January 1 to December 31, 2024

In accordance with the Dental Care Plan Board of Management (NJC Part) Terms of Reference, the undersigned submit this annual report regarding the performance and the management of the Dental Care Plan (NJC Part) during the period of January 1 to December 31, 2024.

Chairperson of the Board of Management

Martin Chartier

Employer Side Members

- Krista Apse, Crown-Indigenous Relations and Northern Affairs Canada

- Philippe Blanchette, Financial Transactions and Reports Analysis Centre of Canada

- Noreen Majeed, Military Police Complaints Commission of Canada

- Jane Manuel, Treasury Board of Canada Secretariat

Bargaining Agent Side Members

- Paul Cameron, International Brotherhood of Electrical Workers

- Mathieu Delorme, Association of Canadian Financial Officers

- Celyn Dufay, Professional Institute of the Public Service of Canada

- Mireille Vallière, Canadian Association of Professional Employees

GENERAL STATEMENT

The Dental Care Plan Board of Management (NJC Part) (the Board) is pleased to present this report for the period of January 1 to December 31, 2024. The Public Service Dental Care Plan (PSDCP or the Plan) completed 37 years of operation on March 1, 2024.

The Plan is intended to cover reasonable and customary dental treatment necessary to prevent or correct dental disease or defect, provided the treatment is consistent with generally accepted dental practices. The Plan is private, and its cost is fully paid by the Treasury Board of Canada Secretariat (TBS), the Employer.

The Board is composed of management and union representatives. It is responsible for the overall administration of the Plan, balancing the needs of Plan members within the allocated funding, resolving members’ complaints regarding eligibility or claims disputes, monitoring the claims settlement performance of the Administrator (Canada Life), and recommending changes to the Plan.

ADMINISTRATION

The Administrator had an average claim turnaround time of 0.66 calendar days, significantly lower than their 2023 time of 3.32 calendar days. The contact volume statistics for 2024 showed there were 316,222 enquiries, with 207,705 telephone calls and 108,517 emails. Out of the 207,705 telephone calls, there were 161,175 English and 46,530 French.

Regarding service level standards during 2024, the Administrator exceeded their target of 80%, answering 95.45% of calls 60 seconds. This is a significant increase compared to 2023 that saw 77.79% of calls answered within 60 seconds. Additionally, the average abandon rate for 2024 was 1.35%, compared to 4.63% in 2023. Regarding first call resolution, the Administrator was just below the 93% target, sitting at 90.80%.

The Administrator continued to provide data on what percentage of claims are submitted by Plan members versus the service providers. It was noted that in 2024, 79.67% of claims were submitted by the service providers and only 20.33% of claims were submitted by members themselves.

As a part of the Board’s duties, it is responsible for the overall administration of the Plan and monitoring the claims settlement performance of the Administrator. TBS indicated that more robust reporting and auditing will be available following the new PSDCP contract which came into effect on November 1, 2024, and that scaling for children will continue to be included in its annual reporting.

The Administrator launched a newly improved website, titled My Canada Life at Work in 2023, which showed that as of Q4-2023, 72.32% of Plan members had registered for the new website. As of Q4-2024, 81.35% of members have registered and 66.01% of those registered have signed up for direct deposit.

ACTIVITIES

The Board met five (5) times, via virtual and hybrid meeting formats, devoting its time to overseeing the administration and financial status of the Plan, resolving appeal cases, members’ complaints regarding eligibility and claims disputes, and recommending improvements to the Plan. The Board reviewed 14 appeals; this is a decrease of 50% from 2023. All 14 of these appeals were denied.

The Board continued to participate in the Employer’s Observer Program, which is an informal program whereby diverse senior-level public servants are selected to participate on pension and benefits boards to develop their knowledge and experience to become an Employer representative in the future. The Board had both Employer Side and Bargaining Agent Side observers who attended Board meetings on a regular basis this year.

The Plan review was done throughout 2024 with the new contract coming into effect November 1, 2024, and improvements and changes to the Plan implemented January 1, 2025. The PIPSC representatives attended consultation meetings with TBS to ensure that several items were taken into consideration such as enhanced coverage for clients diagnosed with cancer, dependant children who take a break from full-time studies, care and nurturing leave, scaling limits, and dental accident coordination.

TRAINING

When possible, the Board participates in conferences and learning sessions held by the International Foundation of Employee Benefit Plans (IFEBP) as a means to develop Board member expertise and to stay current with trends in employee benefits, including dental. The Board remains committed to investing in the development of its members. Various Board members were able to attend three (3) conferences in 2024: the Legal and Legislative Update, the Canadian Public Sector Pension and Benefits Conference and the 57th Annual Canadian Benefits Conference. To provide the most benefit to all Board members, those who attend provide the Board with a debrief of the conference upon their return.

PLAN EXPENDITURES

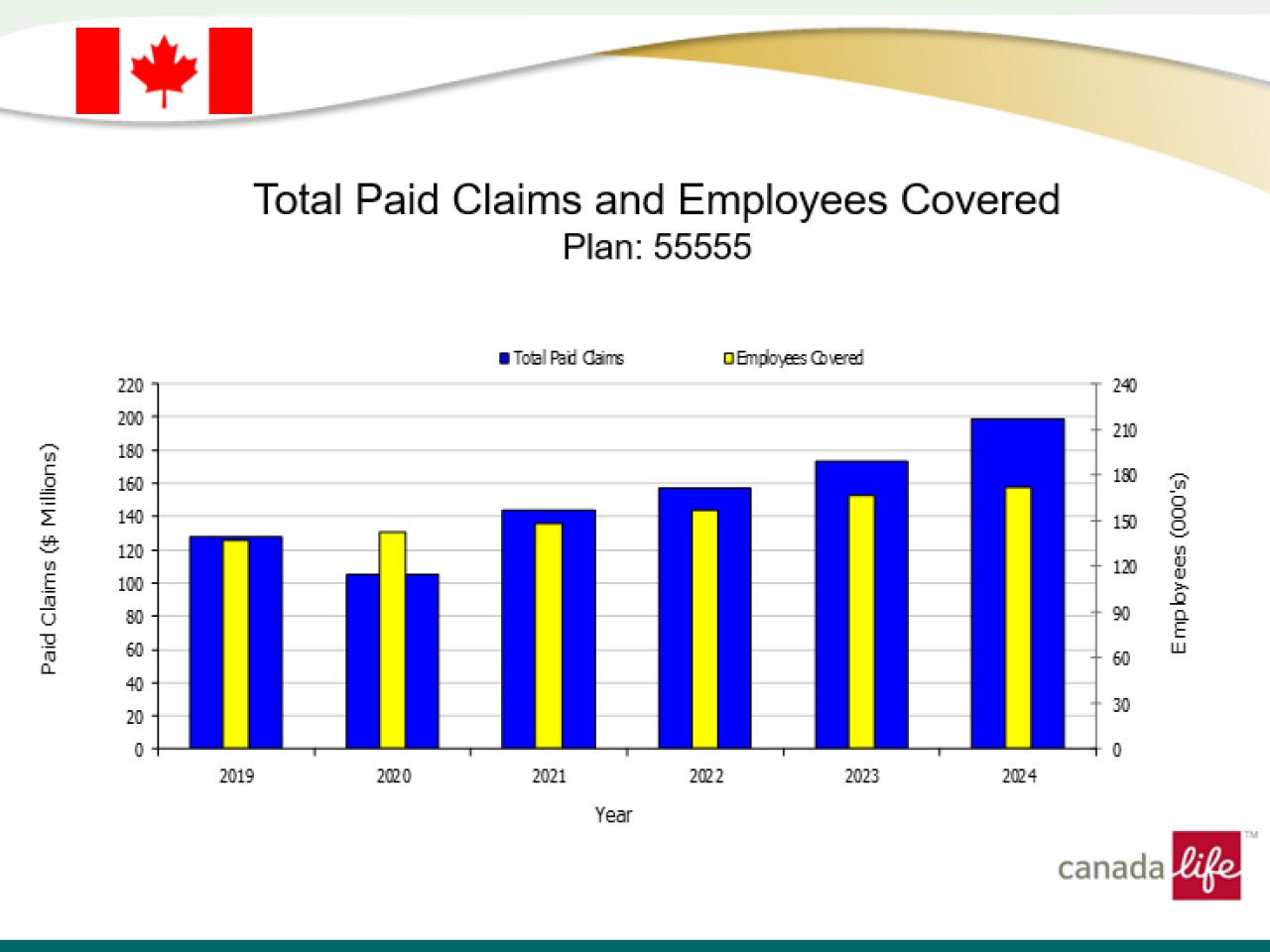

The total cost of the Plan (NJC Part) since 2019 is as follows:

2019 $137.0 M

2020 $112.2 M

2021 $153.8 M

2022 $168.1 M

2023 $184.8 M

2024 $213.0 M

The Plan’s costs increased from 2015-2019 by 1.6%, 2.8%, 1.7%, 3.1% and 9.4% respectively. In 2020, the costs decreased by 18.1%. This drastic reduction was due to the closure of dental offices in Q2 due to the COVID pandemic. The administration expenses decreased proportionately in relation to the number of claims processed and the taxes decreased in relation to the value of paid claims and administration expenses. The Plan’s costs increased in 2021, 2022 and 2023 by 37.1%, 9.3% and 9.9% respectively. In 2024, the costs increased by 15.3% over 2023 or 26.7% over 2022.

The total cost of $213M for 2024 includes $201.3M or 94.5% for paid claims and $11.7M or 5.5% for expenses. The year-to-year changes are:

2019 9.4%

2020 (18.1%)

2021 37.1%

2022 9.3%

2023 9.9%

2024 15.3%

PAID CLAIMS AND EMPLOYEES COVERED (NJC PART)

The number of covered employees at the end of 2024 was 176,348, of which a total of 152,068 employees (86.2%) submitted at least one claim, either for themselves or an eligible dependant.

A total of 1,072,323 member claims were resolved, representing an increase of 12.2% over 2023 or 21.3% from 2022; the average cost per claim in 2024 increased by 3.9% to $187.72 from 2023 or increased by 5.65% from 2022. The average benefit per member in 2024 increased to $1,141.48 from $1,027.93 in 2023, which represents an increase of 11% or from $985.37 in 2022, which represents an increase of 15.8%.

Out of these 1,072,323 member claims, 12.16% were submitted via paper, 79.67% were submitted by the provider and 8.17% were submitted online by the member. Overall, a total of 2,516,772 claims were handled, including dependant claims, representing an increase of 10% over 2023 and 18.1% from 2022.

For 2024, the total amount charged by dentists to Plan members was $400,090,664 compared to $201,297,223 in net benefits paid to employees, for a reimbursement ratio of 50.3% (see Table 1).

| BREAKDOWN OF PAID CLAIMS Plan Number 55555 - NJC 6 year Claims Processed Analysis |

|||||||

|---|---|---|---|---|---|---|---|

| YEAR | ROUTINE $ |

% | MAJOR $ |

% | ORTHO AMOUNT $ |

% | TOTAL AMOUNT$ |

| 2019 | 104,120,814 | 81.3 | 11,474,634 | 9.0 | 12,467,706 | 9.7 | 128,063,154 |

| 2020 | 84,406,432 | 80.4 | 9,522,652 | 9.1 | 11,047,849 | 10.5 | 104,976,933 |

| 2021 | 115,629,048 | 80.2 | 13,104,366 | 9.1 | 15,429,241 | 10.7 | 144,162,655 |

| 2022 | 126,353,081 | 80.4 | 13,838,140 | 8.8 | 16,892,862 | 10.8 | 157,084,083 |

| 2023 | 143,380,811 | 83.0 | 12,976,688 | 7.5 | 16,467,701 | 9.5 | 172,825,200 |

| 2024 | 165,265,020 | 82.1 | 16,506,372 | 8.2 | 19,525,831 | 9.7 | 201,297,223 |

Variations between years 2019 and 2024, concerning paid claims by type of treatment, are as follows:

| TREATMENT | 2019 (%) |

2020 (%) |

2021 (%) |

2022 (%) |

2023 (%) |

2024 (%) |

|---|---|---|---|---|---|---|

| Major Restodsfrative | 5.81 | 5.81 | 5.78 | 5.34 | 4.68 | 5.12 |

| Minor Restorative | 20.75 | 20.75 | 20.52 | 20.00 | 20.38 | 19.90 |

| Oral Surgery | 5.23 | 5.65 | 5.91 | 5.68 | 5.55 | 5.86 |

| Orthodontic | 9.74 | 10.52 | 10.70 | 10.75 | 9.54 | 9.70 |

| Periodontic | 25.00 | 24.11 | 24.97 | 25.50 | 26.57 | 26.60 |

| Preventive | 12.04 | 10.86 | 10.47 | 10.89 | 11.36 | 10.85 |

| Adjunctive | 1.40 | 1.49 | 1.58 | 1.57 | 1.49 | 1.55 |

| Reline Rebase | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 |

| Dentures | 1.66 | 1.53 | 1.62 | 1.61 | 1.30 | 1.78 |

| Diagnostic | 13.50 | 13.93 | 13.59 | 13.92 | 14.68 | 14.44 |

| Endodontic | 3.35 | 3.60 | 3.15 | 2.86 | 2.91 | 2.84 |

| Fixed Bridges | 1.50 | 1.73 | 1.39 | 1.86 | 1.53 | 1.35 |

| TOTAL | 100 | 100 | 100 | 100 | 100 | 100 |

Table 2 (above) shows that while most percentages remained fairly stable from 2019 to 2024 there was an increase in 2024 for major restorative and denture services. In contrast, there were decreases in minor restorative, preventative services and fixed bridges.

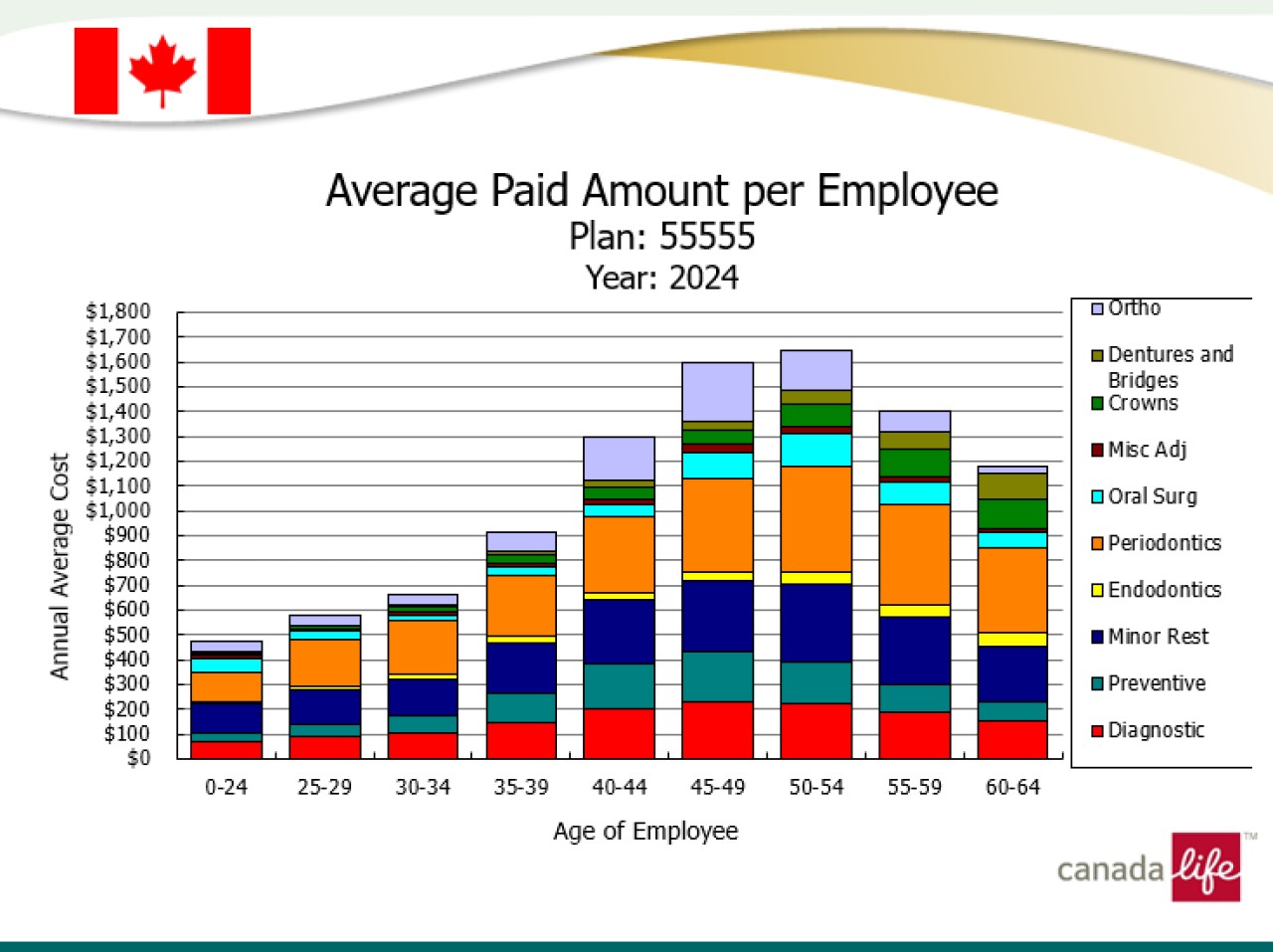

Figure 2 (below) represents the average amount paid by the Administrator to employees in 2024 in the various age groups. While the 45-49 age group continues to have one of two highest average paid amounts per employee, the 40-44 age group dropped to third from second highest average amount paid per employee in 2023. Age group 50-54 now leads as the highest average amount paid per employee compared to 2023.

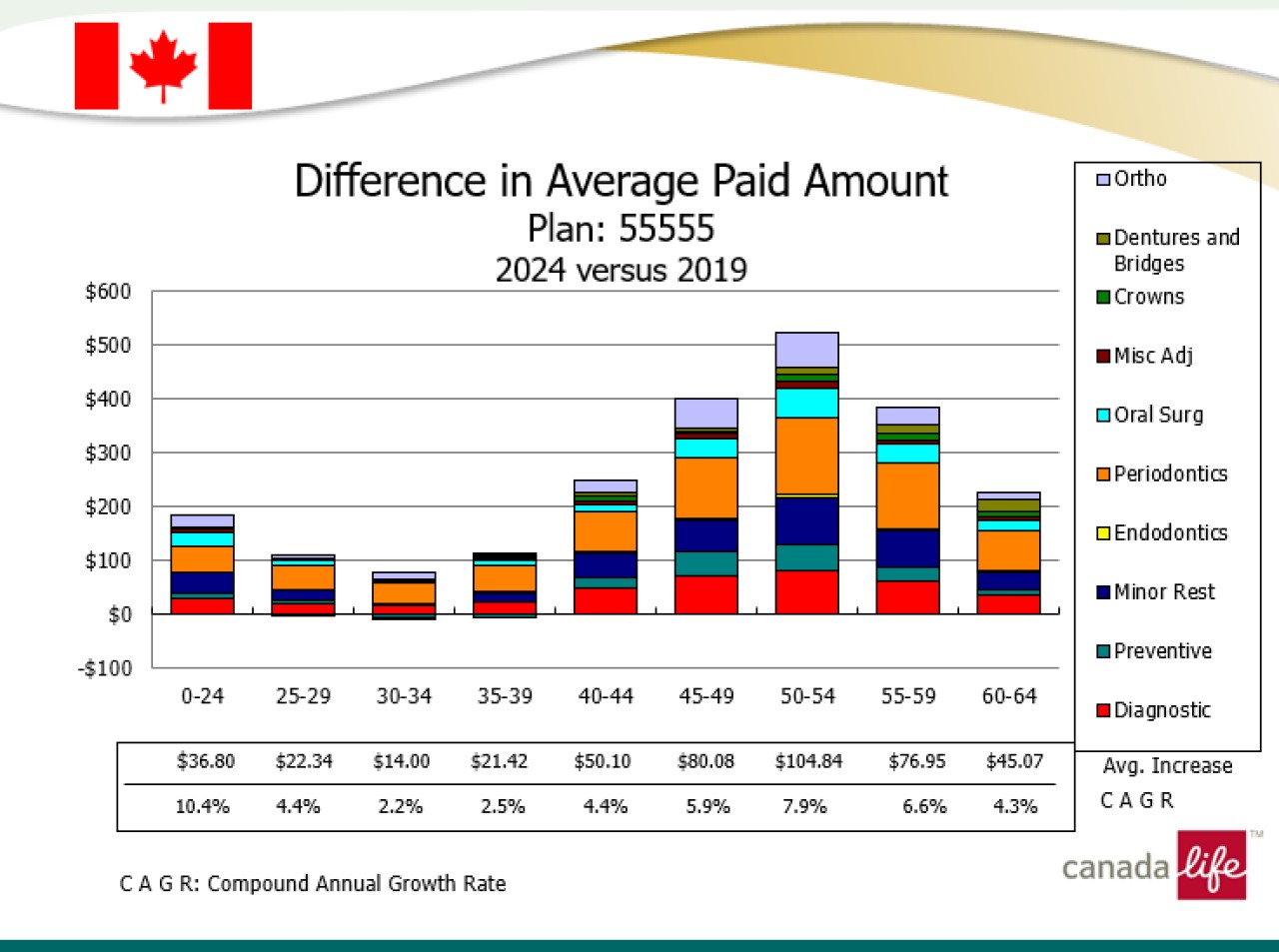

Figure 3 (below) shows that the average amount paid increased for all age categories from 2019 to 2024; however, more noticeably for the 45-59 age group. The table also shows that the average amount increased for all services and all age categories except for some decreases in various age bands for preventive, endodontics and dentures and bridges.

Overall, compared to 2019, the Plan showed a compound average cost increase per employee in all age bands except for some treatments for ages 25-39. The majority of services increased with the exception of preventive services for the 30-39 age bands, endodontics for ages 30-34 and bridges and dentures for ages 25-29, which all saw a reduction in average costs.

Total costs for the Plan in 2024 increased by 16.5% over 2023, driven mostly by the increase in the average amount paid per employee of 11% combined with an increase in the average amount per certificate of 9.8%.

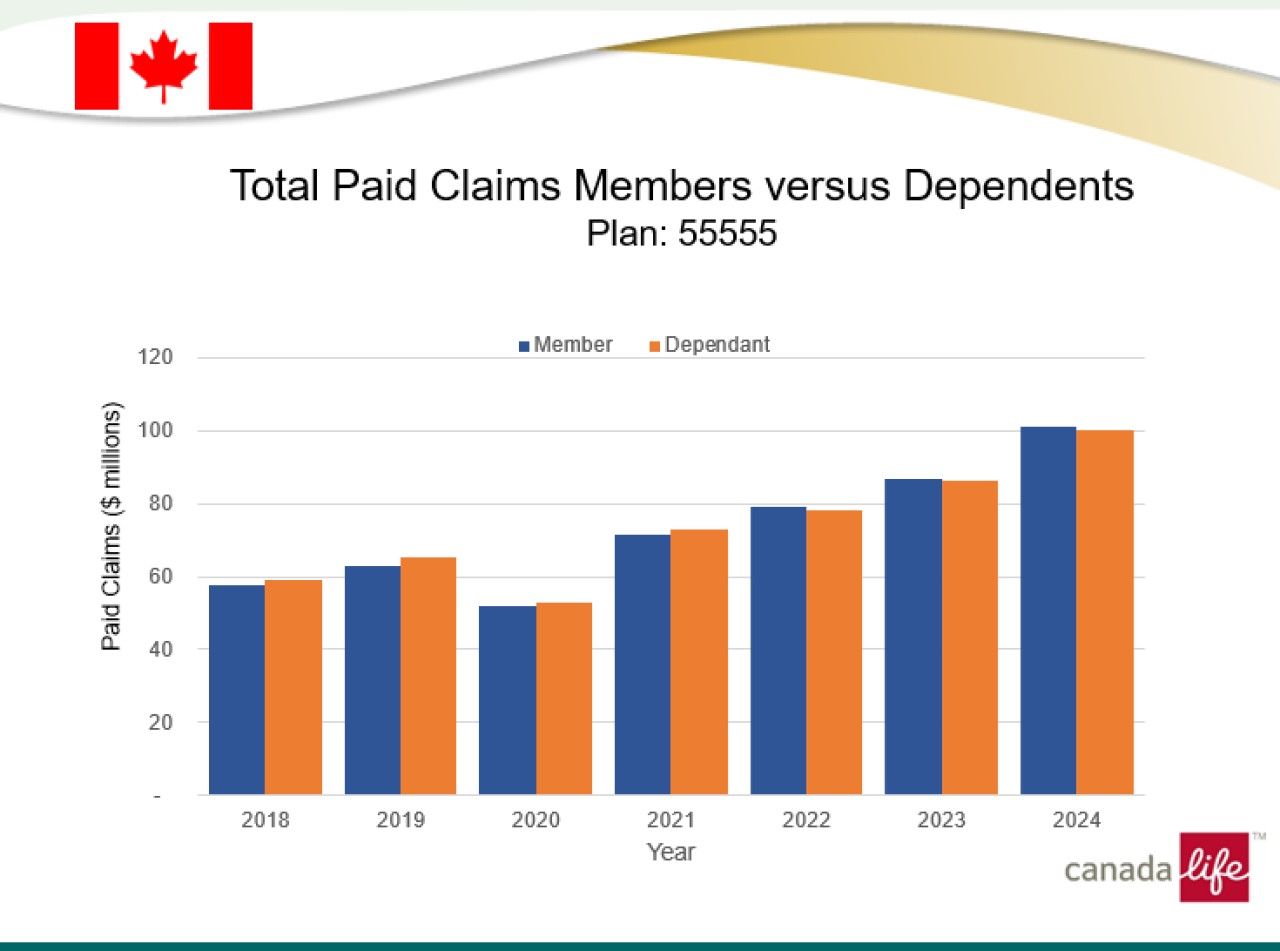

Figure 4 (above) shows increase year over year with dependent claims slightly higher than member claims each year, except for 2022 to 2024 where we saw dependent claims drop 1% lower than member claims each year. In 2021 and 2020 the table shows dependent claims paid were 1.7% higher than members, whereas in 2019 we saw dependent claims 3.3% higher than members.

Throughout the year, the Board continuously monitors the performance of the Plan and the level of service provided to the Plan members.

SERVICE LEVEL PERFORMANCE REVIEW

For 2024, the performance was as follows:

| TARGETS | RESULTS | |

|---|---|---|

| Calls answered in 60 seconds or less | 80% | 95.45% |

| Wait time for calls | 60 seconds or less | 21 seconds |

| Claims turnaround time | 7 calendar days | 2.8 calendar days |

| Abandon rate | 5% of total calls or less | 1.35% of total calls |

In addition to call centre response times, e-mail response times were also captured. It was reported that e-mails are responded to within 24-48 hours.

Currently, there are 143,459 (81.35%) NJC members registered for member portal access. Of those registered for member portal access, 94,697 NJC members (66.01%), have elected for direct deposit. In 2024, 89.61% of total claims resolved for the PSDCP were submitted electronically.

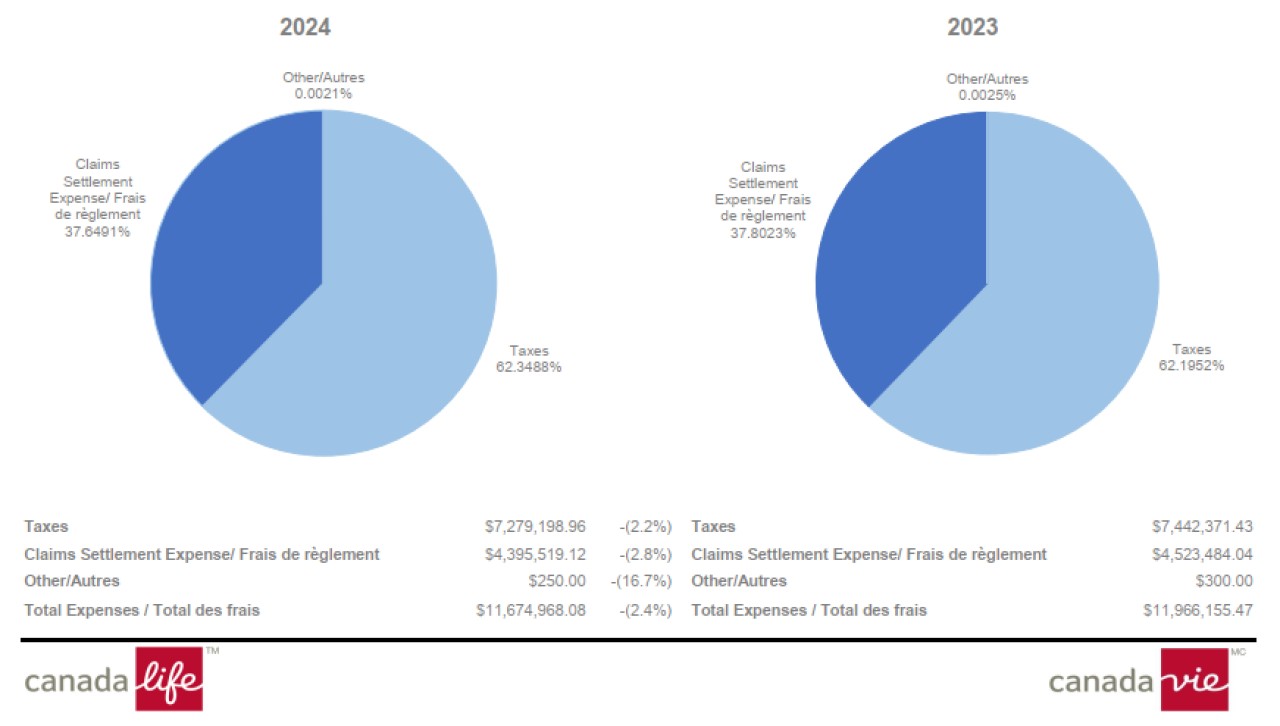

Figure 5 (below) denotes the Plan’s operating expenses from the previous contract for 2024. In other words, expenses for November and December are not captured. The breakdown by expense category is provided below.

PUBLIC SERVICE DENTAL CARE PLAN

OPERATING EXPENSES, 55555 PSDCP (NJC)

JANUARY 1-OCTOBER 31, 2024 vs. JANUARY 1-DECEMBER 31, 2023

COMMUNICATION

Plan members who subscribed to the Compensation and Email Notification System continued to receive bi-monthly emails from TBS throughout 2024 to provide information and reminders regarding the Plan. When the Board notices trends in appeals, they provide TBS with suggestions on what information could be sent out to Plan members to assist them.

The emails that were sent out through the Compensation and Email Notification System in 2024 were as follows:

- The email notification in March 2024 informed plan members of the new contract implementation date of November 1, 2024 and provided the 2024 rates for Quebec taxable benefits.

- In May 2024, the email notification sought participants for a survey on pensions and benefits terminology.

- The email notification in June 2024 promoted the Canada Life App, the transition to the new PSDCP contract, and reminded members to update their personal information regarding life changes such as family status, dependants, etc.

- The email notification in August 2024 informed plan members that Canada Life will complete their PSDCP positive enrolment should they not complete it themselves.

- The email notification in October 2024 reminded plan members of the new PSDCP contract coming into effect November 1, 2024, as well as the PSDCP improvements coming into effect January 1, 2025.

- The email notification in December 2024 reminded Plan members that their PSDCP contract number changed following the new contract coming into effect, reminded them of the changes coming on January 1, 2025, and informed plan members that positive enrolment is required under the Pensioners’ Dental Services Plan (PDSP) upon retirement even if they did so under the PSDCP.

CONCLUSION

In closing, the Board wishes to take this opportunity to thank the Administrator, Canada Life, for their contribution to the administration of the Plan in the year 2024. As always, the Board is pleased to oversee and provide advice on the management of this important employee benefit.