Reimbursement for Business Use of Personal Vehicles

Model Year 2026

Study prepared for The Treasury Board of Canada Secretariat

By Corporate Fleet Services

1. Executive Summary

Corporate Fleet Services (CFS) has been mandated by the Treasury Board of Canada Secretariat to perform the annual evaluation of per-kilometre reimbursement rates for government employees required to use their personal vehicles while performing government business. This study assesses all vehicle operating expenses and provides recommendations for reimbursement rates for each Canadian province and territory.

The present study is based on 2026 model-year vehicles and accounts for all of the following:

- 2026 model year vehicle prices for four different vehicle classes (compact sedans, small crossover/SUV, medium crossover/SUV and electric vehicles—which include battery electric and plug-in hybrid electric vehicles); additionally, a light-duty truck class was used for the evaluation in the territories;

- Prevalent manufacturer rebates, interest rates and residual values;

- Top-selling vehicle models by 2025 Canadian sales (from the beginning of the year until August 2025) in each class studied, for a total of 55 vehicles;

- Cash purchases, financing and lease contracts, according to their respective share of the market;

- Updated vehicle insurance premium rates;

- Updated vehicle registration rates;

- Updated fuel price data and fuel consumption parameters;

- Updated preventative maintenance, repairs, tires and miscellaneous expenses.

This report summarizes all assumptions, methodology, values and findings. It presents up-to-date recommended rates of reimbursement for consideration by the Treasury Board of Canada Secretariat.

1.1 Methodology and Evaluation

The recommendations for reimbursement rates are given for the model year 2026 for:

- Travel Rates (travellers authorized and reimbursed to use their personal vehicles on government business travel), also referred to as “Kilometric Rates” in the National Joint Council Travel Directive (Appendix B); and

- Commuting Rates (employees reimbursed variable expenses to use their personal vehicles to commute to their designated remote worksites), also referred to as “Lower Kilometric Rates” in the National Joint Council Commuting Assistance Directive (Appendix A).

These rates are given on a per-kilometre basis, for each province and territory. This is intended to accurately account for differences in vehicle operating costs across Canada.

The recommendations are based on the total costs of operating privately owned or leased vehicles. In order to reflect realistic conditions, the study assumes an annual driving distance of 20,000 kilometres and ownership terms of both four and five years. Fixed costs include ownership expenses consisting of depreciation, financing or leasing interest and taxes, as well as vehicle insurance and registration. Variable costs cover fuel, preventative maintenance, repairs, tires and miscellaneous items. All cost variations between the provinces and territories are accounted for, as well as the special driving conditions in the three territories.

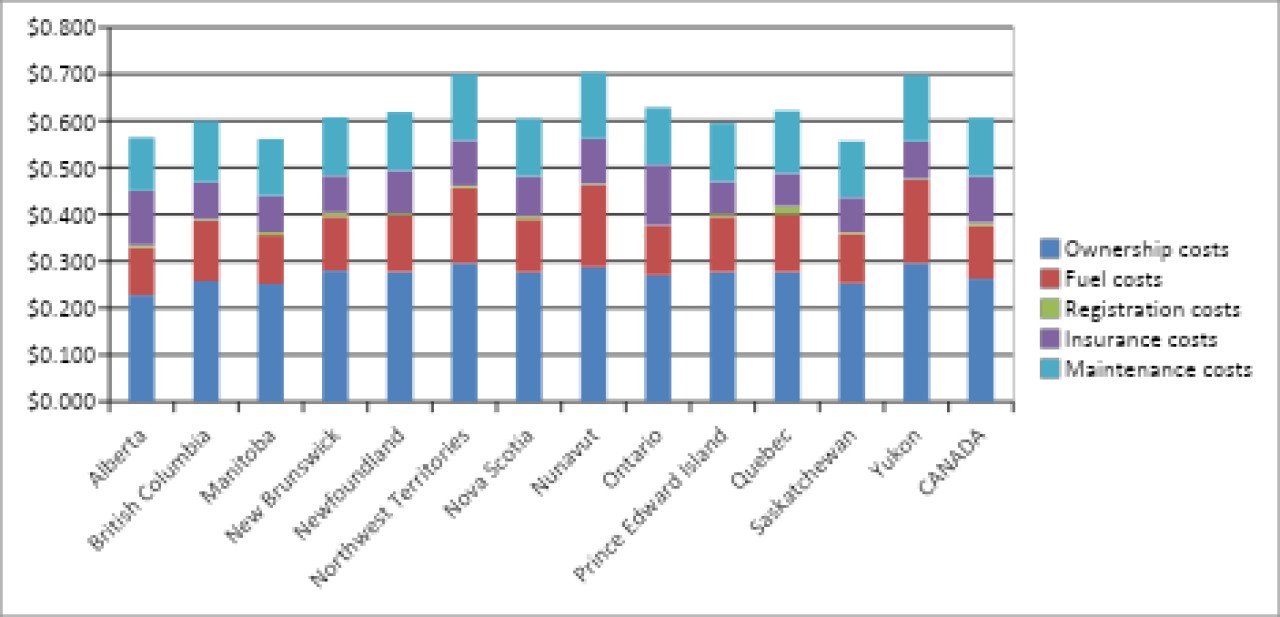

Weighted average nationwide costs of operating personally owned or leased vehicles were determined to be $0.610 per kilometre, as compared to $0.600 in the previous Fuel Update (August 2025, for publication on October 1, 2025) and $0.610 in the previous Annual Report (November 2024, for publication on January 1, 2025). The slight increase versus the previous Fuel Update (August 2025, for publication on October 1, 2025) was primarily driven by an overall rise in maintenance and insurance costs, which was partially offset by a small decrease in total ownership costs (due mainly to reduced interest rates and higher used vehicle resale values). On the other hand, gasoline prices had varied both ways across Canada depending on the location, which had a two-way effect on both reimbursement rates, with some pushing rates upwards and some downwards (for example, the Yukon is the only region that saw a decrease of half a cent in both rates due to lower gasoline prices).

The following table indicates Canadian average expenses by cost component as calculated in the current study, in dollars per kilometre, before rounding up to the nearest half-cent:

| Cost Component | Cost ($/km) | Cost Sub-component | Cost ($/km) |

|---|---|---|---|

| Ownership | $0.263 | Depreciation | $0.180 |

| Interest | $0.034 | ||

| Acquisition Sales Tax | $0.049 | ||

| Registration | $0.006 | Registration | $0.006 |

| Insurance | $0.099 | Insurance | $0.099 |

| Fuel | $0.113 | Fuel | $0.113 |

| Maintenance | $0.125 | Preventative Maintenance | $0.060 |

| Repairs | $0.023 | ||

| Tires | $0.019 | ||

| Miscellaneous | $0.009 | ||

| Maintenance Sales Tax | $0.014 | ||

| Total | $0.606 | Rounded up to $0.610 | $0.606 |

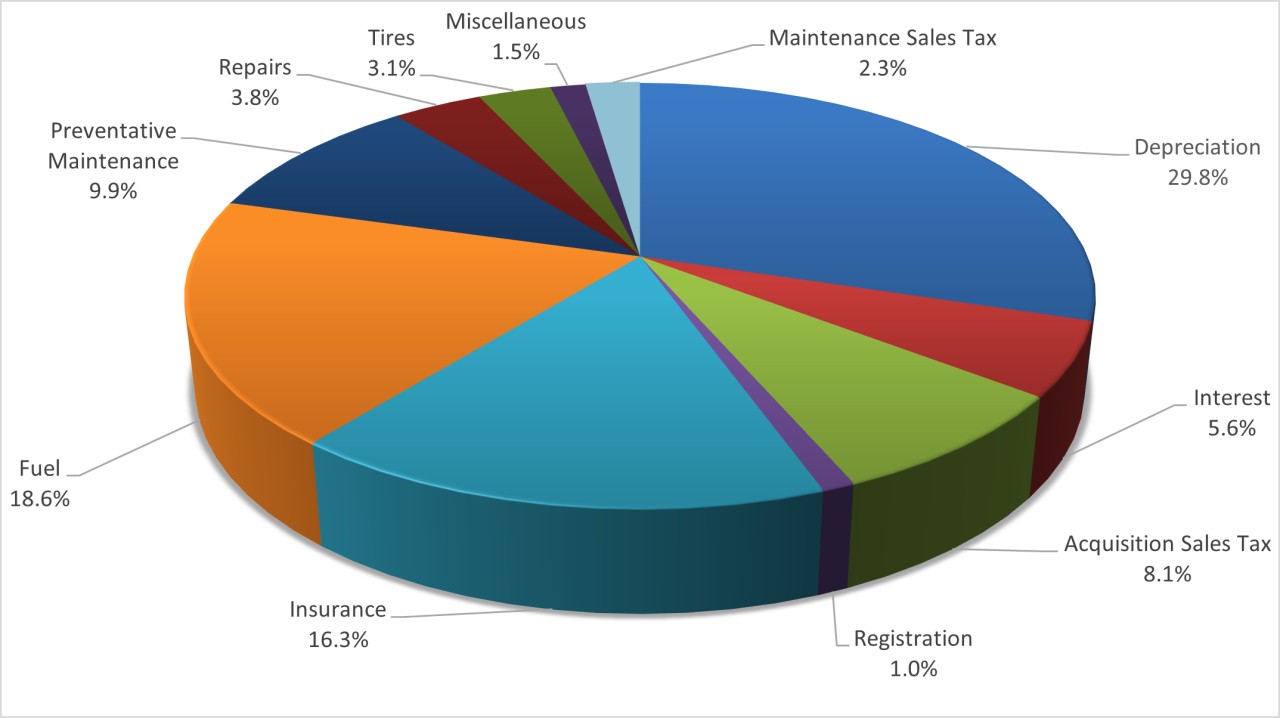

The largest component of vehicle operating expenses is ownership (encompassing depreciation, interest and acquisition sales tax), which accounts for 43.5% of total costs, followed by maintenance expenses at 20.6% and fuel expenses at 18.6%.

2. Preamble

Corporate Fleet Services (CFS) has calculated reimbursement rates for business use of personal vehicles by government employees according to the methodology and parameters listed in a Statement of Work issued through a competitive RFP process. CFS is therefore pleased to present this study with its findings and recommendations, based on extensive research performed on behalf of the Treasury Board of Canada Secretariat.

2.1 Note on Methodology

The current study strictly follows the methodology described in the Statement of Work from the RFP response to solicitation No. 24062-22-299 from July 2023. It also reflects the methodology employed in the previous Annual Report (November 2024, for publication on January 1, 2025) as well as subsequent Fuel Updates. The analysis is deemed to accurately reflect costs in the current Canadian automotive marketplace and is described in detail in Sections 3 through 6.

2.2 Policy Recommendations

It is our opinion that public employees continue to be reimbursed for government business use of personal vehicles on a cents per kilometre basis, reflective of the practice that has been in use since 1999. This is deemed to be consistent with current public and private sector practices as well as it accounts for a fair and simple reimbursement method in line with accepted reimbursement policies across Canada.

However, since there are substantial differences among the ten Canadian provinces and three territories, these rates are calculated separately for each province and territory in order to account for differences in vehicle operating costs.

3. Methodology and Cost Component Determination

3.1 Assumptions

The present study’s objective is to determine reimbursement rates for business use of personal vehicles by government employees in order to reflect current Canadian automotive market conditions as accurately as possible. To accomplish this, an in-depth analysis was performed on all components of the total cost of operating a vehicle.

The methodology employed follows all the elements listed in the Statement of Work that were similarly used in the previous Annual Report (November 2024, for publication on January 1, 2025). The purpose was to calculate the different rates of reimbursement in cents per kilometre, separately for all 10 Canadian provinces as well as the three territories. In light of this, we performed research and data analysis to calculate costs for the following components, which represent the total costs of running a personal vehicle:

(1) Fixed expenses:

- Ownership:

- Depreciation;

- Prevalent retail rebates;

- Financing methods;

- Prevalent interest rates;

- Applicable sales taxes;

- Projected resale values;

- Registration;

- Insurance.

(2) Variable expenses:

- Fuel;

- Vehicle maintenance:

- Preventative maintenance;

- Projected costs of repairs beyond the manufacturer warranty;

- Tires;

- Miscellaneous expenses.

All calculations assumed four- and five-year retention periods as well as considered all vehicles to run an average of 20,000 kilometres per year.

In addition, in order to assess current prevalent insurance premiums by province and territory, the study used a certain demographic to reflect the average government employee. The demographics are based on data available from the Treasury Board of Canada Secretariat as well as Statistics Canada. The following characteristics were used:

- DRIVER: 43 years old, both male and female, married, with more than 20 years of driving experience, a clean driving record (no accidents in the last 5 years), employed full-time, with post-secondary education;

- VEHICLE: 2025 Toyota RAV4 LE AWD, with a total cost of $35,615 plus applicable taxes, financed by Toyota Financial Services, driven a projected 20,000 kilometres per year, having up to 15% business use and driving an average of 15 kilometres to work every day;

- COVERAGE: Third-party liability ($1,000,000 for all provinces and territories, comprehensive and collision coverage included with a deductible typically ranging between $250 and $500, based on individual insurance company offers).

The following chart gives an overview of the cost proportion of the components involved in total expenses of operating a vehicle:

|

Cost Category |

Percentage |

|---|---|

|

Depreciation |

29.8% |

|

Fuel |

18.6% |

|

Insurance |

16.3% |

|

Preventative Maintenance |

9.9% |

|

Acquisition Sales Tax |

8.1% |

|

Interest |

5.6% |

|

Repairs |

3.8% |

|

Tires |

3.1% |

|

Maintenance Sales Tax |

2.3% |

|

Miscellaneous |

1.5% |

|

Registration |

1.0% |

3.2 Vehicle Selection

In order to be reflective of the Canadian marketplace we have performed a thorough study throughout all provinces and territories, focusing on 55 vehicle models (nameplates) grouped under four vehicle classes for the provinces, and three classes for the territories. The models studied account for a significant portion of the Canadian vehicle market, and they were deemed representative of the types of vehicles used by government employees.

The study covers the following categories of vehicles, prevalent in the Canadian automotive landscape:

- Compact sedans;

- Small crossovers/SUVs;

- Medium crossovers/SUVs;

- Electric vehicles (both battery electric and plug-in hybrid electric);

- Light-duty pick-up trucks (for the territories only).

For each of these categories the most sold vehicle models from relevant manufacturers (according to sales in Canada) were studied, covering approximately 79% of the Canadian market for their respective classes. For compact sedans, medium crossovers/suvs as well as electric vehicles, 10 vehicles were chosen for each category. For small crossovers/SUVs, 20 vehicles were chosen. The pick-up truck class contains five nameplates, due to the lower number of available models on the Canadian market (refer to Section 6.1 - Vehicle selection for the territories for further details). However, consistent with the past approach, no luxury or commercial vehicles have been considered in this study, as it is our opinion they do not reflect the typical vehicle choice of the average government employee.

In order to accurately account for costs of all the nameplates studied, each vehicle was assigned a percentage weight directly proportional to total year-to-date sales as of August 2025. Subsequently, all costs, both fixed and variable, were averaged per province or yerritory according to the weight assigned to each vehicle.

Following is a table listing the vehicles studied, as well as the class they belong to, and the weight assigned to each according to recent Canadian sales for the ten provinces:

| Make | Model | Class | Weight for Provinces | 2026 Model Year Pricing* |

|---|---|---|---|---|

| Honda | Civic | Compact | 3.7% | $34,030 |

| Toyota | Corolla | Compact | 2.9% | $27,460 |

| Hyundai | Elantra | Compact | 2.9% | $26,699 |

| Volkswagen | Jetta | Compact | 1.9% | $30,545 |

| Kia | K4 | Compact | 1.6% | $28,645* |

| Mazda | 3 | Compact | 1.6% | $29,945* |

| Nissan | Sentra | Compact | 1.1% | $27,898* |

| Volkswagen | Golf | Compact | 0.4% | $38,945 |

| Subaru | Impreza | Compact | 0.3% | $33,720 |

| Toyota | Prius HEV | Compact | 0.1% | $40,225 |

| Toyota | RAV4 | Small Crossover/SUV | 8.6% | $35,615* |

| Honda | CR-V | Small Crossover/SUV | 6.4% | $41,775 |

| Hyundai | Tucson | Small Crossover/SUV | 3.8% | $37,399 |

| Nissan | Kicks | Small Crossover/SUV | 3.7% | $31,528 |

| Subaru | CrossTrek/XV | Small Crossover/SUV | 3.7% | $32,890 |

| Nissan | Rogue | Small Crossover/SUV | 3.7% | $36,428 |

| Ford | Escape | Small Crossover/SUV | 3.1% | $38,394 |

| Volkswagen | Taos | Small Crossover/SUV | 2.8% | $34,270 |

| Mazda | CX-5 | Small Crossover/SUV | 2.8% | $35,095* |

| Kia | Sportage | Small Crossover/SUV | 2.7% | $36,195 |

| Chevrolet | Equinox | Small Crossover/SUV | 2.7% | $38,599 |

| Hyundai | Kona | Small Crossover/SUV | 2.6% | $30,799 |

| Chevrolet | Trax | Small Crossover/SUV | 2.4% | $28,999 |

| Subaru | Forester | Small Crossover/SUV | 2.4% | $35,990 |

| Kia | Seltos | Small Crossover/SUV | 2.2% | $29,895 |

| Toyota | Corolla Cross | Small Crossover/SUV | 2.1% | $31,910 |

| Ford | Bronco Sport | Small Crossover/SUV | 2.0% | $41,090 |

| Mazda | CX-30 | Small Crossover/SUV | 1.8% | $31,495* |

| Honda | HR-V | Small Crossover/SUV | 1.8% | $34,600 |

| Hyundai | Venue | Small Crossover/SUV | 1.7% | $24,049 |

| Tesla | Model Y | Battery Electric/Plug-in Hybrid | 1.5% | $67,740 |

| Tesla | Model 3 | Battery Electric/Plug-in Hybrid | 1.2% | $62,740* |

| Hyundai | Kona EV | Battery Electric/Plug-in Hybrid | 1.1% | $46,049 |

| Ford | Mustang Mach E | Battery Electric/Plug-in Hybrid | 1.0% | $49,590 |

| Mitsubishi | Outlander PHEV | Battery Electric/Plug-in Hybrid | 0.9% | $50,498* |

| Toyota | Prius Prime | Battery Electric/Plug-in Hybrid | 0.7% | $41,910 |

| Hyundai | IONIQ 5 | Battery Electric/Plug-in Hybrid | 0.6% | $57,549 |

| Volkswagen | ID.4 | Battery Electric/Plug-in Hybrid | 0.6% | $50,695* |

| Hyundai | Tucson PHEV | Battery Electric/Plug-in Hybrid | 0.5% | $55,349 |

| Kia | EV9 | Battery Electric/Plug-in Hybrid | 0.4% | $62,145 |

| Ford | Explorer | Medium Crossover/SUV | 1.5% | $54,395 |

| Jeep | Wrangler | Medium Crossover/SUV | 1.4% | $60,585 |

| Hyundai | Santa Fe | Medium Crossover/SUV | 1.4% | $50,099* |

| Volkswagen | Atlas | Medium Crossover/SUV | 1.4% | $60,845 |

| Mazda | CX-50 | Medium Crossover/SUV | 1.2% | $42,145* |

| Ford | Bronco | Medium Crossover/SUV | 1.1% | $53,660 |

| Toyota | Grand Highlander | Medium Crossover/SUV | 1.1% | $53,565 |

| Jeep | Grand Cherokee | Medium Crossover/SUV | 1.0% | $61,765* |

| Honda | Pilot | Medium Crossover/SUV | 1.0% | $55,350* |

| Mazda | CX-90 | Medium Crossover/SUV | 0.9% | $48,445* |

* Note: The current study used 2025 model-year pricing for vehicles for which prices were not yet available for 2026 model-year. All prices are given before applicable taxes.

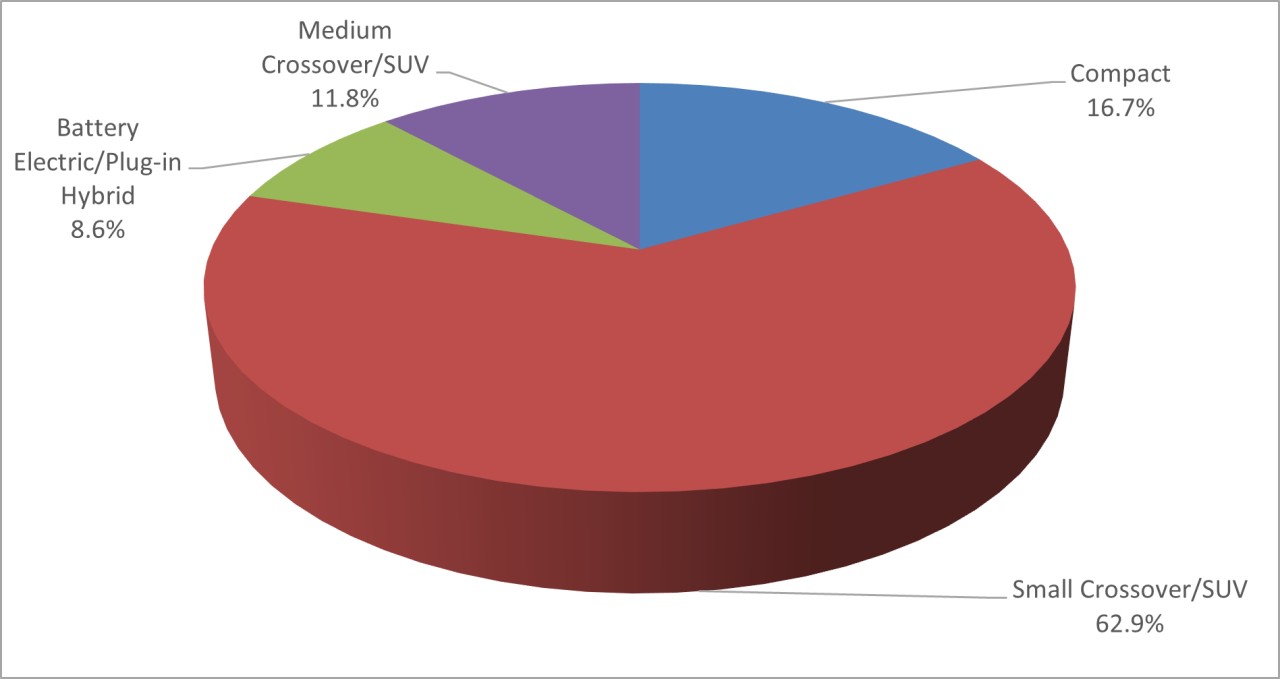

Following are two pie-charts showing the weight of each class as well as that of each brand name, for all vehicles studied, relative to their respective Canadian sales:

Distribution of Vehicles Studied by Class for Provinces

|

Vehicle category |

Percentage |

|---|---|

|

Small crossover/SUV |

62.9% |

|

Compact |

16.7% |

|

Medium crossover/SUV |

11.8% |

|

Battery electric/plug-in hybrid |

8.6% |

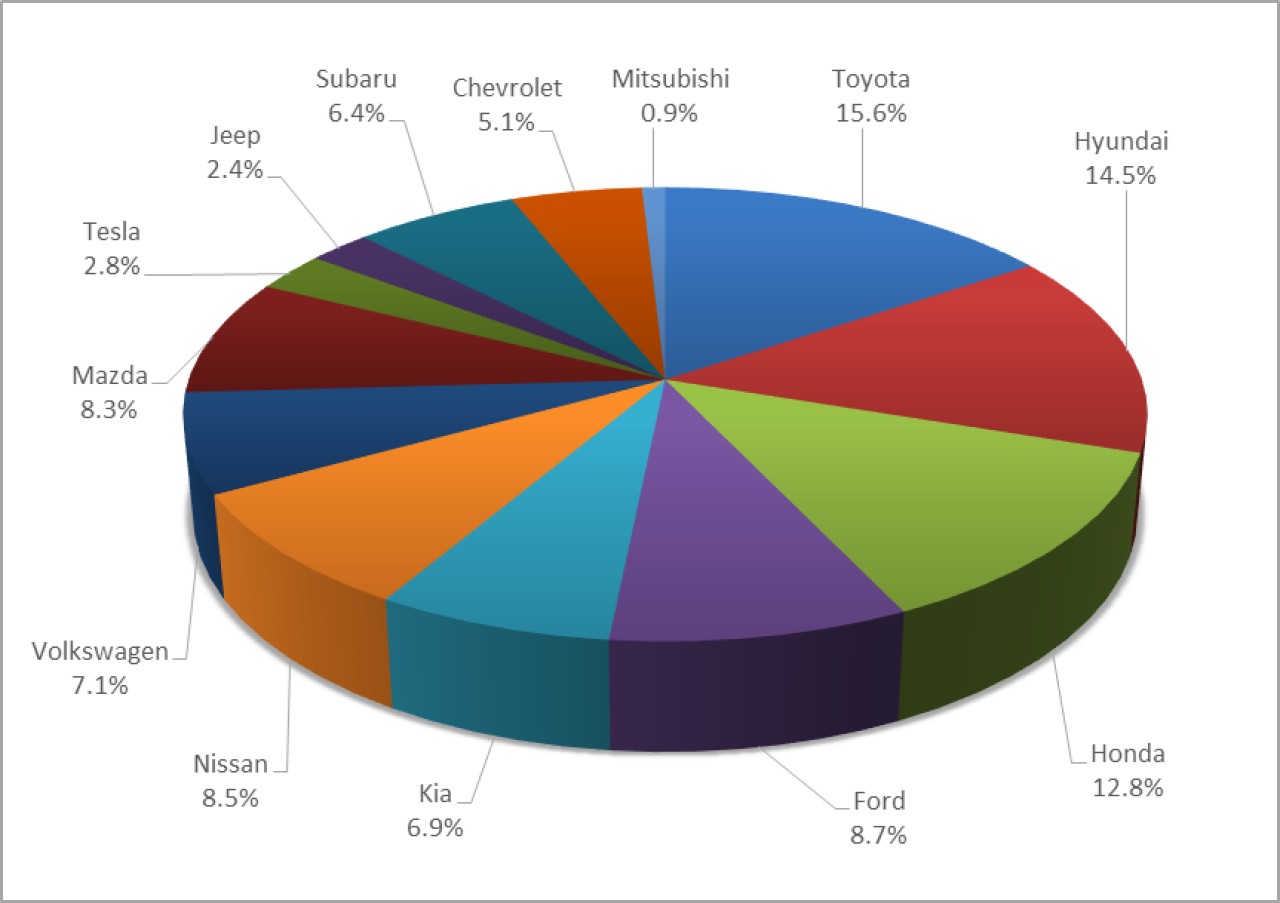

Distribution of Vehicles Studied by Brand Name

|

Manufacturer |

Percentage |

|---|---|

|

Toyota |

15.6% |

|

Hyundai |

14.5% |

|

Honda |

12.8% |

|

Ford |

8.7% |

|

Nissan |

8.5% |

|

Mazda |

8.3% |

|

Volkswagen |

7.1% |

|

Kia |

6.9% |

|

Subaru |

6.4% |

|

Chevrolet |

5.1% |

|

Tesla |

2.8% |

|

Jeep |

2.4% |

|

Mitsubishi |

0.9% |

For the three territories, a different sample of vehicles was studied to account for their particularities, as described in Section 6: Operational Costs in the Territories.

All costs have been calculated separately for:

- Each province or territory;

- Each vehicle studied;

- Each cost component (fixed and variable expenses).

3.3 Data Sources

The present study used information available in the public domain, data from previous studies that we have performed, as well as new research and consultations with specialized professionals and agencies. For each element studied we confirmed the accuracy of the data by consulting additional data sources and cross-referencing the findings. All data sources were assessed for reliability and were thoroughly documented.

3.4 Use of Weighted Averages

In order to accurately reflect current market conditions, consistent with the methodology employed in the previous year’s report, the present study follows a weighted average approach instead of a simple average, by employing weighted arithmetic means where relevant. This was deemed necessary because not all elements calculated contribute the same amount to the total. For example, according to the most recent information available from Statistics Canada, in Ontario there were approximately 75 times as many vehicles registered than in Prince Edward Island, and thus the two regions contribute significantly different amounts to the overall Canadian average. This method was employed throughout the study to better reflect the reality of the Canadian market.

In the same manner, certain vehicle models sell significantly more units on the Canadian market than others and therefore contribute more to the overall weighted average. For example, the Honda Civic sells considerably more units in Canada than the Mazda 3, more than double the amount, and therefore the operating costs for the Honda Civic should reflect proportionately in the total calculated weighted average for each component of the cost. See Section 3.2: Vehicle Selection for details.

4. Fixed Expenses Analysis

4.1 Ownership Costs

4.1.1 Current Model-Year Vehicle Prices

4.1.1.1 Vehicle Pricing

For each vehicle under study, we have extracted 2026 model year MSRP (Manufacturer Suggested Retail Price) values. The main tool employed was Carbook Pro (formerly known as AutoQuote), the industry-leading software that provides up-to-date detailed pricing for all new vehicles available on the Canadian market. At the time of the current study, pricing was not yet available for 15 vehicle models out of a total of 55. For these, 2025 model-year values were used, as in our experience, these values vary only slightly from year to year and are generally reflective of 2026 values.

MSRP pricing is established by the manufacturers for the whole model year and is valid across Canada. Values extracted from Carbook Pro were also cross-checked against the information published by vehicle manufacturers. On average, MSRP prices for vehicles studied increased by approximately 2.5% as compared to the previous year.

4.1.1.2 Prevalent Manufacturer Rebates

Vehicle manufacturers offer retail rebates for new vehicles in order to promote sales and distinguish themselves from their competition. We have thus performed substantial research to determine prevalent retail rebates for all vehicles studied. A period of one year was used as retail rebates vary from month to month as well as display variation, primarily by vehicle model and type of acquisition (cash, finance or lease).

All the data obtained was integrated into a 2,145 data-points matrix and subsequently reflected in the purchase price of each vehicle by province and territory and by the type of acquisition. Direct price negotiation between vehicle retailers and buying individuals could not be accounted for in this study.

Similar to the previous year, manufacturers still rarely offered rebates on new vehicles. The average rebate for the recent 12-month period was $251, a slight decrease from $316 last year, still considerably below the rebates of six years ago (pre-pandemic) when the average was close to $1,100.

4.1.1.3 Federal and Provincial Levies

Provincial and federal levies apply to the purchase of new vehicles and are intended in principle to offset environmental costs such as disposal and recycling of air conditioning fluids or tires. For the vehicles under study the following levies apply:

• Air conditioning: $100 (federal);

• Tire, environmental and other levies: $0–$35 (provincial and territorial).

All applicable fees and levies have been factored in the analysis.

4.1.1.4 Provincial and Federal Rebates for Electric Vehicles

Over the course of the past year, the federal government, as well as several provincial governments, either paused, reduced or outright eliminated their incentives previously offered for the acquisition of electric vehicles. The stated motivation for this was either that allocated funds had run out, or citing economic instability and high costs. The federal Incentives for zero-emission vehicles (iZEV) program was paused indefinitely in January 2025, while British Columbia paused theirs in May 2025. Nova Scotia and New Brunswick ended their programs completely in May and July 2025, respectively. Prince Edward Island and Quebec maintained their programs, albeit with a reduction in the amounts offered.

In light of this, only four remaining provinces (Manitoba, Quebec, Newfoundland and Labrador and Prince Edward Island), as well as the Yukon, still currently offer government-funded rebates for the acquisition of a battery electric vehicle (BEV) or plug-in hybrid electric vehicle (PHEV). Rebates offered by provinces and territories range between $1,000 and $5,000 per vehicle.

Additionally, it is worth mentioning that in some of the regions that still maintain their electric vehicle rebates, the eligibility was switched to apply only to specified BEVs and PHEVs manufactured in countries that have a free-trade agreement with Canada. Vehicles manufactured in a country that does not have a free-trade agreement with Canada are no longer eligible which, for example, removes the rebates for Tesla vehicles manufactured in China. Where applicable, electric vehicle rebates also vary by a number of other factors, such as battery capacity or driving range, vehicle size and MSRP cost. All these particular variations were integrated into the current study accordingly.

For reference, the following table lists all currently applicable federal and provincial electric vehicle rebates, by type:

| Area of Application | |||||

|---|---|---|---|---|---|

| Type | MB | QC | NL | PE | YT |

| Battery electric vehicles (BEV) | $4,000 | $4,000 | $2,500 | $4,000 | $5,000 |

| Long-range plug-in hybrid electric (PHEV)* | $4,000 | $2,000 | $1,500 | $2,000 | $5,000 |

| Plug-in hybrid electric (PHEV) | $4,000 | $1,000 | $1,500 | $2,000 | $3,000 |

* Definition of a “long-range PHEV” varies by program, e.g. the Yukon has a range requirement of 50 kilometres or more, while Quebec has battery capacity requirements instead. Manitoba, Newfoundland and Labrador and Prince Edward Island have no distinctions between Long-range and Regular PHEVs.

4.1.2 Method of Vehicle Acquisition

We have performed research on the Canadian market to establish which methods of vehicle acquisition are the most prevalent, as well as what market share is held by each. With the slight reduction of interest rates, a shift away from cash purchases in favour of financing and, to a lesser extent, leasing, has been observed. Information provided by the Canadian Finance and Leasing Association in the Canadian Market Overview 2025 is used in the study and supported by other industry publications.

Consequently, in Canada, the new vehicle market is currently distributed among the following three forms of acquisition as follows:

• Cash purchases (up-front payment): 18.9%;

• Financing contracts (vehicle loans): 54.8%;

• Vehicle leases: 26.3%.

Therefore, in order to accurately reflect the reality of the market, we have analyzed all three forms of acquisition and subsequently calculated a weighted average for each vehicle under study according to their proportion of the market.

The net cost of vehicle ownership was calculated according to the method of acquisition (cash, financing or leasing). All three vehicle acquisition methods were addressed with their specific particularities, proportionately with their prevalence in the Canadian automotive landscape, as follows:

- Cash purchase: the real cost of ownership is the full price paid for the vehicle (including freight and pre-delivery inspection (PDI), all fees and levies as well as sales taxes), less the projected resale value (expected return) after the period of retention (four and five years).

- Financed vehicles: vehicles that are financed through any financial institution (through a vehicle loan) cost more than a cash purchase since interest is added to the actual price of the vehicle. Prevailing interest rates were used for all calculations as published by the different vehicle manufacturers throughout the year (refer to Section 4.1.5 for details). The amount of interest paid was based on the assumption that upon acquisition of a new vehicle, the old vehicle is traded in or otherwise sold and the amount applied up-front to reduce the capital cost and subsequently interest costs.

- Leased vehicles: personally leased vehicles are usually subject to closed-end lease agreements. Under these circumstances, the term “ownership” does not properly define the acquisition, since the vehicle is owned by the lessor until the end of the lease term. The cost of “ownership” must then be calculated according to the actual monthly payments incurred by drivers for the period of the term plus applicable sales taxes.

4.1.3 Four- and Five-Year Retention Periods

We calculated ownership costs for both four- and five-year retention periods, terms that were found to be reflective of average retention periods for the Canadian automotive landscape. All calculations were performed by vehicle and per province or territory taking into account both retention periods and the results were averaged to yield one value per vehicle, by province or territory.

4.1.4 Vehicles Driven 20,000 Kilometres Annually

All vehicles under study were considered to be driven 20,000 km per year. This is deemed to be a reasonable benchmark to base all reimbursement calculations on since the average Canadian vehicle is driven between 16,000 and 24,000 km per year. All calculations were made using this benchmark all across Canada.

4.1.5 Financing and Leasing Interest Rates

We have performed in-depth research to determine the prevalent interest rates provided by vehicle manufacturers. The manufacturers offer what are known as subvented rates to promote sales of new vehicles. These rates are typically substantially lower than regular financial institutions’ loans. Since these reduced rates are prevalent on the market, we deemed it reflective of reality to integrate these rates into our calculations.

Interest rates vary considerably by:

- Vehicle manufacturer;

- Vehicle model;

- Form of financing (financing contract or lease);

- Period of financing or lease (48 and 60 month periods were researched).

All these variations were integrated into a 2,860 data-points matrix and subsequently reflected in the ownership costs of each vehicle, by province and territory.

For the current study, all vehicle models studied had manufacturer-established interest rates available for four- and five year financing. However, while all the manufacturers studied offered subvented leasing rates, some did not offer them for certain models on four- and five-year leasing terms. In these instances, average market (financial institutions or third-party leasing companies) rates were used.

All yearly average interest rates (financing and leasing) varied from 1.09% to 7.91% for manufacturers’ subvented rates, while the third-party interest rates were approximated at 10.00%. The average interest rate for financing contracts was 4.33% (down from 5.13% the previous year), while the lease rate was 6.07% (down from 7.58% last year). Overall, interest rates are lower as compared to the previous year.

4.1.6 Sales Taxes

Federal and provincial sales taxes (GST, PST, QST, HST) apply to the full cost of a new vehicle according to the taxation method of each province or territory. Sales taxes also apply to:

- Interest charged for financing or leasing;

- Certain fees and levies;

- Parts and labour for all preventative maintenance, repairs and tires.

Whether a vehicle is cash-purchased, financed or leased, taxes apply differently. For both cash purchases and financing contracts, the full price of a new vehicle is subject to sales tax, whereas for leased vehicles sales tax is only applied to monthly lease payments (including tax on interest).

Sales taxes have been factored into all calculations as to accurately reflect the direct costs to the end user of a vehicle. Following is a table listing the combined GST/PST/QST/HST applicable for each province and territory for the period relevant to the current study:

| Sales Taxes in Canada by Province and Territory | Combined Sales Taxes |

|---|---|

| Alberta | 5% |

| British Columbia | 12% |

| Manitoba | 12% |

| New Brunswick | 15% |

| Newfoundland and Labrador | 15% |

| Northwest Territories | 5% |

| Nova Scotia | 14% |

| Nunavut | 5% |

| Ontario | 13% |

| Prince Edward Island | 15% |

| Quebec | 14.975% |

| Saskatchewan | 11% |

| Yukon | 5% |

4.1.6.1 Taxes on Fuel

Fuel prices listed at the pump have all taxes included, as is the standard throughout Canada. Fuel is usually taxed federally, provincially as well as regionally. Approximately a third of the price paid at the pump is made up of the following:

- Federal excise Tax;

- GST/HST/PST/QST;

- Provincial fuel tax;

- Carbon tax;

- Transit tax (in some provinces).

All fuel prices given in the present study have all taxes included.

4.1.6.2 Taxes on Insurance Premiums

Regular sales tax (GST/PST/QST/HST) as well as additional insurance-specific taxes apply differently to insurance premiums across Canada depending on each province or territory. Insurance premiums given in the present study account for all applicable taxes.

4.1.6.3 Recent and Upcoming Tax Rate Changes

We have consulted directly with all relevant public sources in order to determine if there are any impending tax rate changes across Canada in the near future. At this time, no changes in sales taxes are recorded anywhere in Canada. However, it is worth noting that the government of Nova Scotia reduced the provincial portion of the sales tax by 1%, effective April 1, 2025, reducing the HST from 15% to 14%.

For each subsequent Fuel Update of the present study, research will be performed again for all Canadian provinces and territories to determine if tax amounts have changed or if any changes are foreseen in the future.

4.1.7 Resale Values (Vehicle Remarketing)

In order to accurately assess total costs of vehicle ownership, an analysis was performed for each vehicle under study, to project resale values for retention periods of four and five years. Resale values were extracted from resale market data for the same or a similar vehicle model. The research was based on:

- Four-year-old vehicles with approximately 80,000 km;

- Five-year-old vehicles with approximately 100,000 km.

The values were extracted from the Canadian Black Book, an industry standard for establishing values for used cars and were supported through consultation with specialized vehicle resellers, as well as employing other relevant tools. Final values were projected for:

- Four and five year retention periods;

- Every Canadian province and territory;

- Each vehicle under study, assuming an average vehicle condition.

On average, vehicle resale values increased by approximately 4.5%, nearly twice as much as the increase in the price of new vehicles. The trade tensions and tariffs imposed by the U.S. had an impact on the availability and cost of new vehicles in Canada, making them temporarily less available and increasing the overall uncertainty for consumers. This led to an increased demand for pre-owned vehicles, applying upward pressure on resale prices.

Resale values were integrated into the depreciation analysis differently depending on the type of acquisition, as follows:

- For cash purchases resale values were subtracted from the initial total cost of a new car;

- For financing contacts, we used the assumption that vehicle owners either trade in their old vehicle or otherwise sell it and put the amount down to offset part of the payment for the new vehicle and therefore reduce the total cost of interest;

- On vehicle leases, however, the actual resale value of the vehicle is virtually irrelevant. Lessors typically base their depreciation calculations on projected residual values that are established directly by manufacturers. We have performed complete research to determine these residual values for all vehicles under study, by compiling a 1,430 data-points matrix to accurately calculate total leasing costs. As compared to the previous year, average residual values decreased by approximately 1.9%. Residual values show variations by:

- vehicle model;

- retention periods (four and five years);

- model trim.

4.1.8 Total Cost of Ownership Calculations

For each province and territory, total costs of ownership were calculated for:

- Each vehicle under study;

- All three acquisition methods (cash purchase, financing contract and leasing);

- Four- and five-year retention periods.

A weighted average was then calculated for all vehicles under study to yield a final cost-of-ownership figure per province and territory. All figures were converted and expressed in dollars per kilometre.

The following three tables give a detailed breakdown of vehicle ownership costs in Canada in dollars per kilometre, by vehicle class, four- and five-year retention periods, split by depreciation costs, financing costs (interest) and sales taxes, as well as a weighted average according to vehicle sales figures:

|

Depreciation |

Compact | Small Crossover/ SUV Medium |

Crossover/ SUV |

Battery Electric/ Plug-in Hybrid |

Weighted Average |

|---|---|---|---|---|---|

| 4-yr ownership | $0.124 | $0.163 | $0.289 | $0.296 | $0.183 |

| 5-yr ownership | $0.126 | $0.159 |

$0.275 | $0.282 | $0.178 |

| $0.180 | |||||

|

Interest |

Compact | Small Crossover/ SUV Medium |

Crossover/ SUV |

Battery Electric/ Plug-in Hybrid |

Weighted Average |

|---|---|---|---|---|---|

| 4-yr ownership | $0.026 |

$0.027 | $0.050 | $0.051 | $0.032 |

| 5-yr ownership | $0.030 | $0.032 | $0.060 | $0.058 | $0.037 |

| $0.034 | |||||

|

Acquisition Sales Tax |

Compact | Small Crossover/ SUV Medium |

Crossover/ SUV |

Battery Electric/ Plug-in Hybrid |

Weighted Average |

|---|---|---|---|---|---|

| 4-yr ownership | $0.043 | $0.049 | $0.075 | $0.075 | $0.053 |

| 5-yr ownership | $0.035 | $0.041 | $0.063 | $0.062 | $0.044 |

| $0.049 | |||||

Note: Total weighted averages are rounded to three decimals.

4.1.9 Costs of Ownership Changes From the Previous Year

A combination of increased resale values for used vehicles and lower interest rates, only partially offset by slightly higher MSRP prices for new vehicles, has resulted in overall ownership costs decreasing by 1.9% as compared to the previous year's report. This had an overall downward effect on reimbursement rates across Canada, although it was offset by increased maintenance and insurance costs. The variation in costs of ownership between provinces and territories remained minimal.

4.2 Vehicle Registration Costs

Vehicle registration and plating is regulated at the provincial level. Each Canadian province and territory has its own regulatory body governing the rules and costs of vehicle registration. Registration costs are typically charged annually in the form of a registration renewal. In some provinces there are certain one-time up-front costs that are charged only at the time of the initial vehicle registration.

We have performed a complete study of these costs by contacting all provincial and territorial authorities. Registration costs do not have additional taxes applied to them as payment is made directly to the respective governmental agencies. The terms registration and licensing are used interchangeably in this study.

Registration costs vary by:

- Province or territory;

- Vehicle class;

- Certain other parameters (vehicle weight, cylinder capacity, excessive fuel consumption, etc.).

All these costs have been integrated into the calculations for each province and territory. Annual registration costs vary between $0 in Ontario and $348 in Quebec and contribute a weighted average of $0.006 per kilometre for all of Canada.

The following table lists annual registration costs used in the study for all 10 provinces and three territories:

| Province/Territory | Annual Registration Costs | Registration Costs ($/km) |

|---|---|---|

| Alberta | $100 | $0.005 |

| British Columbia | $61 | $0.003 |

| Manitoba | $126 | $0.006 |

| New Brunswick | $165 | $0.008 |

| Newfoundland and Labrador | $90 | $0.005 |

| Northwest Territories | $83 | $0.004 |

| Nova Scotia | $125 | $0.006 |

| Nunavut | $60 | $0.003 |

| Ontario | $0 | $0.000 |

| Prince Edward Island | $130 | $0.007 |

| Quebec | $348 | $0.017 |

| Saskatchewan | $68 | $0.003 |

| Yukon | $54 | $0.003 |

4.2.1 Note on the Province of Quebec

It must be noted that in Quebec, provincially regulated bodily injury insurance must be purchased through the annual vehicle registration process. This is the reason why registration costs in Quebec are generally higher than in the other provinces or territories. In addition, Greater Montreal Area municipalities saw a significant increase in the Vehicle Registration Tax that is collected to fund the public transportation network since 2021. The Vehicle Registration Tax in the Greater Montreal Area increased from $59 to $150 per year in 2025, pushing the overall registration costs up.

4.3 VEHICLE INSURANCE COSTS

4.3.1 Regulation of vehicle insurance

Insurance rates vary greatly across Canada, primarily due to different provincial laws determining vehicle accident fault, subrogation or no-fault policies. Vehicle insurance is offered by private insurers in Alberta, Ontario as well as the four Atlantic provinces and the three territories. Quebec, however, has a hybrid system where bodily injury insurance is provided by the province through its vehicle registration process, while third-party liability is provided by private insurers. On the other hand, the provinces of British Columbia, Manitoba and Saskatchewan have mandatory public vehicle insurance, offered exclusively by the provincial governmental bodies.

4.3.2 Variability of insurance premiums

Insurance premium rates vary considerably not only from province to province, but also according to a substantial number of other parameters related to the insured driver’s personal characteristics as well as to the vehicle being insured. Where insurance is offered privately, insurance premiums also vary considerably from one insurer to another.

4.3.3 Analysis of prevalent insurance premiums

We have performed a thorough analysis of current prevalent insurance premium rates for the average government employee to keep these figures in line with current market conditions as well as recent industry publications. The steps taken to determine the insurance rates used in the present study were as follow:

- The latest information on the average insurance premiums paid in each province and territory were collected from the General Insurance Statistical Agency (GISA), Groupement des assureurs automobiles (GAA), Insurance Corporation of British Columbia (ICBC), Manitoba Public Insurance (MPI) and Saskatchewan Government Insurance (SGI) to form an industry baseline for each Canadian province and territory. The inflation rate on vehicle insurance premiums posted by Statistics Canada was also applied in the calculations.

- Provided the specifics of the present study and the demographics of the average government employee, an allowable variability factor was added to the industry baseline premiums to establish the prevalent insurance rates to be used in the study. The variability factor accounts for the following:

- The differences between the average driver/vehicle in Canada versus the average government employee, as well as the selection of vehicles in the study,

- Any potentially applicable discounts that an average Canadian driver might be able to obtain (e.g. discounts when combining car and home insurance, discounts based on credit score), that this study was unable to directly account for.

- The calculated rates were then substantiated, whenever possible, th+rough quotes obtained based on the average government employee as described in Section 3.1. We requested over 150 quotes based on this established demographic directly from private insurers as well as insurance brokers. For provinces with public insurance, the data available from the governing bodies was used.

Following is a table listing average insurance premiums for the 10 provinces and three territories, as well as a comparison with the insurance premiums published in the previous year's study, for direct comparison (averaged annual premiums have been rounded up to the nearest $25):

| Province/Territory | Current Insurance Premiums | Insurance Costs ($/km) | January 1, 2025, Annual Report insurance premiums |

|---|---|---|---|

| Alberta | $2,325 | $0.116 | $2,250 |

| British Columbia | $1,575 | $0.079 | $1,525 |

| Manitoba | $1,550 | $0.078 | $1,450 |

| New Brunswick | $1,575 | $0.079 | $1,525 |

| Newfoundland and Labrador | $1,825 | $0.091 | $1,775 |

| Northwest Territories | $1,925 | $0.096 | $1,825 |

| Nova Scotia | $1,700 | $0.085 | $1,625 |

| Nunavut | $1,925 | $0.096 | $1,800 |

| Ontario | $2,575 | $0.129 | $2,350 |

| Prince Edward Island | $1,375 | $0.069 | $1,275 |

| Quebec | $1,400 | $0.070 | $1,300 |

| Saskatchewan | $1,475 | $0.074 | $1,350 |

| Yukon | $1,600 | $0.080 | $1,525 |

The values obtained through the present study are deemed to be reflective of the current reality for the established demographic. Insurance rates vary between $1,375 and $2,575, with a Canadian weighted average of $0.099 per kilometre. A moderate increase in insurance premiums ranging from 3%-10% has been observed across all Canadian provinces and territories. The largest hike was in Ontario, where the premium increased by $225 or 9.6% as compared to last year.

5. Variable Expenses Analysis

5.1 Fuel Expenses

Fuel expenses are directly related to three main factors: buying location, fuel consumption of the vehicle and time of the year. The current study focuses on gasoline prices across Canada, which are strongly related to variations in the world energy market.

This report aims to provide an overview of the current market situation and present the latest estimates and forecasts pertinent to the energy market conditions. Nevertheless, similar to the previous reports, caution must be exercised when considering the data available due to the rapidly changing nature of global markets.

5.1.1 Energy Market Context

The global crude oil supply continues to exceed the demand, leading to an increase in global crude oil inventories and applying a downward pressure on prices. While some events are casting uncertainty over the supply, especially the latest sanctions on Russian oil, the lagging global economic growth is indicating a further slowdown in demand, accentuating the imbalance.

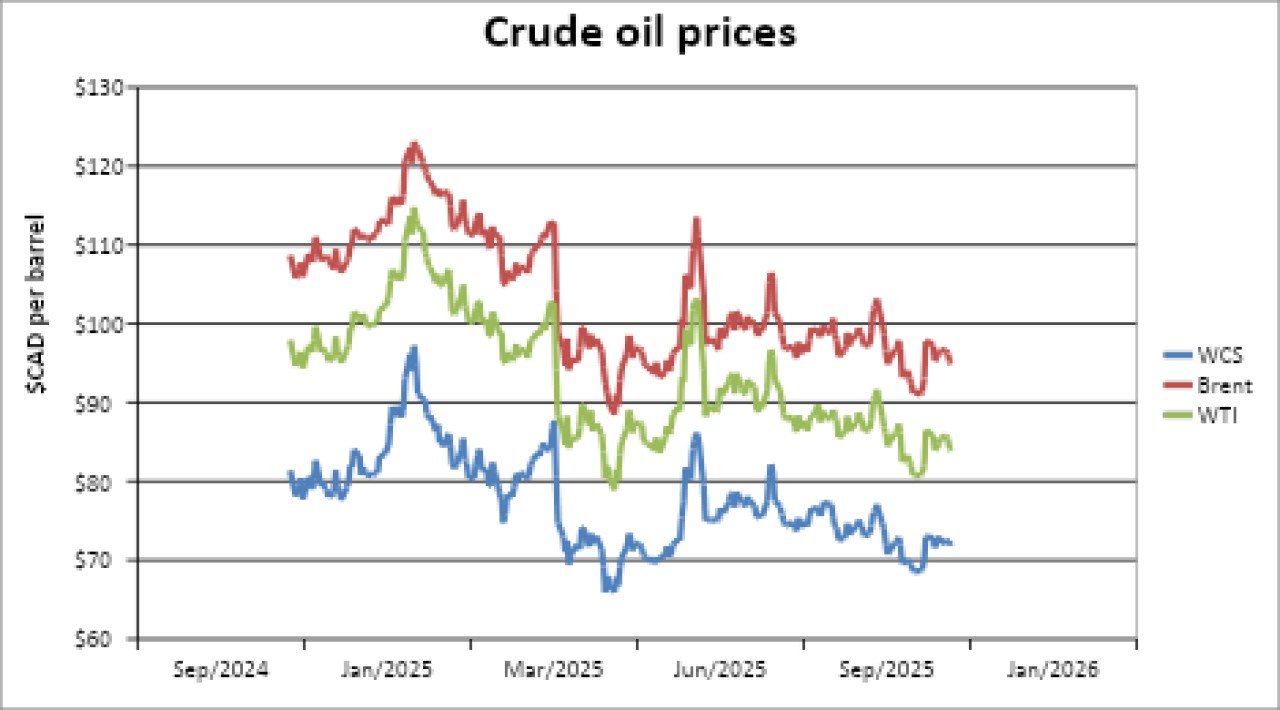

Over the past three months, global crude oil prices, on average, have been on a slight downward trend. The crude oil was largely trading sideways in August and early September. West Texas Intermediate (WTI) peaked on September 26, closing at $65.72 USD per barrel, followed by a drop to the three-month lowest price by October 17, when it closed at $57.54 USD per barrel, a decline of about 12.5% in the three-week span. Brent followed a similar pattern, going from $70.13 USD per barrel on September 26 to $61.01 USD on October 20, a decline of 13.0%. As of November 7, WTI stood at $59.75 USD per barrel, and Brent was at $63.63 USD per barrel.

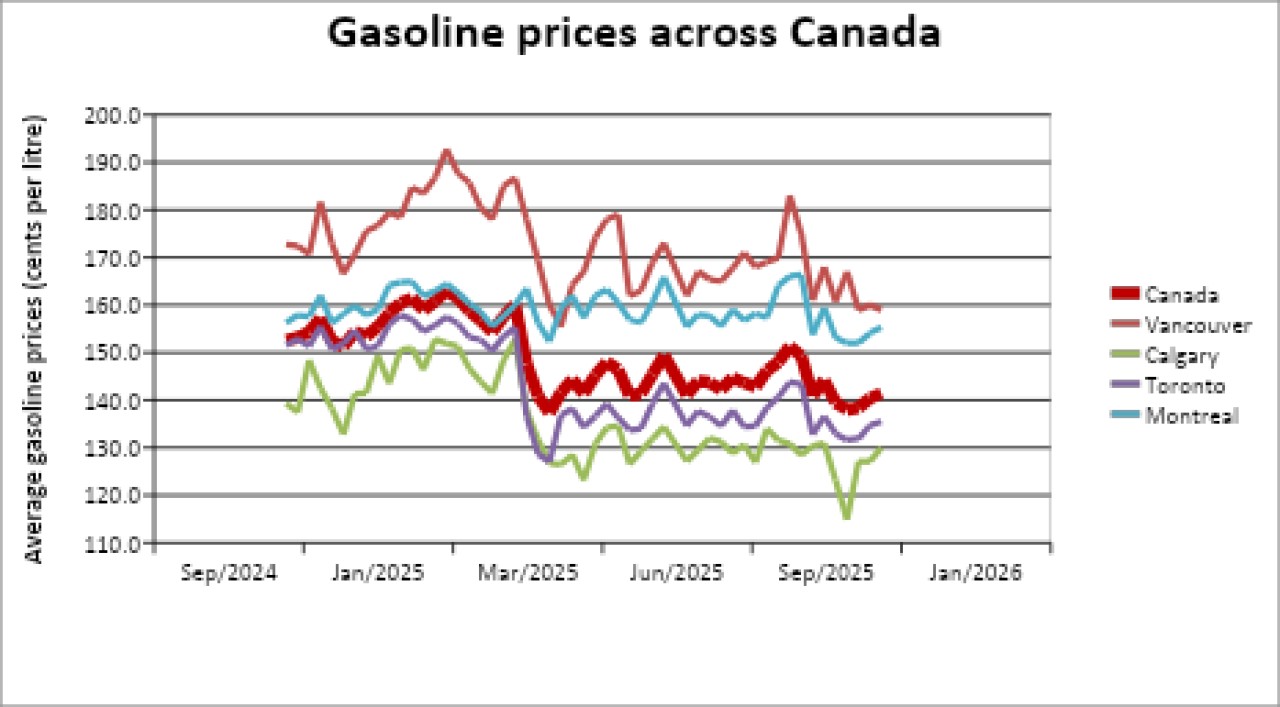

Gasoline prices in Canada followed the general crude oil trends, although exhibiting more restrained fluctuations. The average price for gasoline in Canada exhibited a small increase in September, peaking on September 11 at $1.532 per litre. The price dropped to $1.369 per litre by October 20, a decline of 10.6%. However, the three-month average price of gasoline remained nearly unchanged at $1.435 per litre as compared to $1.440 per litre in the previous three-month period. From a yearly perspective, the three-month average price in Canada was 7.7% lower than during the same three-month period last year, when the price averaged at $1.554 per litre.

5.1.1.1 Global Crude Oil Demand

The global economy has been showing signs of a moderate slowdown in the second half of 2025. According to the International Monetary Fund’s (IMF) latest World Economic Outlook (WEO) from October 2025, global Gross Domestic Product (GDP) growth is projected to slow from 3.3% in 2024 to 3.2% in 2025, and further to 3.1% in 2026. While there is an improvement relative to the July WEO Update, the forecast stands below the October 2024 WEO projections. The slowdown is reflecting headwinds from uncertainty and protectionism, even though the tariff shock from this spring has been smaller than originally anticipated. As noted by the IMF: “After the United States introduced higher tariffs starting in February, subsequent deals and resets have tempered some extremes, but uncertainty about the stability and trajectory of the global economy remains acute.”

Advanced Economies as a group are expected to grow by 1.6% this year, as well as the next, at a slower pace as compared to 1.8% in 2024. The United States (U.S.) economy is projected to expand by 2.0% in 2025 and 2.1% in 2026. As compared to the projections in the IMF WEO from last fall, U.S. growth has been revised downwards while inflation has increased, reflecting the negative impact of the administration’s trade policies. The IMF estimates that the effective U.S. tariff rate is at about 19% and the trade policy developments continue to cast high uncertainty over the global economy. Notably, the countermeasures by U.S. trading partners have been limited and have barely moved the effective tariff rates on U.S. imports. While the U.S. trade policies appear to have had a limited effect on the outlook so far, the IMF notes that other factors are masking their effects. Firstly, U.S. immigration policies are offsetting the reduction in labour demand, keeping the unemployment rates relatively stable despite a significant decline in the number of jobs added. Secondly, the Artificial Intelligence boom is pushing the financial markets up.

The Euro Area has also seen an upward adjustment of 0.2 percentage points, thanks to strong domestic demand, with the growth for 2025 projected at 1.2%. However, exports have continued to decline, and the recent appreciation of the Euro against the U.S. dollar is reducing their competitiveness in the global markets. The 2026 outlook for the Euro Area has been slightly reduced and stands at 1.1%.

The Canadian economy is adjusting to the new trading reality with the United States (U.S.). Exports have fallen, and business investments have declined. The restructuring of the economy is adding costs and putting upward pressure on inflation. The Bank of Canada, in its Monetary Policy Report (MPR) from October 2025, notes that continued uncertainty on trade relationships is weighing on the outlook. The economy contracted by 1.6% in the second quarter of 2025 due to the effects of tariffs and rising uncertainty in the business environment. The Bank of Canada projects that the Gross Domestic Product (GDP) growth will be weak in the second half of 2025, averaging about 0.75%. This is supported by household and government spending despite declining exports and business investments. Overall, the Bank is projecting that the growth rate this year will be at 1.2%, and 1.1% for 2026. By comparison, before the tariff announcements, the Bank had projected a 1.8% growth path for both years. The Bank estimates the average U.S. tariff rate on Canada to be 5.9% in October, while the Canadian tariff rate on the U.S. is about 1.0%, a significant increase from 0.1% and 0.0% respectively last year. While the inflation was close to target around 2.0% during the summer, it increased to 2.4% in September and October. By comparison, the IMF outlook for Canada remains unchanged for 2025 at 1.2% and has seen a minor upward adjustment of 0.1 percentage points for 2026 and is now at 1.5%.

The Emerging Markets and Developing Economies are forecast to grow by 4.2% this year and 4.0% next year. Although China has been hit with the largest U.S. tariffs so far, it has been able to largely offset their impacts by redirecting its exports to other Asian and European partners and benefiting from a depreciation of the U.S. dollar. As a result, China’s growth projections remain unchanged at 4.8% for 2025 and 4.2% for 2026. Nevertheless, the IMF notes that China’s prospects remain weak due to its real estate sector troubles and signs that large-scale subsidies to the manufacturing sector have reached their limit.

The risks to the outlook remain tilted on the downside. The prolonged trade policy uncertainty could dampen consumption and investment. Further escalation of protectionist measures could suppress investment and disrupt supply chains. The IMF also notes that a stock market hike resulting from the Artificial Intelligence investment boom and the possible risks of exacerbated optimism could lead to eventual price declines. In addition, the pressures on the independence of key economic institutions, such as central banks, could erode the public trust in policy credibility and undermine sound economic decision-making and the ability to help stabilize large economic shocks.

As a result, the outlook for the demand for crude oil remains varied. According to the Monthly Oil Market Report (MOMR) from November 2025, OPEC projections remain unchanged from three months ago, with global demand averaging at 105.1 million barrels per day (mb/d) this year, before rising further to 106.5 mb/d in 2026. By comparison, the U.S. Energy Information Administration (EIA) estimates that global oil consumption is expected to average 104.1 mb/d this year and increase to 105.2 mb/d in 2026.

5.1.1.2 Global Crude Oil Supply

The weakening of the global demand has not been met with reduced production – in fact, supply has been on the rise. The market is reaching a point of continued overproduction, with supply consistently exceeding demand. Inventories are rising and becoming costlier, and, as a result, the price of crude is declining.

According to various estimates, the supply is exceeding the demand by about 2.0% this year. This trend is likely to continue into the next year. According to the International Energy Agency’s (IEA) estimates, surplus production this year will be 2.3 million barrels per day (mb/d). By comparison, the U.S. Energy Information Administration’s (EIA) estimates stand at 1.9 mb/d of oversupply in 2025. For 2026, the U.S. EIA projects an average surplus to increase to 2.2 mb/d, while the IEA warns that the surplus pace could reach as high as 4.1 mb/d or nearly 4% of the global supply.

Overall, according to the U.S. EIA, global production is steadily rising from 103.2 mb/d in 2024 to 106.0 mb/d in 2025 and to 107.4 mb/d in 2026, with Canada, the U.S., Brazil and Guyana contributing 75% of the total global growth in 2025 and 67% in 2026. The IEA estimates global production to average 106.3 mb/d in 2025, before increasing to 108.7 mb/d in 2026.

According to the latest U.S. EIA’s Short-Term Energy Outlook (STEO), U.S. oil production is expected to reach 13.6 mb/d and remain at that level in 2026, a 3.0% increase from the 13.2 mb/d average production last year. Similarly, the latest available data from the Canada Energy Regulator indicates that Canada is on a path to average 5.2 mb/d of oil production this year, an increase of more than 2.0% over last year’s production level. Canada remains the fourth largest supplier of crude oil globally after the U.S., Saudi Arabia, and Russia, and amongst the main growth drivers in 2025 and 2026.

Between April and September 2025, the OPEC+ coalition unwound its voluntary production cuts of 2.2 mb/d, which had been in effect since November 2023. On November 2, the group confirmed plans to increase production targets by an additional 137,000 barrels per day starting in December 2025. At the same time, the group announced plans to pause any further production increases through March 2026 due to lower expected seasonal demand in the coming winter.

Driven by the strong production and weakening demand, global crude oil inventories have been on a steep rise during the last few months. As reported by the International Energy Agency (IEA) in their Oil Market Report from November 2025, global oil inventories increased by 77.7 million barrels in September or about 2.6 mb/d. Over the first nine months of the year, observable inventories have risen by 313 million barrels, or 1.15 mb/d on average, a significant, sustained inventory build. According to the U.S. EIA's latest STEO from November 2025, end-of-the-year OECD inventories are expected to increase by about 6.7% as compared to 2024 and add an additional 8.7% in 2026. The rising inventories mean that storing oil is becoming increasingly expensive, which in turn applies a downward pressure on the global crude prices as has been observed recently.

Concerns regarding supply from the Middle East, as well as Russia, have been providing a partial counterbalance to the global production hike. In late summer, the escalating tensions between Iran and Israel added some support to the global crude prices. Later in the fall, citing the unsuccessful peace deal attempts in Ukraine, the U.S. announced sanctions on two of Russia’s largest oil companies, Rosneft and Lukoil. The two companies produce more than half of Russia’s oil and provide roughly 25% of the Russian government’s revenue. The two companies together export 3.1 mb/d, which is about 3% of the global supply. The new measures prohibit U.S. persons and entities from engaging in transactions with them and their subsidiaries. The sanctions will take full effect on November 21, 2025. Nevertheless, the effects of these sanctions have begun taking shape already, with Russia’s oil revenues declining, inventories rising and discounts to Russian oil widening as compared to the benchmark price of Brent. Urals crude, a Russian crude oil benchmark, was selling at a discount of about $2.25 USD per barrel earlier in the year. That discount has increased more than eightfold to $19.30 USD per barrel as of November 10. The sanctions have forced major refiners in India and China to reduce and eliminate their imports of Russian oil to avoid secondary sanctions. Those refiners are now turning to Middle Eastern, Latin American, and U.S. crude oil suppliers.

5.1.2 Gasoline prices across Canada

Over the last three months, gasoline prices in Canada have exhibited some fluctuations, generally aligned with crude oil price variations. However, on average, gasoline prices have remained quite stable across the country. During the September-November 2025 period, the average price for gasoline in Canada was $1.435 as compared to $1.440 for the three months prior, a slight decline of 0.4%. The Atlantic provinces, along with Quebec and Saskatchewan, saw slight increases between 0.06% in Quebec to 2.75% in New Brunswick. Ontario, Alberta, British Columbia and Manitoba saw declines between 0.15% in Ontario and 1.15% in Alberta. The Northwest Territories saw an increase of 1.39%, while Nunavut and the Yukon saw price declines between 0.32% and 1.42% respectively.

Prices of gasoline in Canada include all applicable taxes. Prices vary significantly across the country, mainly due to the difference in the types and amounts of taxes being charged on fuel in different provinces and territories. According to Natural Resources Canada, the vast majority of light-duty vehicles on Canadian roads run on gasoline. We have therefore researched the average prices of regular gasoline charged at the pump. The fuel price data was primarily obtained from Natural Resources Canada via Kalibrate (previously Kent Marketing), based on daily published fuel prices for 78 locations across Canada. This data was verified against additional databases that similarly track fuel prices all across Canada.

Consistent with the methodology of the previous study, when determining average gasoline prices per province or territory, we have used a weighted average according to population in order to better conform to reality. In this manner, metropolitan population centers account for a greater portion of the total than smaller municipalities. Prices were tracked daily across Canada (except for Saturdays, Sundays and holidays).

Fuel price data was extracted for a period of three months (August 11 to November 7, 2025) in order to better reflect current prices. Gasoline prices in Canada varied during this period between $1.127 in Calgary, AB to $1.920 in Vancouver, BC, with a national average of $1.435.

The following is a table with three-month average regular gasoline prices for all Canadian provinces and territories, in dollars per litre, as well as gasoline prices from previous reports, for comparison:

| Province/Territory | Current average fuel price ($/litre) |

Current average fuel cost ($/km) |

October 1st, 2025, Fuel Update ($/litre) |

July 1st, 2025, Fuel Update ($/litre) |

April 1st, 2025, Fuel Update ($/litre) |

January 1st, 2025, Annual Report ($/litre) |

|---|---|---|---|---|---|---|

| Alberta | $1.285 | $0.102 | $1.300 | $1.371 | $1.437 | $1.450 |

| British Columbia | $1.632 | $0.129 | $1.637 | $1.716 | $1.752 | $1.723 |

| Manitoba | $1.322 | $0.105 | $1.334 | $1.416 | $1.387 | $1.338 |

| New Brunswick | $1.455 | $0.115 | $1.416 | $1.483 | $1.592 | $1.569 |

| Newfoundland and Labrador | $1.526 | $0.121 | $1.511 | $1.591 | $1.681 | $1.671 |

| Northwest Territories | $1.455 | $0.162 | $1.435 | $1.533 | $1.624 | $1.626 |

| Nova Scotia | $1.435 | $0.114 | $1.431 | $1.496 | $1.594 | $1.576 |

| Nunavut | $1.573 | $0.175 | $1.578 | $1.664 | $1.758 | $1.751 |

| Ontario | $1.348 | $0.107 | $1.350 | $1.425 | $1.533 | $1.521 |

| Prince Edward Island | $1.492 | $0.118 | $1.487 | $1.556 | $1.665 | $1.633 |

| Quebec | $1.557 | $0.123 | $1.556 | $1.566 | $1.586 | $1.573 |

| Saskatchewan | $1.344 | $0.106 | $1.339 | $1.447 | $1.487 | $1.515 |

| Yukon | $1.596 | $0.177 | $1.619 | $1.718 | $1.823 | $1.862 |

Gas prices in Nunavut are typically set for a full calendar year and rarely exhibit any changes. The latest price update occurred on April 1, 2025. The territorial average was thus determined to be $1.573 for the current study.

For illustration purposes, the following graph displays gasoline prices for the main metropolitan areas for a one-year period (November 2024–November 2025).

Also, for illustration purposes, the following graph displays crude oil prices for three benchmarks: WTI (West Texas Intermediate), Brent and WCS (Western Canadian Select) for a one-year period (November 2024–November 2025).

5.1.3 Fuel consumption

For each vehicle under study, fuel consumption figures were extracted from the industry’s vehicle pricing and specification standard tool, Carbook Pro, backed up by Natural Resources Canada’s EnerGuide. For models where 2026 model year figures were not available, 2025 figures with similar engine sizes were used. Fuel consumption figures are determined by vehicle manufacturers based on standardized tests, and are published for both city driving and highway driving. For battery-electric and plug-in hybrid electric vehicles, Carbook Pro and the EnerGuide provides figures for fuel consumption by using a litre-equivalent (Le/100 km) system, thus facilitating the comparison with conventional fuel vehicles.

In provinces where the majority of the population lives in large urban centres (e.g., Ontario) vehicles are driven more under city-driving conditions rather than highway-driving conditions. In light of this fact, the percentage of city versus highway driving has been referenced to a 55/45 city/highway split, consistent with the methodology used by EnerGuide. On the other hand, for the territories, a reversed 30/70 city/highway split was factored in, due to the predominantly rural character of the territories and long distances to be covered.

The following table gives average fuel consumption figures by class of vehicle, in litres of gasoline per hundred kilometres, as well as the weighted averages according to year-to-date vehicle sales:

|

Combined Fuel Consumption |

Compact | Small Crossover/ SUV |

Medium Crossover/ SUV |

Battery Electric/ Plug-in Hybrid |

Pickup Truck |

Weighted Average |

|---|---|---|---|---|---|---|

| Provinces | 7.0 | 8.3 | 10.7 | 3.3 | - | 7.9 |

| Territories | - | 7.9 | 10.1 | - | 11.6 | 9.3 |

5.1.4 Calculation of fuel expenses

Based on an average of 20,000 kilometres per year and following the methodology described above, the study calculated average fuel costs, per province or territory, for all vehicles under study. These numbers were weight-averaged according to population to yield individual fuel cost figures for each province or territory.

Fuel contributes on average $0.113 per kilometre to total operating costs, ranging from $0.102 in Alberta to $0.177 in the Yukon.

5.2 VEHICLE MAINTENANCE EXPENSES

In order to keep a vehicle in proper running condition and respect all driving safety requirements, a vehicle must be adequately maintained. Vehicle maintenance includes the following:

- Preventative maintenance (that has to be performed regularly);

- Repairs outside of manufacturer warranty and not caused by accidents;

- An additional set of tires;

- Miscellaneous expenses.

5.2.1 Preventative maintenance

Preventative maintenance includes, but is not limited to, the following:

- Oil changes;

- Regular check-ups;

- Tire rotation;

- Spark plugs change;

- Front and rear brakes cleaning;

- Discs and pads replacement;

- Wheel alignment;

- Battery change;

- Cabin filter replacement;

- Air-intake filter replacement.

Costs of preventative maintenance were estimated based on consultation with specialized garages and qualified mechanics in order to determine the frequency and costs for parts and labour. Sales taxes apply to all preventative maintenance costs.

5.2.2 Projected costs of repairs not covered by manufacturer warranty

Since the current study is considering retention periods of four and five years, a certain cost for projected repairs must be taken into account. Repairs due to accidents are covered by insurance and are reflected in insurance premiums costs. Most manufacturers offer warranties of up to 3 years or 60,000 kilometres (with the exception of Kia, Hyundai, Mitsubishi, Volkswagen and Tesla, which offer longer warranties). Beyond this period or mileage, any mechanical system that breaks down will incur a direct cost to the owner. Repairs not covered by manufacturer warranty have been accounted for in the present study accordingly.

5.2.3 Tires

The various vehicles under study have different tire requirements, mostly due to different rim sizes. All new vehicles come with a set of standard all-seasons tires. However, if only one set of tires is used, they wear out and need to be replaced, on average, after 60,000 kilometres. This implies that at least one new set of tires must be purchased for both four- and five-year retention periods.

For the purpose of this study, average quality all-seasons tires were considered. Costs of tires vary between $1,060 and $2,110 for a set of four with installation included, mainly depending on the type and size, plus applicable taxes.

5.2.3.1 Adjustments for Quebec and British Columbia

The province of Quebec mandates the use of winter tires for all light-duty vehicles, for the period between December 1 and March 15. In order to reflect this requirement a 50% increase in the cost of tires was factored into the calculations. This accounts for purchasing an additional set of winter tires while offsetting the need to purchase another set of all-season tires for the four-year retention period studied but not necessarily for the five-year period.

Similarly, British Columbia mandates the use of winter tires on most highways and in mountainous areas between October 1 and April 30. A 50% increase in the costs of winter tires was factored in the calculations to account for this requirement, in order to reflect the fact that winter tires are consistently used by vehicles registered in this province.

5.2.4 Miscellaneous maintenance expenses

There are other common expenses related to maintaining a vehicle that do not fall under the previous three categories, but which are necessary for safety as well as aesthetic reasons. The present study allocated a $174 per year allowance for miscellaneous costs such as windshield washer fluid, occasional car wash and polish, light bulbs etc.

5.2.5 Total costs related to vehicle maintenance

Total maintenance costs were calculated for every province and territory. Costs are higher for Quebec and British Columbia mainly due to winter tire regulations. Costs for the three territories are also higher primarily due to the extra equipment needed to support driving conditions in the North, as detailed in Section 6. Costs are lower for the province of Alberta due to the fact that there is no provincial sales tax applicable.

The following five tables give a full break-down of vehicle maintenance costs in dollars per kilometre, by vehicle class as well as four- and five-year retention periods, split by preventative maintenance, repairs, tires, miscellaneous and maintenance sales tax, as well as weighted averages according to vehicle sales:

|

Preventative |

Compact | Small Crossover/SUV |

Medium Crossover/SUV |

Battery Electric/ Plug-in Hybrid |

Weighted Average |

|---|---|---|---|---|---|

| 4-yr ownership | $0.060 | $0.060 | $0.063 | $0.031 | $0.057 |

| 5-yr ownership | $0.067 | $0.066 | $0.070 | $0.038 | $0.063 |

| $0.060 | |||||

|

Repairs |

Compact | Small Crossover/SUV |

Medium Crossover/SUV |

Battery Electric/ Plug-in Hybrid |

Weighted Average |

|---|---|---|---|---|---|

| 4-yr ownership | $0.018 | $0.018 | $0.019 | $0.012 | $0.018 |

| 5-yr ownership | $0.029 | $0.029 | $0.031 | $0.012 | $0.028 |

| $0.023 | |||||

|

Tires |

Compact | Small Crossover/SUV |

Medium Crossover/SUV |

Battery Electric/ Plug-in Hybrid |

Weighted Average |

|---|---|---|---|---|---|

| 4-yr ownership | $0.016 | $0.020 | $0.029 | $0.027 | $0.021 |

| 5-yr ownership | $0.013 | $0.016 | $0.023 | $0.022 | $0.017 |

| $0.019 | |||||

|

Miscellaneous |

Compact | Small Crossover/SUV |

Medium Crossover/SUV |

Battery Electric/ Plug-in Hybrid |

Weighted Average |

|---|---|---|---|---|---|

| 4-yr ownership | $0.009 | $0.009 | $0.009 | $0.009 | $0.009 |

| 5-yr ownership | $0.009 | $0.009 | $0.009 | $0.009 | $0.009 |

| $0.009 | |||||

|

Maintenance |

Compact | Small Crossover/SUV |

Medium Crossover/SUV |

Battery Electric/ Plug-in Hybrid |

Weighted Average |

|---|---|---|---|---|---|

| 4-yr ownership | $0.013 | $0.013 | $0.015 | $0.010 | $0.013 |

| 5-yr ownership | $0.014 | $0.015 | $0.016 | $0.010 | $0.015 |

| $0.014 | |||||

* Note: that the total weighted averages are rounded to three decimals.

6. OPERATIONAL COSTS IN THE TERRITORIES

In order to accurately reflect the actual costs of operating vehicles in the three Canadian territories, the analysis required a different approach than for the ten provinces. The territories are mostly rural and driving conditions are harsher, especially in the wintertime. This means that prevalently larger vehicles are used with winter-adapted equipment and therefore the costs for maintenance, tires, fuel and specialized equipment are higher.

This section describes the methodology used for the territories as w ell as highlights where it differs from the methodology used for the ten provinces.

6.1 VEHICLE SELECTION FOR THE TERRITORIES

The nature of the climate and road conditions in the three territories is considerably different than for the ten provinces. Due to this fact, as well as the harsh winter driving conditions that drivers face in the North, the automotive landscape has a different make-up, and as a result trucks and crossovers/SUVs are significantly favoured over compact sedans and battery electric/plug-in hybrid electric vehicles. Following this rationale, the present study selected three vehicle classes that were deemed representative of the territories, the same as in the previous Annual Report (November 2024, for publication on January 1, 2025):

- Small crossovers/SUVs;

- Medium crossovers/SUVs;

- Light-duty pick-up trucks.

The study kept the vehicles studied in the small and medium crossover/SUVs categories, added the five most sold trucks in the light-duty pick-up truck category and eliminated the compact sedan and battery electric/plug-in hybrid electric vehicle classes.

Following is a table listing the vehicles studied for the territories, as well as the class they belong to, and the weight assigned to each according to recent Canadian sales:

|

Make |

Model |

Class |

Weight for Territories |

2026 Model Year Pricing* |

|---|---|---|---|---|

|

Toyota |

RAV4 |

Small Crossover/SUV |

8.0% |

$35,615* |

|

Honda |

CR-V |

Small Crossover/SUV |

5.9% |

$41,775 |

|

Hyundai |

Tucson |

Small Crossover/SUV |

3.5% |

$37,399 |

|

Nissan |

Kicks |

Small Crossover/SUV |

3.4% |

$31,528 |

|

Subaru |

CrossTrek/XV |

Small Crossover/SUV |

3.4% |

$32,890 |

|

Nissan |

Rogue |

Small Crossover/SUV |

3.4% |

$36,428 |

|

Ford |

Escape |

Small Crossover/SUV |

2.9% |

$38,394 |

|

Volkswagen |

Taos |

Small Crossover/SUV |

2.6% |

$34,270 |

|

Mazda |

CX-5 |

Small Crossover/SUV |

2.6% |

$35,095* |

|

Kia |

Sportage |

Small Crossover/SUV |

2.5% |

$36,195 |

|

Chevrolet |

Equinox |

Small Crossover/SUV |

2.4% |

$38,599 |

|

Hyundai |

Kona |

Small Crossover/SUV |

2.4% |

$30,799 |

|

Chevrolet |

Trax |

Small Crossover/SUV |

2.3% |

$28,999 |

|

Subaru |

Forester |

Small Crossover/SUV |

2.2% |

$35,990 |

|

Kia |

Seltos |

Small Crossover/SUV |

2.1% |

$29,895 |

|

Toyota |

Corolla Cross |

Small Crossover/SUV |

1.9% |

$31,910 |

|

Ford |

Bronco Sport |

Small Crossover/SUV |

1.8% |

$41,090 |

|

Mazda |

CX-30 |

Small Crossover/SUV |

1.7% |

$31,495* |

|

Honda |

HR-V |

Small Crossover/SUV |

1.6% |

$34,600 |

|

Hyundai |

Venue |

Small Crossover/SUV |

1.6% |

$24,049 |

|

Ford |

Explorer |

Medium Crossover/SUV |

1.3% |

$54,395 |

|

Jeep |

Wrangler |

Medium Crossover/SUV |

1.3% |

$60,585 |

|

Hyundai |

Santa Fe |

Medium Crossover/SUV |

1.3% |

$50,099* |

|

Volkswagen |

Atlas |

Medium Crossover/SUV |

1.2% |

$60,845 |

|

Mazda |

CX-50 |

Medium Crossover/SUV |

1.1% |

$42,145* |

|

Ford |

Bronco |

Medium Crossover/SUV |

1.0% |

$53,660 |

|

Toyota |

Grand Highlander |

Medium Crossover/SUV |

1.0% |

$53,565 |

|

Jeep |

Grand Cherokee |

Medium Crossover/SUV |

0.9% |

$61,765* |

|

Honda |

Pilot |

Medium Crossover/SUV |

0.9% |

$55,350* |

|

Mazda |

CX-90 |

Medium Crossover/SUV |

0.8% |

$48,445* |

|

Ford |

F-Series |

Truck |

12.6% |

$64,030 |

|

GMC |

Sierra |

Truck |

6.5% |

$67,599 |

|

Chevrolet |

Silverado |

Truck |

6.1% |

$61,699 |

|

Ram |

P/U |

Truck |

4.2% |

$65,890 |

|

Toyota |

Tacoma |

Truck |

1.6% |

$62,086* |

*Note: The current study used 2025 model-year pricing for vehicles for which prices were not yet available for 2026 model-year. All prices are given before applicable taxes.

6.2 OTHER OPERATING COST ADJUSTMENTS FOR THE TERRITORIES

The methodology to calculate fixed and variable expenses for the territories remained the same as for the provinces. However, by virtue of using different vehicle classes, total costs are higher than for the provinces.

The territories usually display more elevated costs for fuel due to the higher costs of transportation and servicing. At the same time, by adding light-duty pick-up trucks and eliminating the more fuel-efficient compact sedan and electric vehicle (battery electric/plug-in hybrid) classes, overall fuel consumption is also higher than for the 10 provinces.

In terms of vehicle maintenance, adjustments were also made to reflect the extra equipment necessary for safe driving in the North, as well as the use of special off-road or winter tires. The extra equipment that most acutely influences total maintenance costs for the territories includes, but is not limited to, winter preparation packages, specialized tires, off-road survival kits and specialized signalling and communication devices. In addition, the use of special engine oils and other freeze-resistant liquids, as well as increased idling add to the operating expenses. For this reason, repair costs were increased by 25%, tire costs by 50% and fuel costs by 20% for the territories.

7. OPERATING COST SUMMARY AND RECOMMENDATIONS

We recommend continuing the practice of reimbursing government-authorized personal vehicle use on the basis of both fixed and variable expenses, referred to as the Travel Rate (also known as “Kilometric Rate” in the National Joint Council Travel Directive). At the same time, we recommend reimbursing employees for use of personal vehicles to commute to their designated remote worksites on the basis of variables expenses only, referred to as the Commuting Rate (also known as “Lower Kilometric Rate” in the National Joint Council Commuting Assistance Directive). This is consistent with current practice. All rates have been rounded up to the nearest half-cent.

The following table provides calculated evaluations for both the Travel and Commuting Rates, as well as rates determined in the previous Annual Report (November 2024, for publication on January 1, 2025) and the latest Fuel Update (August 2025, for publication on October 1, 2025), for comparison.

Current Reimbursement Schedule ($/km)

|

Travel Rate (Kilometric Rate) |

Commuting Rate (Lower Kilometric Rate) |

|||||

|---|---|---|---|---|---|---|

|

Province/Territory |

Current Annual Report |

October 1, 2025, Fuel Update |

January 1, 2025, Annual Report |

Current Annual Report |

October 1, 2025, Fuel Update |

January 1, 2025, Annual Report |

|

Alberta |

$0.565 |

$0.565 |

$0.575 |

$0.220 |

$0.210 |

$0.225 |

|

British Columbia |

$0.600 |

$0.595 |

$0.600 |

$0.260 |

$0.255 |

$0.260 |

|

Manitoba |

$0.565 |

$0.560 |

$0.560 |

$0.230 |

$0.220 |

$0.220 |

|

New Brunswick |

$0.610 |

$0.595 |

$0.605 |

$0.240 |

$0.230 |

$0.245 |

|

Newfoundland and Labrador |

$0.620 |

$0.615 |

$0.630 |