1.8% |

| Dodge | 1.2% |

| Ford | 11.5% |

| Honda | 10.9% |

| Hyundai | 15.3% |

| Jeep | 6.8% |

| Kia | 3.0% |

| Mazda | 5.1% |

| Mitsubishi | 0.4% |

| Nissan | 11.3% |

| Subaru | 3.0% |

| Tesla | 3.6% |

| Toyota | 21.3% |

| Volkswagen | 3.2% |

- For the three Territories, a different sample of vehicles was studied to account for their particularities, as described in Section 6: Operational Costs in the Territories.

- All costs have been calculated separately for:

- each Province or Territory

- each vehicle studied

- each cost component (fixed and variable expenses)

3.3 Data Sources

The present study used information available in the public domain, data from previous studies that we have performed, as well as new research and consultations with specialized professionals and agencies. For each element studied we confirmed the accuracy of the data by consulting additional data sources and cross-referencing the findings. All data sources were assessed for reliability and were thoroughly documented.

3.4 Use of Weighted Averages

In order to accurately reflect current market conditions, consistent with the methodology employed in the previous year’s report, the present study follows a weighted average approach instead of a simple average, by employing weighted arithmetic means where relevant. This was deemed necessary because not all elements calculated contribute the same amount to the total. For example, according to the most recent information available from Statistics Canada, in Ontario there were approximately 72 times more vehicles registered than in Prince Edward Island, and thus the two regions contribute significantly different amounts to the overall Canadian average. This method was employed throughout the study to better reflect the reality of the Canadian market.

In the same manner, certain vehicle models sell significantly more units on the Canadian market than others and therefore contribute more to the overall weighted average. For example, the Toyota Corolla sells considerably more units in Canada than a Mazda 3, approximately four times the amount, and therefore the operating costs for the Toyota Corolla should reflect proportionately in the total calculated weighted average for each component of the cost. See Section 3.2: Vehicle selection for details.

4 Fixed Expenses Analysis

4.1 Ownership Costs

4.1.1 Current model-year vehicle prices

4.1.1.1 Vehicle pricing

For each vehicle under study, we have extracted 2023 model year MSRP (Manufacturer Suggested Retail Price) values. The main tool employed was AutoQuote, the industry leading software that provides up-to-date detailed pricing for all new vehicles available on the Canadian market. At the time of the current study, pricing was not yet available for five (5) vehicle models out of a total of 57. For these, 2022 model-year values were used, as in our experience these values vary only slightly from year to year and are generally reflective of 2023 values.

MSRP pricing is established by the manufacturers for the whole model year and is valid across Canada. Variations of the MSRP prices throughout the year are infrequent. Values extracted from AutoQuote were also cross-checked against the information published by vehicle manufacturers. On average, MSRP prices for vehicles studied increased by approximately 6.6% as compared to the previous year.

4.1.1.2 Prevalent manufacturer rebates

Vehicle manufacturers usually offer retail rebates for new vehicles in order to promote sales and distinguish themselves from their competition. We have thus performed substantial research to determine prevalent retail rebates for all vehicles studied. A period of one year was used as retail rebates vary from month to month as well as display variation by:

- Vehicle model

- Province or Territory

- Type of acquisition (cash, finance or lease)

- Model trim

All the data obtained was integrated into a 2,223 data-points matrix and subsequently reflected in the purchase price of each vehicle, by Province and Territory and by the type of acquisition. Direct price negotiation between vehicle retailers and buying individuals could not be accounted for in this study.

Rebates range from $0 to $2,298, depending primarily on each manufacturer’s marketing strategy (significantly down from the maximum rebate of $7,176 the previous year), with an average of approximately $120 (a decrease from $895 last year). In general, rebates have seen a very significant decrease from the previous year for all methods of acquisition (cash, financing and leasing).

4.1.1.3 Federal and provincial levies

Provincial and federal levies apply to the purchase of new vehicles and are intended in principle to offset environmental costs such as disposal and recycling of air conditioning fluids or tires. For the vehicles under study the following levies apply:

- Air conditioning - $100 (federal)

- Tire, environmental and other levies - $0 - $35 (provincial and territorial)

All applicable fees and levies have been factored in the analysis.

4.1.1.4 Provincial and federal rebates for electric vehicles

Six Canadian Provinces (British Columbia, Quebec, Nova Scotia, New Brunswick, Newfoundland and Labrador and Prince Edward Island) as well as two Territories (Northwest Territories and the Yukon) currently offer government-funded rebates for the acquisition of a Battery Electric (BEV) or Plug-in Hybrid Electric vehicle (PHEV). Rebates offered by Provinces and Territories range between $1,500 and $7,000 per vehicle.

Additionally, the Federal Government offers its own electric vehicle incentive, applicable across Canada. Battery Electric as well as Plug-in Hybrid Electric vehicles with range equal or greater than 50 km are eligible for a rebate of $5,000. Plug-in Hybrid Electric vehicles with a shorter range are eligible for a $2,500 rebate.

Where applicable, Federal and Provincial rebates vary by a number of factors, such as battery capacity or driving range, vehicle size and MSRP cost. All these particular variations were integrated in the study accordingly. It is important to note, that while rapidly increasing in popularity, Tesla Model 3 is no longer eligible for Federal Government rebates due to the MSRP of the current lowest trim exceeding program’s eligibility requirements. As most Provinces and Territories follow Federal Government’s eligibility criteria, Tesla vehicles presently are only eligible for rebates in Quebec and the Yukon.

The following table lists all currently applicable Federal and Provincial ‘green vehicle’ rebates, by type:

| Area of application | Type | ||

|---|---|---|---|

| Battery Electric Vehicle (BEV) | Long-range Plug-in Hybrid Electric (PHEV) | Plug-in Hybrid Electric (PHEV) | |

| FEDERAL | $5,000 | $5,000 | $2,500 |

| BC | $4,000 | $4,000 | $2,000 |

| QC | $7,000 | $5,000 | $2,500 |

| NS | $3,000 | $3,000 | $2,000 |

| NB | $5,000 | $5,000 | $2,500 |

| NL | $2,500 | $1,500 | $1,500 |

| PE | $5,000 | $2,500 | $2,500 |

| YT | $5,000 | $5,000 | $3,000 |

| NT | $5,000 | $5,000 | $5,000 |

* Definition of a “long-range PHEV” varies by program, e.g. Federal Government as well as Nova Scotia, New Brunswick and the Yukon has a range requirement of 50 kilometres or more, British Columbia requires 85 kilometres or more, while Quebec has battery capacity requirements instead.

4.1.2 Method of vehicle acquisition

We have performed research on the Canadian market to establish which methods of vehicle acquisition are the most prevalent, as well as what market share is held by each. We have therefore come to the conclusion that in Canada the new vehicle market is currently distributed among the following three forms of acquisition as follows:

- Cash purchases (up-front payment): 12%

- Financing contracts (vehicle loans): 59%

- Vehicle leases: 29%

Therefore, in order to accurately reflect the reality of the market, we have analyzed all three forms of acquisition and subsequently calculated a weighted average for each vehicle under study according to their proportion of the market.

The net cost of vehicle ownership was calculated according to the method of acquisition (cash, financing or leasing). All three vehicle acquisition methods were addressed with their specific particularities, proportionately with their prevalence in the Canadian automotive landscape, as follows:

- Cash purchase: real cost of ownership is the full price paid for the vehicle (including freight and pre-delivery inspection (PDI), all fees and levies as well as sales taxes), less the projected resale value (expected return) after the period of retention (four and five years).

- Financed vehicles: vehicles that are financed through any financial institution (through a vehicle loan) cost more than a cash purchase since interest is added to the actual price of the vehicle. Prevailing interest rates were used for all calculations as published by the different vehicle manufacturers throughout the year. The amount of interest paid was based on the assumption that upon acquisition of a new vehicle, the old vehicle is traded-in or otherwise sold and the amount applied up-front to reduce the capital cost and subsequently interest costs.

- Leased vehicles: personally leased vehicles are usually subject to closed-end lease agreements. Under these circumstances, the term ‘ownership’ does not properly define the acquisition, since the vehicle is owned by the lessor until the end of the lease term. The cost of ‘ownership’ must then be calculated according to the actual monthly payments incurred by drivers for the period of the term plus applicable sales taxes.

4.1.3 Four and five year retention periods

We calculated ownership costs for both four and five-year retention periods, terms that were found to be reflective of average retention periods for the Canadian automotive landscape. All calculations were performed by vehicle and per Province or Territory taking into account both retention periods, and the results were averaged to yield one value per vehicle, by Province or Territory.

4.1.4 Vehicles driven 20,000 kilometres annually

All vehicles under study were considered to be driven 20,000 km per year. This is deemed to be a reasonable benchmark to base all reimbursement calculations on, since the average Canadian vehicle is driven between 16,000 and 24,000 km per year. All calculations were made using this benchmark all across Canada.

4.1.5 Financing interest rates

We have performed in-depth research to determine the prevalent interest rates provided by vehicle manufacturers. The manufacturers offer what is known as subvented rates to promote sales of new vehicles. These rates are typically substantially lower than regular financial institutions’ loans. Since these reduced rates are prevalent on the market, we deemed it reflective of reality to integrate these rates into our calculations.

Interest rates vary considerably by:

- Vehicle manufacturer

- Vehicle model

- Province or Territory

- Form of financing (financing contract or lease)

- Period of financing or lease (48 and 60 months periods were researched)

All these variations were integrated into a 2,964 data-points matrix and subsequently reflected in the ownership costs of each vehicle, by Province and Territory.

For the current study all vehicle models studied had manufacturer-established interest rates available for 4 and 5 year financing. However, while all the manufacturers studied offered subvented leasing rates, some did not offer them for certain models on 4 and 5-year leasing terms. In these instances, average market (financial institutions or third-party leasing company) rates were used.

All interest rates (financing and leasing) varied from 1.53% to 8.54% for manufacturers’ subvented rates, while the third-party interest rates were approximated at 8.00%. The average interest rate for financing contracts was 3.96% (up from 2.11% the previous year), while the lease rate was 5.85% (up from 4.45% last year). Overall, interest rates are higher as compared to the previous year, recording a significant increase of 88% and 32% respectively.

4.1.6 Sales taxes

Federal and provincial sales taxes (GST, PST, QST, HST) apply to the full cost of a new vehicle according to the taxation method of each Province or Territory. Sales taxes also apply to:

- interest charged for financing or leasing

- certain fees and levies

- parts and labour for all preventative maintenance, repairs and tires

Whether a vehicle is cash-purchased, financed or leased, taxes apply differently. For both cash purchases and financing contracts, the full price of a new vehicle is subject to sales tax, whereas for leased vehicles sales tax is only applied to monthly lease payments (including tax on interest).

Sales taxes have been factored into all calculations as to accurately reflect the direct costs to the end user of a vehicle. Following is a table listing the combined GST/PST/QST/HST applicable for each Province and Territory for the period relevant to the current study:

|

Sales taxes in Canada |

Combined sales taxes |

|---|---|

|

Alberta |

5% |

|

British Columbia |

12% |

|

Manitoba |

12% |

|

New Brunswick |

15% |

|

Newfoundland and Labrador |

15% |

|

Northwest Territories |

5% |

|

Nova Scotia |

15% |

|

Nunavut |

5% |

|

Ontario |

13% |

|

Prince Edward Island |

15% |

|

Quebec |

14.975% |

|

Saskatchewan |

11% |

|

Yukon |

5% |

4.1.6.1 Taxes on fuel

Fuel prices listed at the pump have all taxes included, as is the standard throughout Canada. Fuel is usually taxed federally, provincially as well as regionally. Approximately a third of the price paid at the pump is made up of the following:

- Federal excise tax

- GST/HST/PST/QST

- Provincial fuel tax

- Carbon tax

- Transit tax (in some Provinces)

All fuel prices given in the present study have all taxes included.

4.1.6.2 Taxes on insurance premiums

Regular sales tax (GST/PST/QST/HST) as well as additional insurance-specific taxes apply differently to insurance premiums across Canada depending on each Province or Territory. Insurance premiums given in the present study account for all applicable taxes.

4.1.6.3 Recent and upcoming tax rate changes

We have consulted directly with all relevant public sources in order to determine if there are any impending tax rate changes across Canada in the near future. At this time, no changes in sales taxes are foreseen anywhere in Canada.

For each subsequent update of the present study, research will be performed again for all Canadian Provinces and Territories to determine if tax amounts have changed or if any changes are foreseen in the future.

4.1.7 Resale values (vehicle remarketing)

In order to accurately assess total costs of vehicle ownership, an analysis was performed, for each vehicle under study, to project resale values for retention periods of four and five years, based on historic patterns. Resale values were extracted from resale market data for the same or similar vehicle model. The research was based on:

- Four year-old vehicles with approximately 80,000 km

- Five year-old vehicles with approximately 100,000 km

The values were extracted from the Canadian Black Book, an industry standard for establishing values for used cars and were supported through consultation with specialized vehicle resellers, as well as employing other relevant tools. Final values were projected for:

- Four and five year retention periods

- Every Canadian Province and Territory

- Each vehicle under study, assuming an average vehicle condition

Resale values were integrated into the depreciation analysis differently depending on the type of acquisition, as follows:

- For cash purchases resale values were subtracted from the initial total cost of a new car

- For financing contacts, we used the assumption that vehicle owners either trade in their old vehicle or otherwise sell it and put the amount down to offset part of the payment for the new vehicle and therefore reduce the total cost of interest

- On vehicle leases however, the actual resale value of the vehicle is virtually irrelevant. Lessors typically base their depreciation calculations on projected residual values that are established directly by manufacturers. We have performed complete research to determine these residual values for all vehicles under study, by compiling a 1,482 data-points matrix to accurately calculate total leasing costs. Over the previous year, average residual values increased by approximately 12%. Residual values show variations by:

- Vehicle model

- Retention periods (four and five years)

- Model trim

On average, vehicle resale values increased significantly over the course of the past year, by approximately 26%. The increase was higher for sedans and electric vehicles (at 40% or more), and small Crossovers/SUVs and minivans (at about 30%) as compared to medium crossovers/SUVs that increased at around 10% as well as pickup trucks (at only 3% on average). As a result, the average resale values in Provinces increased by roughly 30% while the increase in Territories was at 14% due to a different selection of vehicle classes. Refer to Section 6: Operational Costs in the Territories for details.

The COVID-19 pandemic had a significant impact on the supply and demand balance in both the new and used vehicle markets. Severe supply shortages caused mainly by supply chain disruptions in microchip manufacturing during the past two years led to a reduced supply of new vehicles, which in turn drove resale prices for used vehicles up considerably. This anomaly is expected to continue until supply chains normalize, well into 2023.

4.1.8 Total cost of ownership calculations

For each Province and Territory, total costs of ownership were calculated for:

- each vehicle under study

- all three acquisition methods (cash purchase, financing contract and leasing)

- four and five-year retention periods

A weighted average was then calculated for all vehicles under study to yield a final cost-of-ownership figure per Province and Territory. All figures were converted and expressed in dollars per kilometre.

The following three tables give a detailed break-down of vehicle ownership costs in Canada in dollars per kilometre, by vehicle class, four- and five-year retention periods, split by depreciation costs, financing costs (interest) and sales taxes, as well as a weighted average according to vehicle sales figures:

|

DEPRECIATION |

Compact |

Mid-Size |

Minivan |

Small Crossover/ |

Medium Crossover/ |

Battery Electric/ |

Weighted Average |

|---|---|---|---|---|---|---|---|

|

4-yr ownership |

$0.111 |

$0.127 |

$0.226 |

$0.128 |

$0.222 |

$0.162 |

$0.151 |

|

5-yr ownership |

$0.106 |

$0.133 |

$0.218 |

$0.125 |

$0.217 |

$0.189 |

$0.150 |

|

$0.150 |

|||||||

---

|

INTEREST |

Compact |

Mid-Size |

Minivan |

Small Crossover/ |

Medium Crossover/ |

Battery Electric/ |

Weighted average |

|---|---|---|---|---|---|---|---|

|

4-yr ownership |

$0.019 |

$0.029 |

$0.051 |

$0.024 |

$0.050 |

$0.054 |

$0.032 |

|

5-yr ownership |

$0.022 |

$0.031 |

$0.052 |

$0.028 |

$0.055 |

$0.055 |

$0.035 |

|

$0.034 |

|||||||

---

|

ACQUISITION SALES TAX |

Compact |

Mid-Size |

Minivan |

Small Crossover/ |

Medium Crossover/ |

Battery Electric/ |

Weighted average* |

|---|---|---|---|---|---|---|---|

|

4-yr ownership |

$0.036 |

$0.044 |

$0.067 |

$0.044 |

$0.065 |

$0.066 |

$0.050 |

|

5-yr ownership |

$0.030 |

$0.037 |

$0.055 |

$0.037 |

$0.054 |

$0.057 |

$0.041 |

|

$0.046 |

|||||||

* Note: total weighted averages are rounded to 3 decimals.

4.1.9 Costs of ownership changes from the previous year

An increase in MSRP prices, significantly raising interest rates and record low manufacturer rebates were generally offset by a significant increase in resale values.

As the economic recovery was taking place last year, the demand for vehicles rebounded rapidly. However, due to severe microchip supply shortages that significantly delayed deliveries of new vehicles, used cars have been selling at well above normal rates. Increased resale values reduce the depreciation, thus reducing the overall cost of owning a vehicle. For example, if a vehicle’s purchase price is $35,000 and its regular resale value in the market in 4 years is $15,000, that means this vehicle has a total depreciation of $20,000 over the period, or $5,000 per year. If the same vehicle’s resale value increases to $19,000, the depreciation over the four-year period is $16,000 or $4,000 per year.

Thus, the increased resale values have kept overall costs of ownership relatively constant across most vehicle categories except for trucks and medium crossovers/SUVs. With gasoline prices significantly higher than last year, the demand for larger vehicles that consume more gas have seen only a moderate demand increase. This disproportionately affected ownership costs in the three Territories. A more gradual increase in vehicle resale values provided a smaller offset to the changes in the other vehicle ownership aspects (e.g. MSRP, interest rates and rebates), pushing ownership costs higher, in contrast with all ten Provinces. Refer to Section 6: Operational Costs in the Territories for details.

4.2 Vehicle Registration and Licensing Costs

Vehicle registration, licensing and plating is regulated at the provincial level. Each Canadian Province and Territory has its own regulatory body governing the rules and costs of vehicle licensing. Registration costs are typically charged annually in the form of a registration renewal. In some Provinces there are certain one-time up-front costs that are charged only at the time of the initial vehicle registration.

We have performed a complete study of these costs by contacting all provincial and territorial authorities. Registration costs do not have additional taxes applied to them as payment is made directly to the respective governmental agencies. The terms registration and licensing are used interchangeably in this study.

Registration costs vary by:

- Province or Territory

- Vehicle class

- Certain other parameters (vehicle weight, cylinder capacity, excessive fuel consumption, etc.)

All these costs have been integrated in the calculations for each Province and Territory. Annual registration costs vary between $0 (the Province of Ontario dropped the annual $120 registration fee in 2022), and $247 and contribute a weighted average of $0.005 per kilometre for all of Canada.

The following table lists annual registration costs for all the Provinces and three Territories:

|

Province/Territory |

Annual |

Registration costs |

|---|---|---|

|

Alberta |

$93 |

$0.005 |

|

British Columbia |

$61 |

$0.003 |

|

Manitoba |

$126 |

$0.006 |

|

New Brunswick |

$142 |

$0.007 |

|

Newfoundland and Labrador |

$90 |

$0.005 |

|

Northwest Territories |

$83 |

$0.004 |

|

Nova Scotia |

$125 |

$0.006 |

|

Nunavut |

$42 |

$0.002 |

|

Ontario |

$0 |

$0.000 |

|

Prince Edward Island |

$130 |

$0.007 |

|

Quebec |

$247 |

$0.012 |

|

Saskatchewan |

$68 |

$0.003 |

|

Yukon |

$54 |

$0.003 |

4.2.1 Note on the Province of Quebec

It must be noted that in Quebec, provincially regulated bodily injury insurance must be purchased through the annual vehicle registration process. This is the reason why registration costs in Quebec are generally higher than the other Provinces or Territories.

4.3 Vehicle Insurance Costs

4.3.1 Regulation of vehicle insurance

Insurance rates vary greatly across Canada, primarily due to different provincial laws determining vehicle accident fault, subrogation or no-fault policies. Vehicle insurance is offered by private insurers in Alberta, Ontario as well as the four Atlantic Provinces and the three Territories. Quebec, however, has a hybrid system where bodily injury insurance is provided by the Province through its vehicle registration process, while third-party liability is provided by private insurers. On the other hand, the Provinces of British Columbia, Manitoba and Saskatchewan have mandatory public vehicle insurance. Insurance in these three Provinces is offered exclusively by the provincial governmental bodies.

4.3.2 Variability of insurance premiums

Insurance premium rates vary considerably not only from Province to Province, but also according to a substantial number of other parameters related to the insured driver’s personal characteristics as well as to the vehicle being insured. Where insurance is offered privately, insurance premiums also vary considerably from one insurer to another.

4.3.3 Analysis of prevalent insurance premiums

We have performed in-depth research into current prevalent insurance premium rates for the average government employee to keep these figures in line with current market conditions as well as recent industry publications. The steps taken to determine the insurance rates used in the present study were as follows:

- Insurance premium costs were assessed based on the average government employeeas described in Section 3.1. We requested over 430 quotes based on this established demographic directly from private insurers as well as insurance brokers. For Provinces with public insurance the data available from the governing bodies was used.

- A thorough research of publicly available information on average insurance premiums across Canada was performed. Publications by the Insurance Board of Canada (IBC) was identified as a reliable source to benchmark current average insurance premiums in all Canadian Provinces and Territories, also substantiated by data from other publications.

- Using the figures provided by the Insurance Board of Canada (IBC), a variability factor was added to establish the maximum threshold for individual quotes obtained for the average government employee in each Province and Territory. The variability factor represents the following:

- The differences between the average driver/vehicle in Canada and the average government employee.

- The assumption that an individual would make a choice towards a more affordable insurance option available after obtaining and comparing several insurance quotes from different insurance providers.

- Prevalent insurance premiums were determined by averaging the quotes that fall below the established reasonable threshold for each Province and Territory.

Following is a table listing average insurance premiums for the ten Provinces and three Territories as well as a comparison with the insurance premiums published in the previous year study, for direct comparison (averaged annual premiums have been rounded up to the nearest $25):

|

Province/Territory |

Current insurance premiums |

Insurance costs |

January 1st 2022 Annual Report insurance premiums |

|---|---|---|---|

|

Alberta |

$2,175 |

$0.109 |

$2,025 |

|

British Columbia |

$1,250 |

$0.063 |

$1,500 |

|

Manitoba |

$1,425 |

$0.071 |

$1,300 |

|

New Brunswick |

$1,475 |

$0.074 |

$1,475 |

|

Newfoundland and Labrador |

$1,700 |

$0.085 |

$1,750 |

|

Northwest Territories |

$1,875 |

$0.094 |

$1,850 |

|

Nova Scotia |

$1,575 |

$0.079 |

$1,550 |

|

Nunavut |

$1,825 |

$0.091 |

$1,825 |

|

Ontario |

$2,175 |

$0.109 |

$2,200 |

|

Prince Edward Island |

$1,150 |

$0.058 |

$1,225 |

|

Quebec |

$1,225 |

$0.061 |

$1,200 |

|

Saskatchewan |

$1,275 |

$0.064 |

$1,300 |

|

Yukon |

$1,425 |

$0.071 |

$1,425 |

The values obtained through the present study are deemed to be reflective of the current reality for the established demographic. Insurance rates vary between $1,150 and $2,175, with a Canadian weighted average of $0.087 per kilometre.

The most notable change has been in British Columbia, where average insurance premiums have continued to adjust down after the province introduced its no-fault insurance approach called Enhanced Care in 2021. According to the 2021/22 Annual Service Plan Report, the Insurance Corporation of British Columbia (ICBC) expects for the lower insurance rates to persist for the foreseeable future.

5 Variable Expenses Analysis

5.1 Fuel Expenses

Fuel expenses are directly related to three main factors: buying location, fuel consumption of the vehicle and time of the year. The current study focuses on gasoline prices across Canada, which are strongly related to variations in the world energy market.

This report aims to provide an overview of the current market situation and present the latest estimates and forecasts pertinent to the energy market conditions. Nevertheless, similar to the previous reports, caution must be exercised when considering the data available due to the rapidly changing nature of global markets.

5.1.1 Energy Market Context

Global oil prices were on a steep downward slope in September, reaching the three-month period’s lowest price of $76.71 USD per barrel for West Texas Intermediate (WTI) and $84.06 USD per barrel for Brent on September 26th, 2022. Each had dropped over $20 USD per barrel in less than a month. Since late September, the prices have remained rather flat, while exhibiting high volatility with significant price fluctuations, reflecting various factors affecting the global markets. As of November 18th 2022, WTI stood at just over $80.00 USD per barrel and Brent at $87.50 USD per barrel.

Gasoline prices followed the oil market’s steep decline until mid-September, somewhat recovering in October and November, while, similarly to crude oil, exhibiting significantly increased volatility. As a result, compared to the previous Fuel Update (August 2022 for publication on October 1st, 2022) the Canadian average price for gasoline decreased by 27.5 cents or 14.0% to $1.687. Despite this decline, in a year-to-year perspective, the average price was still 17.2% higher than a year ago.

A variety of factors have kept the markets volatile this fall, from the slowing economic activity and persistent inflation to crude oil supply challenges, particularly in Europe as they relate to the sanctions put on Russia due to the ongoing war in Ukraine.

5.1.1.1 Global Crude Oil Demand

The global demand for crude oil is closely tied with economic activity and growth. The stronger the economy, the stronger the demand for resources, including crude oil. This year has been a challenging one for the global economy. As indicated by the International Monetary Fund (IMF) in their World Economic Outlook (WEO) published in October 2022, the three main factors affecting the global economy remain the Russian invasion of Ukraine, the persistent and broadening inflation that is resulting in a cost-of-living crisis, as well as the economic slowdown in China. While the IMF global growth projection for this year remains unchanged at 3.2%, it has been further reduced by 0.2 basis points for next year, now estimated at 2.7%. For comparison, the global growth in 2021 was 6.0%. About a third of the global economy is now expected to contract either this year or the next, for two consecutive quarters, which is defined as a “recession”. The outlook for the three largest economies—the United States (U.S.), the European Union (EU), and China— foresees a continued slowing down and ultimately stalling.

This year’s global inflation is higher than was seen in several decades and is now forecasted to nearly double from 4.7% last year to 8.8% this year, before declining to 6.5% in 2023 and 4.1% by 2024. The persistent inflation has led to an accelerated and synchronized tightening of monetary conditions across the world, in attempts to restore price stability. This in turn has been raising borrowing costs, reducing household budgets, and curbing domestic demand. This is a sharp change from the COVID-19-pandemic-related fiscal supports seen previously. Although commodity prices are well below their peak from earlier this year and supply chain challenges have recently begun to subside, underlying inflation has yet to ease in many countries.

The war in Ukraine has led to a severe energy crisis in Europe. Russia has been a major energy exporter to Europe with about 3.1 million barrels per day (mb/d) of crude oil and natural gas split about equally and a further 1.3 mb/d in diesel and other petroleum products. In response to the war in Ukraine, the European Union (EU) along with other major advanced economies, have placed financial sanctions on Russia in an attempt to limit their revenues from oil and gas. Natural gas prices in Europe have increased more than four-fold since 2021, with Russia’s gas deliveries down to less than 20% of their previous levels, which is raising the prospect of energy shortages over the coming winter and beyond. The next and more severe sanctions are expected to take place starting December 5th, 2022, when roughly 1.1 mb/d of seaborne imports of Russian crude oil will be banned from Europe. Another ban on petroleum product imports is scheduled to take place as of February 5th, 2023. In addition, the G7 group is planning to allow the shipment of Russian oil only at enforced low prices. While the exact price below which Russian oil could be transported remains to be established, this measure is also set to take effect on December 5th. Given the nature of these unprecedented measures, as well as lingering ambiguities about how some of the measures will work in practice, there is high confusion and uncertainty about the scale of the resulting impact. Nevertheless, the shortage of crude oil, natural gas and diesel in Europe is raising demand for these products in other parts of the globe, including North America.

The energy supply issues have contributed to slower economic activity in Europe, particularly in manufacturing, dampening consumer and, to a lesser extent, business confidence. As a result, while the Euro Area is expected to grow by 3.1% this year, albeit contracting in the second half of the year, the growth next year is projected at mere 0.5%. Moreover, Europe’s largest economy, Germany, is facing a 0.3% contraction in 2023, after a modest 1.5% growth this year. The Europe’s neighboring United Kingdom (UK) is facing similar projections with 3.6% and 0.3% respectively.

The economic outlook for the United States (U.S.) has also been reduced by 0.7% to 1.6% for this year as compared to three months ago, while the projection for 2023 remains the same at 1.0%, a sharp decline from 5.7% in 2021. Similar factors as in other countries have been at play – the labor market remains tight with historically low unemployment rates and high vacancies. The record inflation that peaked in June at 9.1% has led to declining real disposable income, thus weakening consumer demand. Increasing interest rates are also taking a toll on spending, particularly in residential real estate.

Nevertheless, the U.S. dollar (USD) value is presently at its highest level since the early 2000s. This appreciation appears mostly driven by the tightening of monetary policy in the United States and the ongoing energy crisis. The value of USD and oil prices is inversely correlated, meaning that as one goes up, the other one goes down and vice versa. The U.S. Federal Reserve has raised its target rates six times since March 2022, when the rate was originally set at 0%-0.25%, reaching 3.75%-4.00% in November 2022. Rising interest rates make returns on low-risk bonds more appealing. In order to buy the bonds, international investors are purchasing the U.S. dollars and as a result driving its value up. This leaves less money available for commodity markets and, as such, reducing demand and causing energy prices to decline.

Canada’s economic outlook for this year, published by the Bank of Canada in the Monetary Policy Review (MPR), has seen only a minor adjustment of 0.2% and is now at 3.3%. However, the projection for next year has seen a significant drop, from 1.8% in the MPR from July 2022 to 0.9% in October 2022. The IMF projections have also seen reductions, albeit more moderate – a 0.1% reduction for 2022, now at 3.3% and a 0.3% reduction for the next year, now at 1.5%. The Canadian economy continues to operate with significant excess demand – the demand for products and services is exceeding the supply as businesses continue to report widespread labour shortages, pushing the prices up. As a result, inflation remains one of the main concerns for the Canadian economy, with the Bank of Canada projecting annual inflation to be just under 7% this year and about 4% next year. While inflation has declined from its peak of 8.1% year-over-year in June to 6.9% in September, largely due to lower gasoline prices, it is still very high. To curb the inflation, the Bank of Canada, similar to many other central banks, has been raising its interest rate to slow the growth of demand and bring inflation down. Since March 2022 when the target rate was at 0.25%, the rate has been revised upwards six times and is presently at 3.75%. This has led to higher mortgage rates that have resulted in significant declines in housing activity along with a general household spending decline. The weaker Canadian dollar is having a two-fold effect – on one hand it is partially offsetting the negative impacts of the reduced foreign demand (particularly from the U.S.) and at the same time is having a negative impact on business investments as the price of imported machinery and equipment in Canadian dollars is increasing. As a result, the Bank of Canada states that the “growth is projected to essentially stall later this year and through the first half of 2023. Reducing demand growth in the economy allows supply to catch up, bringing inflation down.”

When it comes to Emerging Markets and Developing Economies, the strength of the U.S. dollar is causing acute challenges by raising the cost of imported goods as well as tightening financial conditions as borrowing becomes more expensive, as well as curbing the ability to service their ongoing international debt, leading to debt distress. At the same time, the continued conflict in Ukraine is affecting the global food markets by pushing food prices upwards and causing serious and disproportionate hardship for low-income households worldwide, and especially in low-income countries. As a group, the Emerging Markets and Developing Economies are projected to grow by 3.7% this year as well as the next year, a significantly lower growth rate as compared to 6.6% in 2021.

China’s zero COVID policy that has been resulting in frequent lockdowns, has taken a toll on their economy, especially in the second quarter of 2022, when the world’s fifth-largest city and China’s financial hub, Shanghai, was under a lockdown for an extended period of time. Given the size of China’s economy and its importance for global supply chains, its slowdown is weighing heavily on global trade and overall economic activity. The current IMF projections for China’s economic growth stand at 3.2% this year and slightly improve to 4.4% next year. China is the world’s largest fuel importer, and their crude oil demand fell by 9.7% year-over-year this summer, to the lowest levels since March 2020.

Similar to the last several World Economic Outlook (WEO) reports, IMF notes that the risks to the global economic outlook remain “unusually large and to the downside”. The uncertainty over the war in Ukraine and its effect on the European energy supplies continues. In addition, unforeseen energy and food price shocks could cause inflation to persist longer than anticipated. A resurgence of COVID-19 might also further inhibit growth. However, IMF notes that presently “the risk of monetary, fiscal, or financial policy miscalibration has risen sharply,” meaning that the monetary policy effects on inflation and economy could be miscalculated and not have the desired outcome, or even lead to adverse effects.

As the global economic outlook remains volatile with increased risks, projections for the demand of crude oil vary significantly. According to the Monthly Oil Market Report from November 2022, the Organization of Petroleum Exporting Countries (OPEC) estimates that global oil demand will average 99.6 mb/d this year – a reduction of 0.43 mb/d from the outlook of three months ago. For comparison, the International Energy Agency (IEA) has increased its global oil demand forecasts this year to 99.8 mb/d, the same as projected by the U.S. Energy Information Administration (EIA) forecasts. For the next year, the OPEC demand estimate stands at 101.8 mb/d, IEA’s projection is 1.1 mb/d lower at 100.7 mb/d, while the U.S. EIA expects even lower demand at 100.1 mb/d.

The OPEC reference basket price (calculated as a weighted average of prices of crude oil produced by OPEC countries) averaged $93.62 USD per barrel in October 2022, a $14.93 or 13.8% decrease as compared to July 2022, but 14.0% higher than the average price of $82.11 USD per barrel in October last year.

5.1.1.2 Global Crude Oil Supply

The uncertainty surrounding energy supplies from Russia to Europe due to imposed bans as a result of the war in the Ukraine, have kept the energy markets volatile. The International Energy Agency (IEA) estimates, that the European Union (EU) will need to replace 1 mb/d of crude and 1.1 mb/d of oil products once the two Russian energy import embargoes go into effect. While Russia is expected to reroute some of the previous export capacity from Europe to China and India, it is unlikely that they would be able to do so entirely. As a result, it is expected that Russia’s total crude production will fall. The U.S. Energy Information Administration (EIA) estimates that the Russia’s oil production will decline by about 1.5 mb/d from 10.8 mb/d in 2022 to 9.3 mb/d in 2023.

In August and September, the talks about renewing the Iran nuclear deal (formally known as the Joint Comprehensive Plan of Action), that would allow an estimated 1.0 mb/d of Iranian oil to reach the markets were actively ongoing. Because the arrangement would mean more oil to the market, this was applying a downward pressure on global prices. The expectation was that the deal would take place before Europe’s embargo on Russian energy imports goes into effect. However, since late September there has been no material progress towards an agreement.

While global markets were looking for more oil, the OPEC+ (alliance of OPEC and several non-OPEC countries including Russia) announced new production cuts in October 2022. Although the organization had been underproducing below their already established quotas, with the largest underperformer being Russia, the alliance agreed to reduce their production limits by an additional 2.0 mb/d divided proportionally among members starting in November 2022. Although the full effect will be diluted by underproduction, market analysts have been estimating that the net effect of the decision will be a reduction of about 1.2 mb/d. This decision had an effect of providing oil price support and keeping them in a higher range closer to $90-$95 USD per barrel.

As Europe is facing energy shortages, the demand for North American oil has grown substantially. The U.S. Energy Information Administration (EIA) data shows that the U.S. exports have been increasing steadily and setting new records, e.g. in October, the total exports of crude and refined products exceeded 11.4 mb/d. Despite the rising exports, the projected crude oil output growth has been slowing. According to the latest Short-Term Energy Outlook (STEO) report published by the U.S. EIA, the U.S. production is expected to reach 11.8 mb/d this year and increase to 12.3 mb/d next year, a this is a sizable downward adjustment as compared to 12.7 mb/d projection three months earlier. On a positive note, the hurricane season had only a moderate impact on crude oil production and refining this year. Only one hurricane - Hurricane Ian in late September – had a material impact on production taking offline about 0.485 mb/d barrels per day or 4% of total U.S. production for several days as Chevron and BP evacuated their oil rigs ahead of the storm.

The Canadian crude oil industry has continued benefiting from the elevated crude oil prices. According to the data published by the Canada Energy Regulator, the overall Canadian oil production is projected to increase slightly from 4.74 mb/d in 2021 to 4.81 mb/d or 1.5% this year. While the production increase has not been too steep, the high crude oil prices have meant increased profits and tax revenues.

The U.S. EIA forecasts that the total global crude oil supply will average 99.9 mb/d in 2022, a 0.5 mb/d increase over the projections three months ago, with non-OPEC production contributing 65.8 mb/d. EIA projects that the production will increase to 100.67 mb/d next year.

The tight global crude oil supply has had a direct impact on the refined product prices. One particularly affected distillate has been diesel. In both North America and Europe, many places use diesel for heating. In addition, with natural gas prices at historic heights, the electricity utility companies are also switching over to use more oil (diesel or equivalent distillate fuels) in electricity production, increasing the demand.

The U.S. and Canada’s Northeast corner has some very particular challenges when it comes to refined products. While the U.S. East Coast states consume almost half of the U.S. daily fuel demand, only 15% of it or 0.8 mb/d are produced there. As the result, this region relies on fuel supplies from the southern states through two pipelines as well as imports from Canada and Europe. Last spring, diesel markets faced an upheaval as inventories dropped and supply shortages took hold along the East Coast. Over the summer, conditions improved, and prices declined. Nevertheless, this fall, the situation has been worsening again.

The global diesel inventories have been steadily declining. In October, the U.S. EIA reported that diesel inventories in the Northeast U.S. were 40%-50% below the five-year low. A similar situation existed in Europe with diesel inventories in the Netherlands, a trading and storage hub, falling 40% from a year earlier. Adding to the already complex energy supply situation in Europe, in September and October, five out of the six refineries in France went on strike demanding higher wages. France has a total refining capacity of 1.15 mb/d, and at its peak, the strikes took 0.74 mb/d or 60% of it offline. As a result, prices for diesel in Europe and North America have risen 60% -70% over the past year. Some relief has come from China that increased their export quotas for gasoline and diesel starting October 2022. China has laws that cap how much fuel can be exported. It averaged 0.5 mb/d of refined fuel exports earlier this year, but with the new policy the exports will be rising by 2.5 times to 1.25 mb/d.

As mentioned in the previous Fuel Update (August, 2022 for publication on October 1st, 2022), refinery maintenances were delayed in 2020 and 2021 due to COVID restrictions, while the high demand and profitability for products this summer kept the refineries going. These delayed maintenances are now coming to pass and at a higher rate, adding to the tightness in the refined product markets. E.g. In mid-September, four refineries in California, one in Washington and another one in Alberta were shut down for maintenances simultaneously, causing the West-Coast prices to escalate upwards.

5.1.2 Gasoline prices across Canada

Over the past three months, gas prices largely followed crude oil price trends declining steeply until late September and exhibiting significantly increased volatility since then. Nevertheless, while gasoline prices on average were on a decline and later somewhat stabilizing across most of Canada, British Columbia saw a significant surge at the pump.

In the Vancouver area gas supply chains are directly linked with the U.S. West Coast and thus disruptions in the U.S. have a direct impact on gas prices in Canada. Gasoline price in the Vancouver area set new North American price records two days in a row – price climbed to 239.9 cents per litre on September 29th, 2022 and then to 241.9 the following day. This was a direct result of the refinery maintenance closures in Alberta, Washington and California described in the previous section. The timing coincided with a potential railroad workers strike that eventually was averted but would have stopped much of the crude oil shipments by rail. These local factors made supplies very tight, pushing prices up.

As a result, the three-month average gasoline price in Canada declined by 14%. Eastern Provinces recorded average declines between 14% and 17%. Prairie Provinces and Territories, with an exception of Nunavut, saw declines between 8% and 15%, while the supply issues in British Columbia resulted in a much smaller average decline of 5%.

With the continued volatility of the energy markets, determined by global factors that are hard to forecast, it is difficult to make any prediction regarding gasoline prices for the next three-month period. However, any future changes will be reflected in the subsequent Fuel Update.

Prices of gasoline, in Canada, include all applicable taxes. Prices vary significantly across the country, mainly due to the difference in the types and amounts of taxes being charged on fuel in different Provinces and Territories. According to Natural Resources Canada, the vast majority of light duty vehicles on Canadian roads run on gasoline. We have therefore researched the average prices of regular gasoline charged at the pump. The fuel price data was primarily obtained from Natural Resources Canada via Kalibrate (previously Kent Marketing), based on daily published fuel prices for 78 locations across Canada. This data was verified against additional databases that similarly track fuel prices all across Canada.

Consistent with the methodology of the previous study, when determining average gasoline prices per Province or Territory, we have used a weighted average according to population in order to better conform to reality. In this manner, metropolitan population centers account for a greater portion of the total than smaller municipalities. Prices were tracked daily across Canada (except for Saturdays, Sundays and holidays).

Fuel price data was extracted for a period of three months (August 15th to November 10th, 2022) in order to better reflect current prices. Gasoline prices in Canada, outside of Nunavut, varied during this period between $1.213 in Red Deer, AB to $2.419 in Vancouver, BC, with a national average of $1.687.

The following is a table with three-month average regular gasoline prices for all Canadian Provinces and Territories, in dollars per litre, as well as gasoline prices from previous reports, for comparison:

|

Province/Territory |

Current average fuel price ($/litre) |

Current average fuel cost ($/km) |

Oct 1 2022 Fuel update ($/litre) |

Jul 1 2022 Fuel update ($/litre) |

Apr 1 2022 Fuel update ($/litre) |

Jan 1 2022 (Annual Report) ($/litre) |

|---|---|---|---|---|---|---|

|

Alberta |

$1.515 |

$0.124 |

$1.780 |

$1.569 |

$1.373 |

$1.358 |

|

British Columbia |

$2.001 |

$0.164 |

$2.114 |

$1.956 |

$1.613 |

$1.582 |

|

Manitoba |

$1.753 |

$0.143 |

$1.922 |

$1.683 |

$1.364 |

$1.363 |

|

New Brunswick |

$1.683 |

$0.138 |

$1.994 |

$1.723 |

$1.440 |

$1.408 |

|

Newfoundland and Labrador |

$1.782 |

$0.146 |

$2.095 |

$1.902 |

$1.584 |

$1.568 |

|

Northwest Territories |

$1.765 |

$0.209 |

$1.987 |

$1.736 |

$1.525 |

$1.505 |

|

Nova Scotia |

$1.648 |

$0.135 |

$1.956 |

$1.711 |

$1.391 |

$1.384 |

|

Nunavut |

$1.205 |

$0.143 |

$1.207 |

$1.201 |

$1.120 |

$1.113 |

|

Ontario |

$1.594 |

$0.130 |

$1.921 |

$1.745 |

$1.437 |

$1.410 |

|

Prince Edward Island |

$1.741 |

$0.142 |

$2.026 |

$1.729 |

$1.416 |

$1.402 |

|

Quebec |

$1.715 |

$0.140 |

$2.056 |

$1.823 |

$1.525 |

$1.461 |

|

Saskatchewan |

$1.647 |

$0.135 |

$1.893 |

$1.659 |

$1.367 |

$1.366 |

|

Yukon |

$1.913 |

$0.227 |

$2.088 |

$1.803 |

$1.570 |

$1.559 |

Gas prices in Nunavut are typically set for a full calendar year and rarely exhibit any changes. The latest change occurred on April 1st, 2022, and the Territorial average was determined to be $1.205 for the current study.

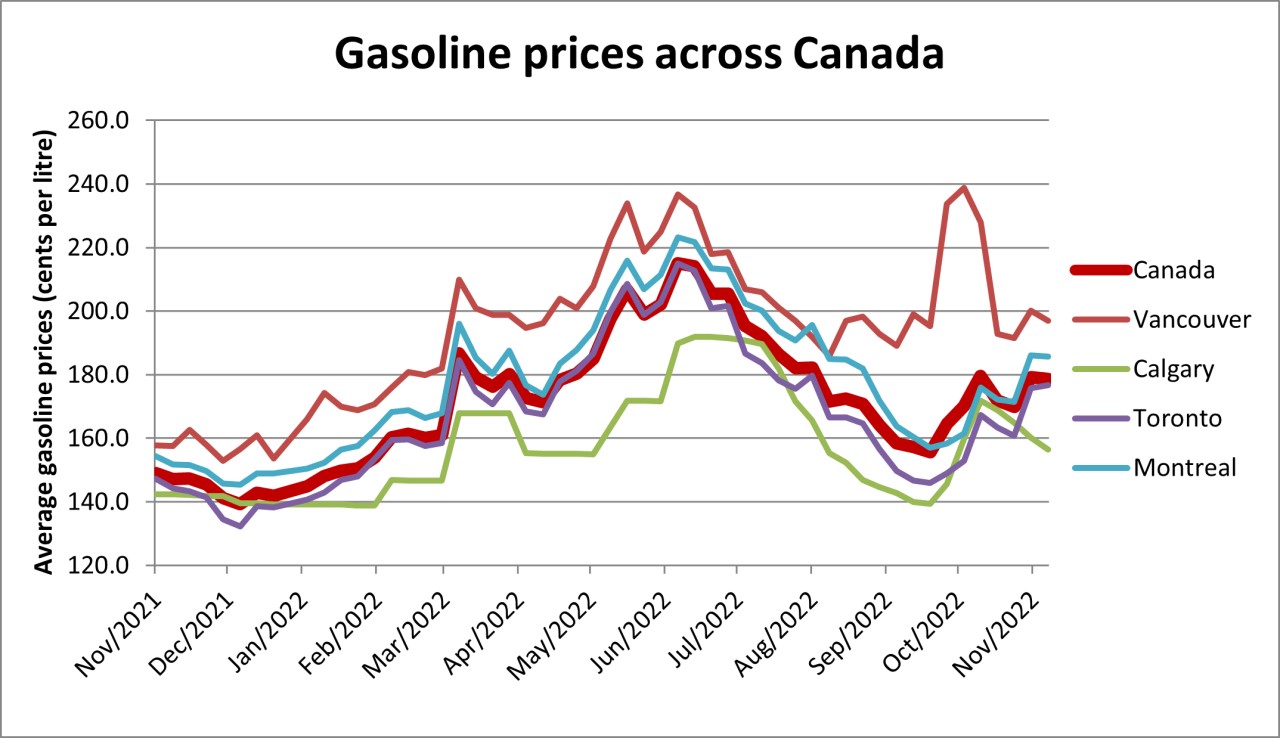

For illustration purposes, the following Graph displays gasoline prices for the main metropolitan areas for a one-year period (November 2021 - November 2022).

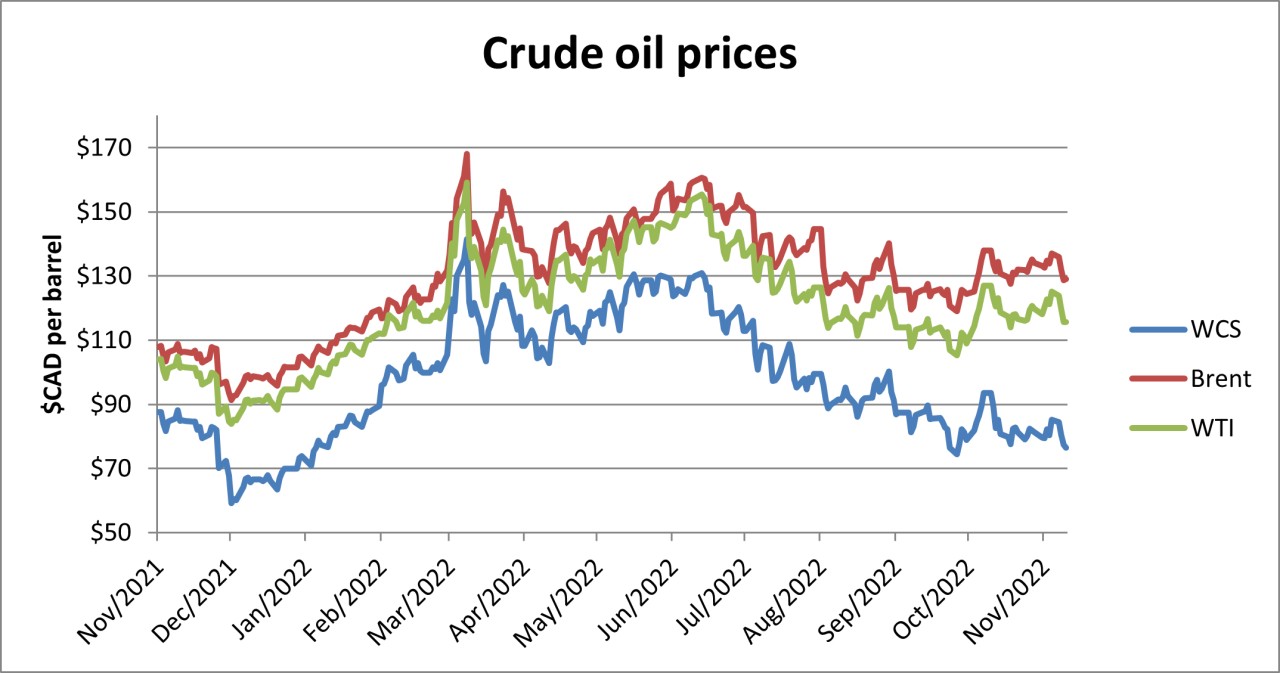

Also, for illustration purposes, the following Graph displays crude oil prices for three benchmarks – WTI (West Texas Intermediate), Brent and WCS (Western Canadian Select) for a one-year period (November 2021 - November 2022).

5.1.3 Fuel consumption

For each vehicle under study, fuel consumption figures were extracted from two main sources, namely Natural Resources Canada’s EnerGuide and the industry’s vehicle pricing and specification standard tool, AutoQuote. For models where 2023 model year figures were not available, 2022 figures with similar engine sizes were used. These figures were correlated back to last year’s consumption figures to check for consistency. Fuel consumption figures are determined by vehicle manufacturers, based on standardized tests, and are published for both city driving and highway driving. For Battery-Electric and Plug-in Hybrid Electric vehicles, the EnerGuide provides figures for fuel consumption by using a litre-equivalent (Le/100 km) system, thus facilitating the comparison with conventional fuel vehicles.

In Provinces where the majority of the population lives in large urban centres (e.g., Ontario) vehicles are driven more under city-driving conditions rather than highway-driving conditions. In light of this fact, the percentage of city versus highway driving has been referenced to a 55/45 city/highway split, consistent with the methodology used by the EnerGuide. On the other hand, for the Territories, a reversed 30/70 city/highway split was factored in, due to the predominantly rural character of the Territories and long distances to be covered.

The following table gives average fuel consumption figures by class of vehicle, in litres of gasoline per hundred kilometres:

|

Combined fuel consumption |

Compact |

Mid-Size |

Minivan |

Small Crossover/ |

Medium Crossover/ |

Battery Electric/ |

Pick-up Truck |

Weighted average |

|---|---|---|---|---|---|---|---|---|

|

Provinces |

7.1 |

7.5 |

10.7 |

8.3 |

10.9 |

2.4 |

- |

8.2 |

|

Territories |

- |

- |

- |

7.9 |

10.2 |

- |

11.4 |

9.9 |

5.1.4 Calculation of fuel expenses

Based on an average of 20,000 kilometres per year and following the methodology described above, the study calculated average fuel costs, per Province or Territory, for all vehicles under study. These numbers were weight-averaged according to population to yield individual fuel costs figures for each Province or Territory.

Fuel contributes on average $0.137 per kilometre to total operating costs, ranging from $0.124 in Alberta to $0.227 in the Yukon.

5.2 Vehicle Maintenance Expenses

In order to keep a vehicle in proper running condition and respect all driving safety requirements, a vehicle must be adequately maintained. Vehicle maintenance involves the following:

- preventative maintenance (that has to be performed regularly)

- repairs outside of manufacturer warranty and not caused by accidents

- an additional set of tires

- miscellaneous expenses

5.2.1 Preventative maintenance

Preventative maintenance includes, but is not limited to, the following:

- oil changes

- regular check-ups

- tire rotation

- spark plugs change

- front and rear brakes cleaning

- discs and pads replacement

- wheel alignment

- battery change

- cabin filter replacement

- air-intake filter replacement

Costs of preventative maintenance were estimated based on consultation with specialized garages and qualified mechanics in order to determine the frequency and costs for parts and labour. Sales taxes apply to all preventative maintenance costs.

5.2.2 Projected costs of repairs not covered by manufacturer warranty

Since the current study is considering retention periods of four and five years, a certain cost for projected repairs must be taken into account. Repairs due to accidents are covered by insurance and are reflected in insurance premiums costs. Most manufacturers offer warranties of up to 3 years or 60,000 kilometres (with the exception of Kia, Hyundai, Volkswagen, Mitsubishi and Mazda, which offer longer warranties). Beyond this period or mileage, any mechanical system that breaks down will incur a direct cost to the owner. Repairs not covered by manufacturer warranty have been accounted for in the present study accordingly.

5.2.3 Tires

The various vehicles under study have different tire requirements, mostly due to different rim sizes. All new vehicles come with a set of standard all-seasons tires. However, if only one set of tires is used, they wear out and need to be replaced, on average, after 60,000 kilometres. This implies that at least one new set of tires must be purchased for both four- and five-year retention periods.

For the purpose of this study, average quality all-seasons tires were considered. Costs of tires vary between $964 and $1,435 for a set of four with installation included, mainly depending on the type and size, plus applicable taxes.

5.2.3.1 Adjustments for Quebec and British Columbia

The Province of Quebec mandates the use of winter tires for all light-duty vehicles, for the period between December 1st and March 15th. In order to reflect this requirement a 50% increase in cost of tires was factored into the calculations. This accounts for purchasing an additional set of winter tires while offsetting the need to purchase another set of all-season tires for the four-year retention period studied but not necessarily for the five-year period.

In British Columbia, certain roads, especially in mountainous areas, mandate the use of winter tires, usually between October 1st and March 31st. A 25% increase in costs of winter tires was factored in the calculations to account for this requirement, in order to reflect the fact that winter tires are only used by a certain portion of vehicles registered in this Province.

5.2.4 Miscellaneous maintenance expenses

There are other common expenses related to maintaining a vehicle that do not fall under the previous three categories, but which are necessary for safety as well as aesthetic reasons. The present study allocated a $150 per year allowance for miscellaneous costs such as windshield washer fluid, occasional car wash and polish, light bulbs etc.