Reimbursement for Business Use of Personal Vehicles

Study prepared for The Treasury Board of Canada Secretariat

By Corporate Fleet Services

1 Fuel Price Update Synopsis

Corporate Fleet Services (CFS) has been mandated by the Treasury Board of Canada Secretariat to perform the Annual evaluation of per-kilometre Reimbursement Rates for government employees that are required to use their personal vehicles while performing government business. Furthermore, the periodic impact of varying fuel prices is to be evaluated quarterly by producing three additional Fuel Price Updates per year. The present document represents the Update for February 2023.

The latest Annual study established Reimbursement Rates for each Canadian Province and Territory after performing a comprehensive analysis of all vehicle operating expenses. These rates were presented in the Reimbursement for Business Use of Personal Vehicles Report, dated November 2022 (for publication on January 1st, 2023).

The present Update reflects the impact of current fuel prices on the Travel and Commuting Rates’ recommendations made in the Annual Report with a focus on average pump prices of gasoline by Province and Territory. The prices were averaged for each Province or Territory for the three months prior to the release of the current Update (the months of December 2022, January 2023 and February 2023). All prices are given in dollars per litre.

This Update also presents the latest recommended rates of reimbursement for consideration by the Treasury Board Secretariat in dollars per kilometre. Federal and Provincial sales taxes were also researched to determine if there were any recent changes that could have had an immediate impact on the total costs of vehicle ownership and operation.

For the period December 2022 - February 2023 fuel expenses represent 22.3% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average of 12.4 cents per kilometre. The present Update identified moderate decreases in average gasoline prices across Canada, which had a slight downward impact on Reimbursement Rates everywhere except in Nunavut. As a result, the Reimbursement Rates for the ten Provinces decreased by a maximum of 2.5 cents relative to the previous Annual Report (November 2022, for publication on January 1st, 2023). For the Territories, while rates for the Yukon and the Northwest Territories decreased in tandem with the Provinces, Nunavut saw an increase of 2.5 cents for both rates (see Section 2.2 - Gasoline Prices Across Canada for details).

2 Fuel Prices

2.1 Energy Market Context

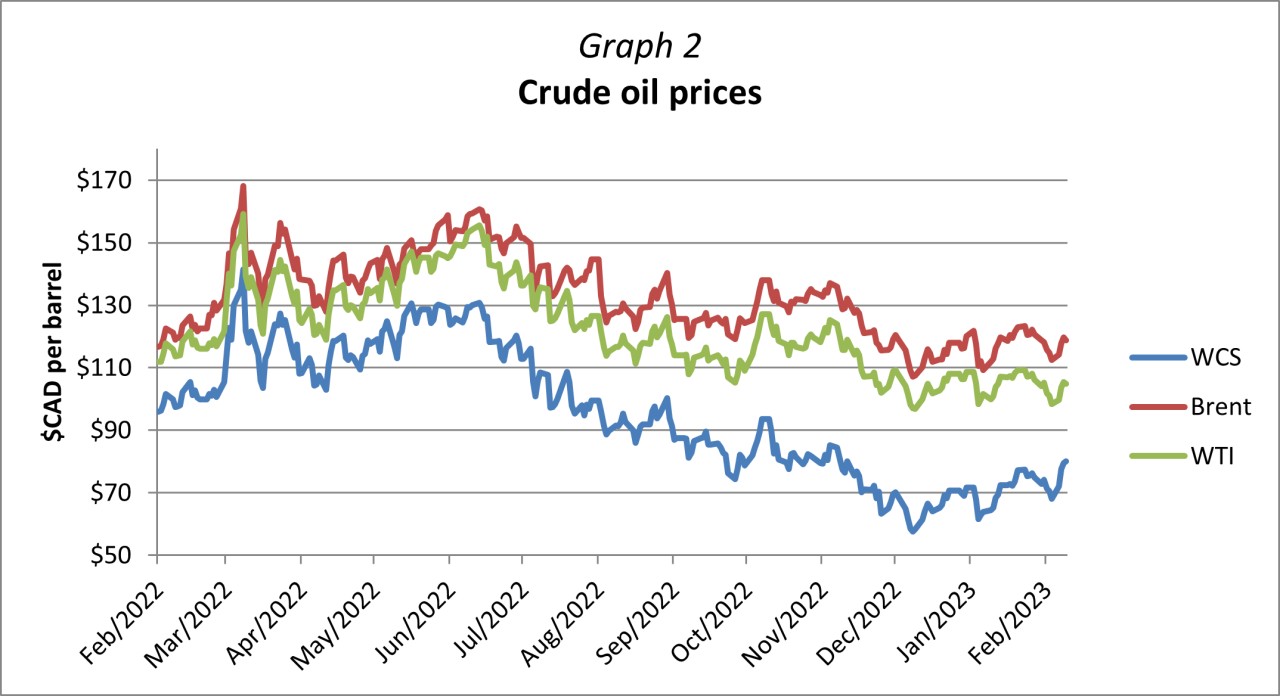

Over the past three months, global crude oil prices have remained relatively stable on average, while continuing to exhibit volatility. The West Texas Intermediate (WTI) fluctuated between $71.00 USD per barrel and $81.50 USD per barrel, while the Brent ranged from just over $76.00 USD per barrel to $88.40 USD per barrel. As of February 17th, 2023, the WTI stood at $76.49 USD per barrel and the Brent was at $83.13 USD per barrel.

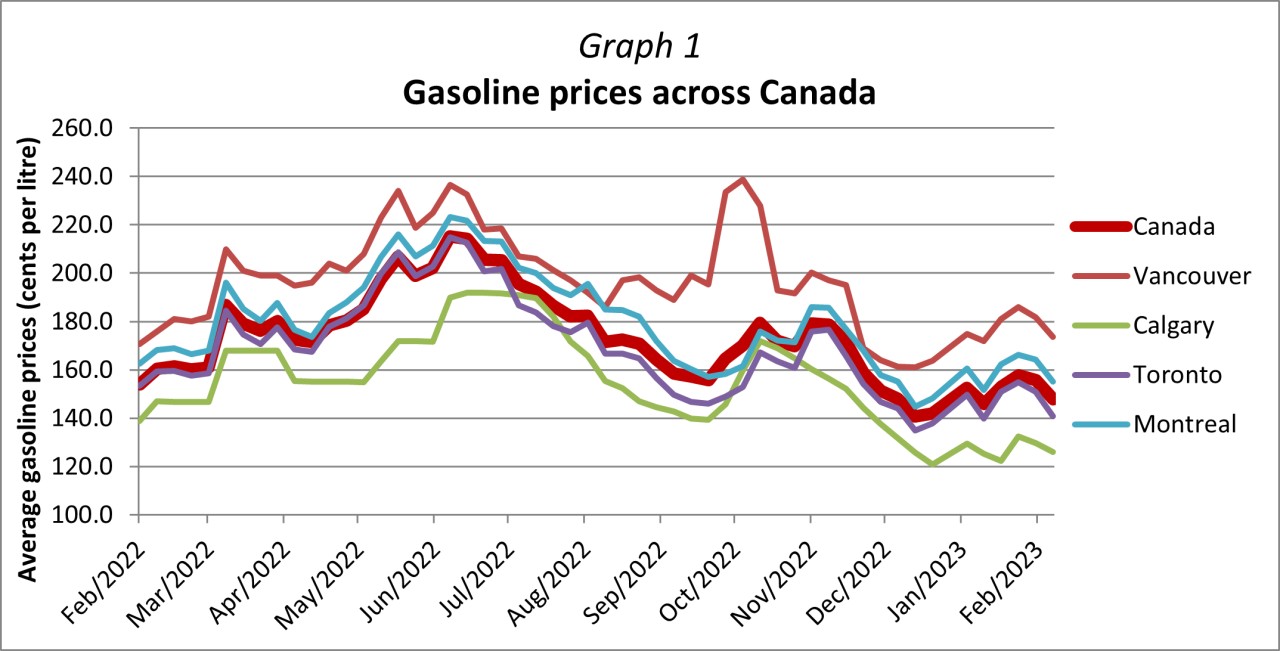

Gasoline prices were on a downward skid in November but, similar to crude oil, remained relatively stable between late November and mid-February. In the three-month period, the Canadian average price for gasoline was 152.0 cents per litre as compared to 168.7 cents per litre reported in the Annual Report (November 2022, for publication on January 1st, 2023), a decrease of 9.9%. In a yearly perspective, however, the price for gasoline remained 3.1% higher than during the same three-month period last year, when the average price was 147.4 cents per litre.

A variety of factors affected the markets, adding to their volatility, yet none had an effect that would significantly move the markets in either direction. Overall, the global economic outlook has seen some improvements as compared to three months ago. This has had a positive impact on stabilizing the global energy markets. Nevertheless, uncertainty about the long-term impact of continuously rising interest rates, as well as the war in Ukraine, continue to dampen economic activity and increase uncertainty about the direction of the markets in the future.

2.1.1 Global Crude Oil Demand

According to the World Economic Outlook (WEO) Update published in January 2023 by the International Monetary Fund (IMF), the global growth projection for this year now stands at 2.9%. This is a 0.2 percentage point increase from the 2.7% projection reported in October 2022, nevertheless, still lower than the 3.4% growth last year as well as well significantly below the historical average of 3.8% between the years 2000 and 2019. The stronger than expected private consumption that led to increased business investment amid continuously tight labor markets supported the economic activity in the second half of 2022. The easing of transportation bottlenecks and declining costs reduced pressures on input prices, providing some relief to previously constrained sectors, such as motor vehicles. The improvement in the growth projections this year has been largely attributed to the resilience of the European economy as well as the reopening of China despite new COVID-19 outbreaks. Although central banks have been rapidly raising interest rates, the global inflation remains significantly elevated, and is projected at 6.6% this year, almost twice as high as the average pre-pandemic levels of 3.5% in the period between 2017-2019.

Advanced economies, as a group, are projected to decline sharply from 2.7% in 2022 to 1.2% in 2023, before beginning to recover in 2024. After a 3.5% growth last year, the Euro Area is expected to bottom out at 0.7% in 2023 (an improvement from the 0.5% projection in October 2022), before rising to 1.6% in 2024. The improvements in the outlook reflect an increasing non-Russian oil and diesel supply, in combination with a warmer than usual winter that has kept gas prices at the pump below what had previously been projected. Notably, the European Union (EU) sanctions on Russian crude oil implemented on December 5th, 2022, as well as the ban on petroleum products (most notably diesel) starting February 5th, 2023, took place without a large impact on the global crude market. In addition, price caps have been implemented for Russian crude, crude oil product transportation and insurance by EU companies. Starting December 5th, 2022, the price for Russian crude oil to be transported by EU companies between Russia and other countries must be below $60 USD per barrel. Notably, because the Russian oil had been already trading below the limit, the cap has had minimal impact on global trading and Russia continued selling to India and China without any meaningful disruption At the same time the U.S. and the Middle East have been increasing their oil shipments to Europe, covering the gap.

The U.S. economy also remains strong, with consumers continuing to spend their savings. The IMF reports that the personal saving rate is at its lowest in more than 60 years with the only exception being in July 2005. The unemployment remains near historic lows and there are plentiful job opportunities. Nevertheless, the steeper path of the Federal Reserve rate hikes is projected to affect the U.S. economy for longer than initially expected. Unlike for the Euro Area, U.S. growth is projected to decline for the next two years from 2.0% in 2022 to 1.4% in 2023 and further to 1.0% in 2024.

According to the Bank of Canada, Canada’s economy remains overheated, but lower energy prices, improvements in global supply chains and the effects of higher interest rates are providing some relief on inflation, particularly as it relates to housing and big-ticket items. In the Monetary Policy Review published in January 2023, the Bank assesses that the economy is in a state of excess demand, i.e. demand exceeding supply. This is putting upward pressure on domestic prices and keeps inflation elevated. The Bank also reports that “more than 220,000 net jobs were created, and the unemployment rate, at 5%, is near an all-time low.” With the labour market still tight, many businesses continue to struggle to attract workers. In addition, weaker foreign demand is also expected to weigh-in on exports. As a result, the Bank projects that the economy is likely to stall though the middle of the year, allowing supply to catch up with demand. The Bank currently estimated that the economy grew by 3.6% last year, but the growth will slow down to 1.0% in 2023. By comparison, the IMF estimates that Canada’s growth rate was 3.5% last year, but the projection for 2023 remains at 1.5%.

The outlook for emerging markets and developing economies has also seen improvements for 2023. The IMF projects that their growth in 2023 will exceed the 2022 level, increasing from 3.9% in 2022 to 4.0% in 2023 and further to 4.2% in 2024. The improvement to the outlook is influenced largely by the changes foreseen for China and Russia. Despite the sanctions, the contraction of Russia’s economy last year was estimated at -2.2% compared to the predicted -3.4%, while a modest 0.3% growth is forecast for 2023. China lifted many of their COVID-19 restrictions late in 2022. While on one hand it was adding some momentum to the economic activity, the economy slowed down in the last quarter of 2022 due to multiple large COVID-19 outbreaks in Beijing and other densely populated regions. As the case numbers subside, the reopened economy is projected to rebound strongly. At the same time, the property market in China continues to restructure as developers have yet to deliver on a large backlog of presold housing, adding a downward pressure on housing prices. As a result, IMF estimates that China’s economy slowed down in the last quarter of 2022, resulting in an annual growth rate of 3.0% last year—the first time in more than 40 years that China’s growth has been below the global average. Nevertheless, it is expected to rebound to 5.2% in 2023.

The OPEC reference basket price (calculated as a weighted average of prices of crude oil produced by OPEC countries) averaged $81.62/b in January 2023, 12.8% lower than in October 2022 and 4.4% lower than a year ago. OPEC has projected that the demand for crude oil will reach 101.87 million barrels per day (mb/d) this year, up from 99.55 mb/d in 2022, with most of the demand growth coming from Asian countries, including China and India. Similarly, the U.S. Energy Information Agency (EIA), in their Short-Term Energy Outlook (STEO), estimated that the global consumption in 2022 was 99.4 mb/d, but EIA projects a considerably more moderate rise in demand this year, reaching 100.5 mb/d. On the other hand, the International Energy Agency (IEA) report from January 2023 forecasts 101.7 mb/d of demand in 2023 – a record high due to China’s reopening.

2.1.2 Global Crude Oil Supply

Over the past three months, the supply side has had a modest effect on global energy markets. Oil and diesel inventories in Europe have been sufficient to supply the market. Since the last production cuts announced by the OPEC+ (alliance of OPEC and several non-OPEC countries including Russia) back in October 2022, the alliance has taken a “wait-and-see” approach. At the same time, the U.S. production has been steadily recovering from the dip taken during the pandemic. According to International Energy Agency (IEA) forecasts, with the Russian oil production on a decline, non-OPEC+ producers are positioned to lead the world supply growth in 2023. The global production this year is forecasted to expand by 1.2 million barrels per day (mb/d), led by the United States, Brazil, Norway, Canada and Guyana – all of which are set to pump at record rates according to IEA estimates.

The U.S. oil production continues to recover, with the latest Short-Term Energy Outlook (STEO) report published by the EIA indicating slight upward adjustments. The U.S. production reached 11.9 mb/d last year and the forecast for this year has risen by 0.2 mb/d and is now projected to average 12.5 mb/d. While crude oil and product inventories in the U.S. have remained relatively stable, the market saw some disruptions due to winter storms. For example, in December 2022, a storm (unofficially named “Elliot”) was one of the largest in recent history, with temperatures falling below freezing in all 48 U.S. continental states and bringing frigid temperatures, heavy snow and widespread power outages for most of Canada and northern U.S. The storm caused reduced operations in over 20 refineries, particularly in the Gulf Coast area, with combined throughput of 6 mb/d. It was estimated that a cumulative 20 million barrels of refined fuels have been removed from the market, including 10 million barrels of gasoline, adding a temporarily tightness in supplies at the pump. According to EIA’s data, the winter storm caused the average U.S. refinery utilization to plummet below 80% overall as compared to 90% or more, which is the usual number.

The Canadian crude oil market also saw some challenges towards the end of 2022, particularly due to larger-than-usual pricing discounts. As reported by the Bank of Canada in January 2023, the Western Canadian Select (WCS) was trading, on average, close to $30 USD per barrel, lower than the price for WTI. This has been due to refinery outages in the U.S. as well as heavily discounted barrels of Russian heavy oil on the global market. The spread between WTI and WCD is anticipated to narrow as refineries come back online. Furthermore, the new Trans Mountain pipeline expansion is scheduled for completion in about a year. The pipeline carries crude from Alberta to Burnaby, British Columbia and the expansion will increase its capacity from 300 mb/d to 890 mb/d. While the U.S. West Coast will be receiving some of this inventory, the majority will move to Asia. This is expected to lead to WCS increases, further narrowing the spread between WTI and WCS.

The U.S. EIA estimates that the total global crude oil supply averaged 99.95 mb/d in 2022, remaining largely unchanged from three months ago, while the projection for 2023 has improved slightly to 101.10 mb/d. The IEA reports that the global crude oil production averaged 100.8 mb/d in January 2023, remaining roughly unchanged for the past several months.

2.2 Gasoline Prices Across Canada

Following a price decline during summer, similar to crude oil, gas prices have been relatively stable between late November and mid-February, resulting in average gasoline prices to move downwards. While the Canadian average price decreased by 9.9% in the last three months, the decrease was above average in Western Canada. In British Columbia, Alberta, Saskatchewan and Manitoba gas prices decreased between 10.6% and 14.1%. As Western Provinces, particularly British Columbia, had previously seen a more moderate price adjustment than the rest of Canada, the current decrease appears to be a lagging adjustment as the local factors affecting gas prices on the West coast described in the Annual Report (November 2022 for publication on January 1st, 2023) start to normalize. The rest of the Canadian provinces saw smaller decreases, ranging from 5.6% in New Brunswick to 7.7% in Ontario. The Yukon and Northwest Territories saw a decrease of 8.9% and 8.2% respectively, while Nunavut saw an increase of 17.0%.

Prices of gasoline, in Canada, include all applicable taxes. Prices vary significantly across Canada, mainly due to the difference in the types and amounts of taxes being charged on fuel in different Provinces and Territories. The present Update calculated the average prices of regular gasoline charged at the pump. The fuel price data was primarily obtained from Natural Resources Canada via Kalibrate (previously Kent Marketing), based on daily published fuel prices for 78 locations across Canada. This data was verified against additional databases that similarly track fuel prices all across Canada.

Consistent with the methodology of the Annual Report, when determining average gasoline prices per Province or Territory, we have used weighted averages according to population in order to better conform to reality. In this manner, metropolitan population centers account for a greater portion of the total average price compared to smaller towns.

The following is a table with average regular gasoline prices for all Canadian Provinces and Territories, in dollars per litre, for the period December 2022 - February 2023:

|

Province/Territory |

Current fuel price |

January 1st, 2023 Fuel Update fuel price |

Price |

|

Alberta |

$1.309 | $1.515 | -$0.206 |

|

British Columbia |

$1.719 | $2.001 | -$0.282 |

|

Manitoba |

$1.539 | $1.753 | -$0.214 |

|

New Brunswick |

$1.589 | $1.683 | -$0.094 |

|

Newfoundland and Labrador |

$1.661 | $1.782 | -$0.121 |

|

Northwest Territories |

$1.621 | $1.765 | -$0.144 |

|

Nova Scotia |

$1.529 | $1.648 | -$0.119 |

|

Nunavut |

$1.410 | $1.205 | $0.205 |

|

Ontario |

$1.471 | $1.594 | -$0.123 |

|

Prince Edward Island |

$1.608 | $1.741 | -$0.133 |

|

Quebec |

$1.597 | $1.715 | -$0.118 |

|

Saskatchewan |

$1.473 | $1.647 | -$0.174 |

|

Yukon |

$1.742 | $1.913 | -$0.171 |

Fuel price data was extracted for a period of three months (November 11th, 2022 to February 10th, 2023) in order to reflect current gasoline price trends. Subsequent reports will focus on three-month periods following the period covered in the present study. Average gasoline prices per litre and per Province or Territory were found to vary between $1.309 in Alberta to $1.742 in the Yukon, with a Canadian average of $1.520, a decrease of 16.7 cents from the previous Annual Report (November 2022, for publication on January 1st, 2023).

Gas prices in Nunavut are typically set for a full calendar year and rarely exhibit any changes. However, after maintaining average gas prices at around $1.20 per litre for 2022, the Government of Nunavut announced a price increase of 20 cents per litre, effective December 4th, 2022. After only slightly increasing prices in April 2022 as a result of a federally-imposed carbon tax, this second increase in December 2022 was set by the Government of Nunavut based on recovering the cost of purchasing and resupply of fuel for the upcoming year. This effectively increases the average gas prices by 17%, in stark contrast with the rest of Canada, that saw decreases between 6% and 14% as compared to the previous Annual Report (November 2022, for publication on January 1st, 2023).

For illustration purposes, Graph 1 displays gasoline prices for the main metropolitan areas for a one-year period (February 2022 - February 2023).

Also for illustration purposes, Graph 2 displays crude oil prices for three benchmarks – WTI (West Texas Intermediate), Brent and WCS (Western Canadian Select) for a one-year period (February 2022 - February 2023).

2.3 Sales Taxes

For the current Update, research was performed to see if there were any relevant changes to Federal and Provincial sales taxes that could have an immediate impact on the Reimbursement Rates. As of the date of this Update, no changes were observed in sales taxes anywhere in Canada as compared to the previous Annual Report. Moreover, no changes are foreseen at this time for the immediate future.

3 Impact of Fuel Prices on Reimbursement Rates

3.1 Fuel Consumption

In calculating the fuel costs contribution to the total vehicle operating costs, the methodology employed in the Annual Report was strictly adhered to. Fuel consumption for every vehicle model in the study was thus combined with average prices per Province or Territory to determine the fuel portion of operating costs, based on an average of 20,000 kilometres per year.

3.2 Updated Reimbursement Rates

For comparison, the following table provides updated Travel and Commuting Rates, as well as rates previously calculated for the Annual Report (November 2022, for publication on January 1st, 2023):

Current Fuel Update Reimbursement Schedule (in dollars per kilometre)

|

Travel Rate |

Commuting Rate |

|||

|

Province/Territory |

Current Fuel Update |

Jan 1st 2023 Annual Report |

Current Fuel Update |

Jan 1st 2023 Annual Report |

|

Alberta |

$0.520 |

$0.540 |

$0.210 |

$0.230 |

|

British Columbia |

$0.545 |

$0.565 |

$0.255 |

$0.280 |

|

Manitoba |

$0.540 |

$0.555 |

$0.235 |

$0.255 |

|

New Brunswick |

$0.570 |

$0.575 |

$0.245 |

$0.250 |

|

Newfoundland and Labrador |

$0.585 |

$0.595 |

$0.250 |

$0.260 |

|

Northwest Territories |

$0.700 |

$0.715 |

$0.320 |

$0.340 |

|

Nova Scotia |

$0.570 |

$0.580 |

$0.240 |

$0.250 |

|

Nunavut |

$0.665 |

$0.640 |

$0.295 |

$0.270 |

|

Ontario |

$0.580 |

$0.590 |

$0.230 |

$0.240 |

|

Prince Edward Island |

$0.550 |

$0.565 |

$0.245 |

$0.255 |

|

Quebec |

$0.565 |

$0.575 |

$0.250 |

$0.260 |

|

Saskatchewan |

$0.520 |

$0.530 |

$0.230 |

$0.245 |

|

Yukon |

$0.690 |

$0.710 |

$0.335 |

$0.355 |

Note: All figures were rounded up to the nearest half-cent.

The impact of gasoline prices on the Reimbursement Rates was moderate for the present Fuel Update. In comparison with the Annual Report (November 2022, for publication on January 1st, 2023), the Travel and Commuting Rates have decreased between 0.5 cents to 2.5 cents per kilometre for the Provinces. For the Territories, the Travel and Commuting Rates decreased by a maximum of 2.0 cents per kilometre in the Yukon and the Northwest Territories, while they increased by 2.5 cents for Nunavut.

Overall, Canadian weighted averages decreased by 1.0 cent per kilometre for the Travel Rate and by 1.5 cents for the Commuting Rate. They are now at 56.0 cents per kilometre and 23.5 cents per kilometre, respectively.

Fuel contributes on average 12.4 cents per kilometre to total operating costs, ranging from 10.7 cents in Alberta, to 20.6 cents in the Yukon. Given the complexity of socio-economic factors affecting the global energy market, it is difficult to make any prediction regarding gasoline prices for the next three-month period. However, any future changes will be reflected in the next Fuel Update.